Share this @internewscast.com

Gold prices jumped to almost $3,450 per ounce in the early hours of Friday morning as it was reported that Israel had launched strikes against Iran.

The price of bullion reached $3,442.44 (£2,539.18) on Friday morning, increasing from $3,383.70 on Thursday night. As of Friday midday, gold was trading at $3,421.61 per ounce.

Friday morning’s peak saw gold climb closer to its record price of $3,500.10 per ounce that it hit back in April, as global stock markets tumbled after tensions flared in the Middle East.

David Morrison, senior market analyst at Trade Nation, said: ‘Gold continues to benefit from a softer dollar and simmering geopolitical concerns. The next upside target is $3,400, a level that has acted as resistance since late April.

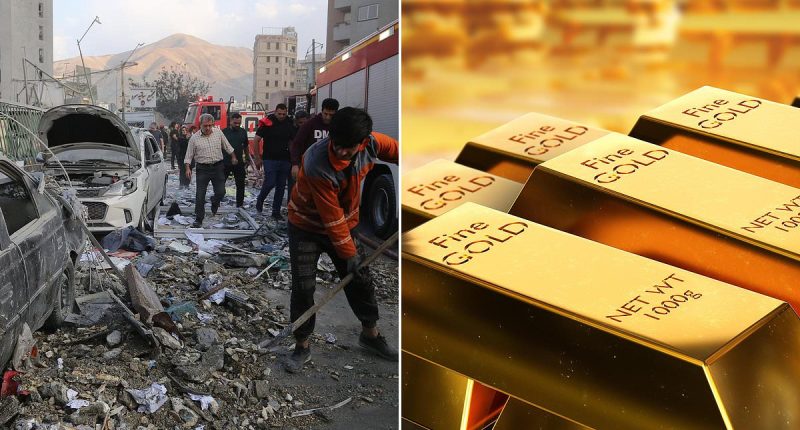

Israel carried out a series of airstrikes across Iran in Thursday night, hitting nuclear facilities, Iranian military commanders and nuclear research scientists.

Israel carried out a series of airstrikes across Iran in Thursday night, mainly targeting nuclear facilities

Israel says the attacks were a pre-emptive strike against Iran’s nuclear programme, claiming Iran has been attempting to assemble nuclear weapons.

It was reported on Thursday that Iran had failed to comply with the global nuclear watchdog for the first time in 20 years.

On Friday, Iran reportedly launched some 100 drones against Israel.

Concerns that these exchanges could escalate into full-blown conflict have seen investors buying into gold to hedge against future uncertainty.

Rick Kanda, managing director at The Gold Bullion Company, said: ‘Gold has a proven track record of performing well during economic uncertainty and global conflicts due to its intrinsic value, which is why many investors see gold as a safe haven.

‘During times of conflict, investors steer away from investing in assets such as stocks and bonds, as geopolitical events often threaten the infrastructures supporting these assets.’

The FTSE 100 opened 0.6 per cent lower, while the DAX 40 fell 1.4 per cent and the CAC 40 was down 1.1 per cent.

New York’s S&P 500 was 1.1 per cent lower in pre-market trading.

Shares in London-listed gold miners Endeavor and Fresnillo were lifted by the rush towards safe havens, rising 1.7 per cent and 1.1 per cent respectively.

Nikos Tzabouras, Senior Market Analyst at Tradu.com, said: ‘Fears of broader escalation can sustain demand for gold and push it to new all-time highs, just as tariffs uncertainty persists, compounding the bullion’s appeal.

‘Still, the US denial of involvement offers a path toward de-escalation, raising hopes for a more contained conflict.

‘If tensions ease, gold could face short-term pullbacks. However, given the current risk-laden backdrop, bullish momentum is well supported.’

Faisel Ali, founder and managing director of Gold Bank London, added: ‘If Israel-Iran tensions are not de-escalated swiftly it could escalate to an all out nuclear war, which could see gold prices reaching astronomical heights.

‘History tells us that the yellow metal has always held itself up even when faced with the most disastrous global wars and economic downturns.’

Meanwhile, oil prices also rose on the news, gaining 7.67 per cent to $74.68 per barrel of brent, as traders fear that conflict could affect supply lines.

Iran confirmed on Friday that its oil facilities have so far not been damaged by Israeli strikes.

‘Currently the activities of these facilities and fuel supply are ongoing in all parts of the country without interruption,’ the county’s oil ministry told AFP.