Share this @internewscast.com

AFP detective superintendent Marie Andersson said criminals rely on everyday Australians to help move their money.

These accounts were used to launder $3.8 million in proceeds of crime, which were ultimately transferred overseas.

Mule accounts a ‘key tactic in a criminal’s playbook’

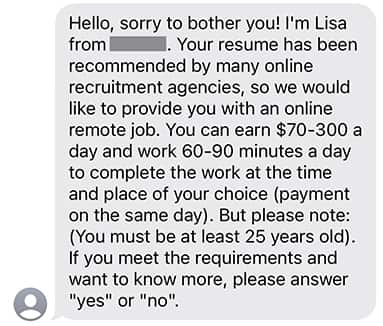

Many individuals are drawn in through fraudulent job offers or enticing posts on social media promising easy money, while others are contacted by friends or people they know. These scams often focus on young individuals, students, and newcomers to Australia.

An example of a money mule scam text message. Source: Supplied / Commonwealth Bank

Australian Banking Association CEO Anna Bligh said mule accounts were a key part of a scammer’s business model and banks were focused on identifying, investigating and shutting them down.

To stay safe, the AFP and banks recommend:

- Never sharing your bank account or login details with anyone

- Avoiding job offers that involve receiving and forwarding money.

- Reporting anything suspicious to your bank, Scamwatch or ReportCyber.