Share this @internewscast.com

The PCIe 7.0 specification has now been unveiled, even though many are still anticipating the arrival of PCIe 6.0 in consumer merchandise. On Wednesday, the PCI Special Interest Group (PCI-SIG) declared that members can now access PCIe 7.0, which offers a theoretical peak bandwidth of 512GB per second bi-directionally over a x16 link.

“PCIe technology has consistently been the high-bandwidth, low-latency IO interconnect of choice for over two decades, and we are excited to disclose the PCIe 7.0 specification, continuing our tradition of doubling IO bandwidth every three years,” stated PCI-SIG President Al Yanes in the announcement. “With the rapid scaling of artificial intelligence applications, the upcoming generation of PCIe technology satisfies the bandwidth needs of data-driven sectors that utilize AI, such as hyperscale data centers, high-performance computing (HPC), automotive, and military/aerospace.”

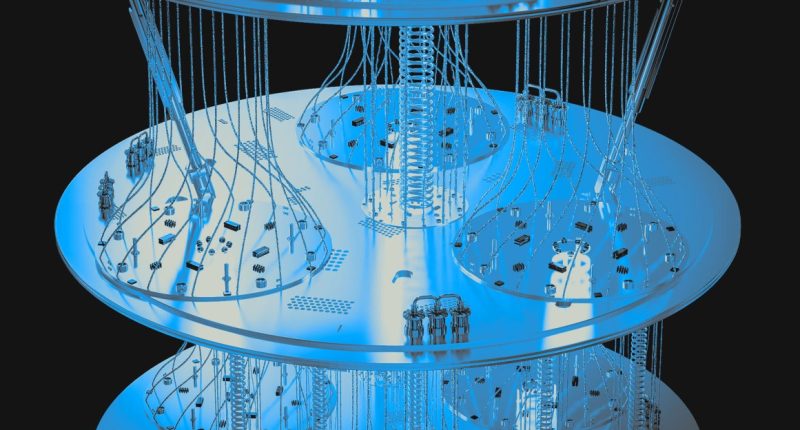

It’s worth noting that consumer computing devices weren’t specifically mentioned — this specification is presently targeting data-driven applications like cloud and quantum computing datacenters and will require time before becoming prevalent in those industries. PCI-SIG assures that PCIe 7.0 will maintain backward compatibility with prior PCI Express iterations, but a timeline for its appearance in standard desktop SSDs or GPUs hasn’t been provided. This isn’t unexpected, as the PCIe 5.0 specification, launched in 2019, only started becoming available in consumer hardware two years ago and still remains relatively rare.

Meanwhile, PCI-SIG says that pathfinding for PCIe 8.0 is “already in progress.” With any luck, PCIe 6.0 will have made its consumer debut by the time the next-gen specifications have been finalized in 2028.