Share this @internewscast.com

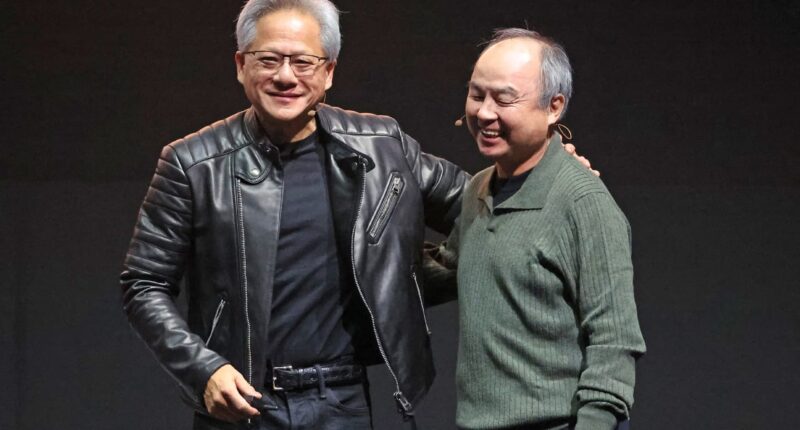

During an artificial intelligence event in Tokyo on November 13, 2024, Nvidia CEO Jensen Huang and SoftBank Group’s CEO Masayoshi Son were seen together.

Photo by Akio Kon for Bloomberg via Getty Images.

On Tuesday, SoftBank announced the complete divestment of its shares in the American chip giant Nvidia, amounting to $5.83 billion. This move aligns with the Japanese conglomerate’s strategic investment focus on OpenAI, the creators of ChatGPT.

According to its earnings report, SoftBank parted with 32.1 million Nvidia shares in October. Additionally, the company revealed the sale of part of its stake in T-Mobile, which fetched $9.17 billion.

Yoshimitsu Goto, SoftBank’s Chief Financial Officer, emphasized their commitment to offering varied investment avenues while preserving financial robustness. “Through these options and tools, we ensure we are prepared for funding in a secure manner,” he explained during an investor presentation. The sale of these stakes, he noted, is integral to SoftBank’s broader strategy of “asset monetization.”

“So through those options and tools we make sure that we are ready for funding in a very safe manner,” he said in comments translated by the company, adding that the stake sales were part of the firm’s strategy for “asset monetization.”

Nvidia shares dipped 0.95% in premarket trade on Tuesday.

While the Nvidia exit may come as a surprise to some investors, it’s not the first time SoftBank has cashed out of the American AI chip darling.

SoftBank’s Vision Fund was an early backer of Nvidia, reportedly amassing a $4 billion stake in 2017 before selling all of its holdings in January 2019. Despite its latest sale, SoftBank’s business interests remain heavily intertwined with Nvidia’s.

That Tokyo-based company is involved in a number of AI ventures that rely on Nvidia’s technology, including the $500 billion Stargate project for data centers in the U.S.

“This should not be seen, in our view, as a cautious or negative stance on Nvidia, but rather in the context of SoftBank needing at least $30.5bn of capital for investments in the Oct-Dec quarter, including $22.5bn for OpenAI and $6.5bn for Ampere,” Rolf Bulk, equity research analyst at New Street Research, told CNBC.

That amounts to “more in a single quarter than it has invested in aggregate over the two prior years combined,” Bulk said.

Morningstar’s Dan Baker added that he doesn’t see the move as representing a fundamental shift in strategy for the company.

“[SoftBank] made a point of saying that it wasn’t any view on NVIDIA… At the end of the day, they are using the money to invest in other AI related companies,” he said.

Vision fund posts blowout $19 billion gain

The stake sales and a blowout gain of $19 billion from SoftBank’s Vision Fund helped the company double its profit in its fiscal second quarter.

The Vision Fund has been aggressively pushing into artificial intelligence, investing and acquiring firms throughout the AI value chain from chips to large language models and robotics.

“The reason we were able to have this result is because of September last year, that was the first time we invested in OpenAI,” said SoftBank’s Goto. He added that OpenAI’s latest valuation milestone of $500 billion marks one of the largest valuations in the world, according to fair value.

Softbank’s shares this year

The Japanese conglomerate’s stock has slumped in the past week as concerns of an AI bubble sent jitters through global markets.

“Our share price recently has been going up and down dynamically… we want to provide as many invest opportunities as possible,” said Goto Tuesday, adding that the company’s announced four-for-one stock split is part of its strategy to provide as many investment opportunities for shareholders as possible.