Share this @internewscast.com

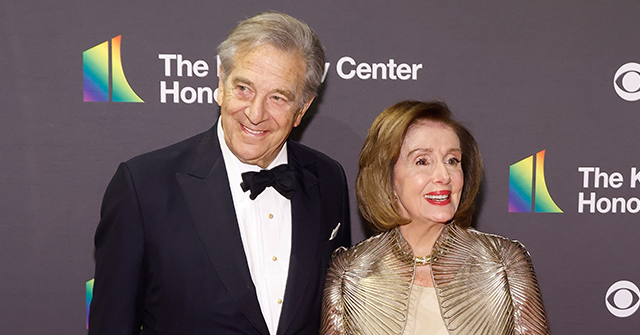

Former House Speaker Nancy Pelosi (D-CA) and her husband, Paul, have made hundreds of millions of dollars off Nancy’s insider knowledge, but Sen. Josh Hawley (R-MO) has a plan to stop it, he told – Editor-in-Chief Alex Marlow on Thursday’s episode of The Alex Marlow Show.

Hawley reintroduced the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act in April to ban members of Congress and their family members from being able to trade or hold stocks.

The bill’s namesake, former Speaker Nancy Pelosi (D-CA), has made “hundreds of millions” – despite a salary never higher than just over $200,000 – since her election to Congress. Hawley said that cannot be done following the law.

“You don’t do it legally,” Hawley said of Pelosi’s acquisition of wealth. “And here’s the thing, Nancy Pelosi and her husband last year, in 2024, beat every hedge fund in the nation, practically. So, either Nancy Pelosi is a mathematical and financial analyst genius… or maybe, maybe the information that she’s privy to turns out to be pretty darn valuable.”

“And everybody knows it’s the second thing. It’s just outrageous,” he added.

Hawley’s nonpartisan bill would be enforced for both Republicans and Democrats, but Pelosi is the most notorious offender.

Hawley said for her to have that success without breaking the law and using insider information, Nancy would have to be “a total financial genius, the likes of which comes along once every I don’t know, 1,000 years.”

Hawley believes elected officials staying in elected office longer than the founders intended is connected with the problem of members exploiting the office to enrich themselves. Its “no coincidence” that “the longer they’re here, the more ways they find to make money off of their jobs,” he told Marlow.

“Members of Congress are paid a salary. That’s fine, obviously, but we’re not talking about that,” he said. “We’re talking about millions and millions and millions of tens of millions of dollars – hundreds of millions, in the Pelosi case that they’ve made while she has been in office.”

Members of Congress “leveraging the office” to get rich is “the farthest thing from what the Founders intended,” Hawley said. “And really it’s a disaster for our system if it’s allowed to continue without any kind of check.”

Paul Pelosi and Nancy Pelosi attend the 2024 Kennedy Center Honors at The Kennedy Center on December 08, 2024 in Washington, DC. (Taylor Hill/FilmMagic via Getty Images)

The PELOSI Act promotes transparency through strict disclosure requirements and the prohibition of trading or owning individual stocks for members and their families.

“If you’re a member of Congress, you shouldn’t be up here day trading,” Hawley said. “You should be focused on your job.”

The bill allows members of Congress to invest in broad-based mutual funds but prohibits them from investing in industry-based funds or even blind trusts, which “are too easy to get around and to manipulate,” he explained.

The bill includes strict disclosure requirements and “tough penalties” for anyone who violates the law.

“If they violate the provisions, if they trade individual stock, if they own individual stock, they have to disgorge all of the profits and pay a financial penalty on top,” Hawley explained. “That’s the only way we’re going to get this stopped,” he said of the strict disclosure requirements.

Hawley has introduced the bill in a previous Congress, but it did not become law.

“I introduced it several years ago, and actually last year, we passed it, believe it or not, through committee in the Senate,” Hawley said, touting that it was the “first time that a stock trading ban” passed in the chamber.

Against heavy odds, the bill garnered support from both Republicans and Democrats, but it did not receive a vote in the House.

Trump – whose first term as president featured Pelosi as his chief nemesis – said this year he would sign a bill banning stock trading if it came to his desk. Hawley is hoping his bill is the one to get there.

But first, it must receive a vote.

“We’ve got to put people on the record. We’ve got to force a vote on this thing,” he said.

Pelosi has already made her hundreds of millions. But if Hawley can pass the PELOSI Act, perhaps he can stop other lawmakers from exploiting their power.

The Alex Marlow Show, hosted by – Editor-in-Chief Alex Marlow, is a weekday podcast produced by – News and Salem Podcast Network. You can subscribe to the podcast on YouTube, Rumble, Apple Podcasts, and Spotify.

Bradley Jaye is Deputy Political Editor for – News. Follow him on X/Twitter and Instagram @BradleyAJaye.