Share this @internewscast.com

On Friday, markets across the Asia-Pacific region experienced declines, echoing Wall Street’s downward trend amid ongoing apprehensions about the high valuations of artificial intelligence stocks.

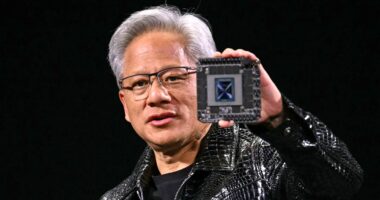

In the United States, shares of leading AI companies plunged on Thursday, exerting pressure on the broader market. Companies such as Nvidia, Microsoft, Palantir Technologies, Broadcom, and Advanced Micro Devices saw some of the sharpest drops.

In Japan, the Nikkei 225 index dropped by 1.19%, closing at 50,276.37. The most significant losses were observed among AI-related stocks. SoftBank’s shares plummeted by 6.87%, while Advantest, a semiconductor testing equipment manufacturer, declined by 5.54%. Additionally, Renesas Electronics, a chipmaker, fell by 3.75%, and Tokyo Electron, a producer of chip production equipment, decreased by 1.35%.

The Topix index also saw a slight decline, finishing the day at approximately 3,298.85.

Japan’s benchmark Nikkei 225 index tumbled 1.19% to close at 50,276.37. Shares of AI-related stocks were the key drag: SoftBank closed 6.87% lower, semiconductor testing equipment maker Advantest lost 5.54%, chipmaker Renesas Electronics fell 3.75%, and Tokyo Electron, a chip production equipment maker, declined 1.35%.

The Topix index ended nearly at 3,298.85.

South Korea’s Kospi fell 1.81% to 3,953.76 in volatile trading, while the small-cap Kosdaq lost 2.38% to 876.81. The country’s memory chip giants, Samsung Electronics and SK Hynix, lost 1.31% and 2.19%, respectively.

Australia’s S&P/ASX 200 fell 0.66% to settle at 8,769.7.

Hong Kong’s Hang Seng Index fell 0.92% to end at 26,241.83, while the mainland’s CSI 300 lost 0.31% to 4,678.79.

China’s October exports plunged 1.1% in U.S. dollar terms from a year earlier, official data showed Friday, missing expectations of a 3% growth in a Reuters survey and a steep drop from the 8.3% surge in September.

Imports also missed expectations, growing 1% year on year in October. Economists had expected a 3.2% growth, down from 7.4% in September. That comes as weak domestic demand continues to weigh on the back of a prolonged housing slump, rising job insecurity, and the tapering of consumption-focused stimulus measures.

India’s Nifty 50 reversed course to rise 0.11%, while the Sensex index was flat.

Shares of Bharti Airtel slumped after a unit of Singapore-based telecom firm Singtel announced Friday it had sold a stake in the Indian company for 1.5 billion Singapore dollars ($1.15 billion).

Singtel shares gained as much as 2.67% on Friday, after hitting an all-time intraday high, while Airtel lost as much as 4.34%.

Singtel said the sale was to “proactively optimise its portfolio through asset recycling,” and would take its stake in Airtel down to 27.5% from 28.3%. CFO Arthur Lang said that with this transaction, asset sales from Singtel have now reached SG$5.6 billion, more than half of the company’ medium term monetisation target of SG$9 billion.

U.S. futures edged higher in early Asian hours after Thursday’s tech sell-off.

Overnight, the Dow Jones Industrial Average slid 398.70 points, or 0.84%, to close at 46,912.30. The S&P 500 traded down by 1.12%, to settle at 6,720.32, while the Nasdaq Composite tumbled 1.9% to end at 23,053.99.

— CNBC’s Sean Conlon and Sarah Min contributed to this report.