Share this @internewscast.com

Projections from Westpac indicate that property prices will climb by 6 percent this year, followed by an additional 8 percent in 2026, influenced partly by the Reserve Bank’s recent three interest rate reductions.

Canstar estimates this will increase Sydney’s median house price by just over $154,000 by the end of next year, reaching approximately $1.67 million.

“Melbourne’s median house price could surpass the million-dollar threshold, a psychological barrier for many first-time buyers, seemingly pushing the goal further out of reach.”

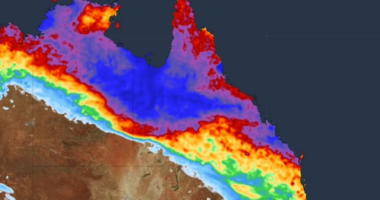

These predicted price hikes are fueled by lowered interest rates, coupled with a persistent undersupply and high demand that has troubled Australia for some time.

Nevertheless, with the Reserve Bank planning at least one more rate cut this year and possibly another in early 2026, ANZ cautioned that the cash rate might remain unchanged after surprisingly robust GDP numbers were released this week.

“Should consumer spending continue strong and neither the CPI nor labor market data weakens, the RBA might view the cash rate as balanced, negating the need for additional cuts,” noted Adam Boyton, ANZ’s head of Australian economics.

Tindall said unexpectedly high rates could throw something of a spanner in the housing price works.

“You don’t have to look too far back to see how quickly market expectations can change when conditions do,” she said.

“The danger is, Australians will borrow to the limit, banking on prices continuing to climb. If circumstances change – whether that’s interest rates, job security or the economy – it could leave some households overexposed.

“The more households borrow, the more vulnerable they become to rate rises or shocks to employment.”

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.