Share this @internewscast.com

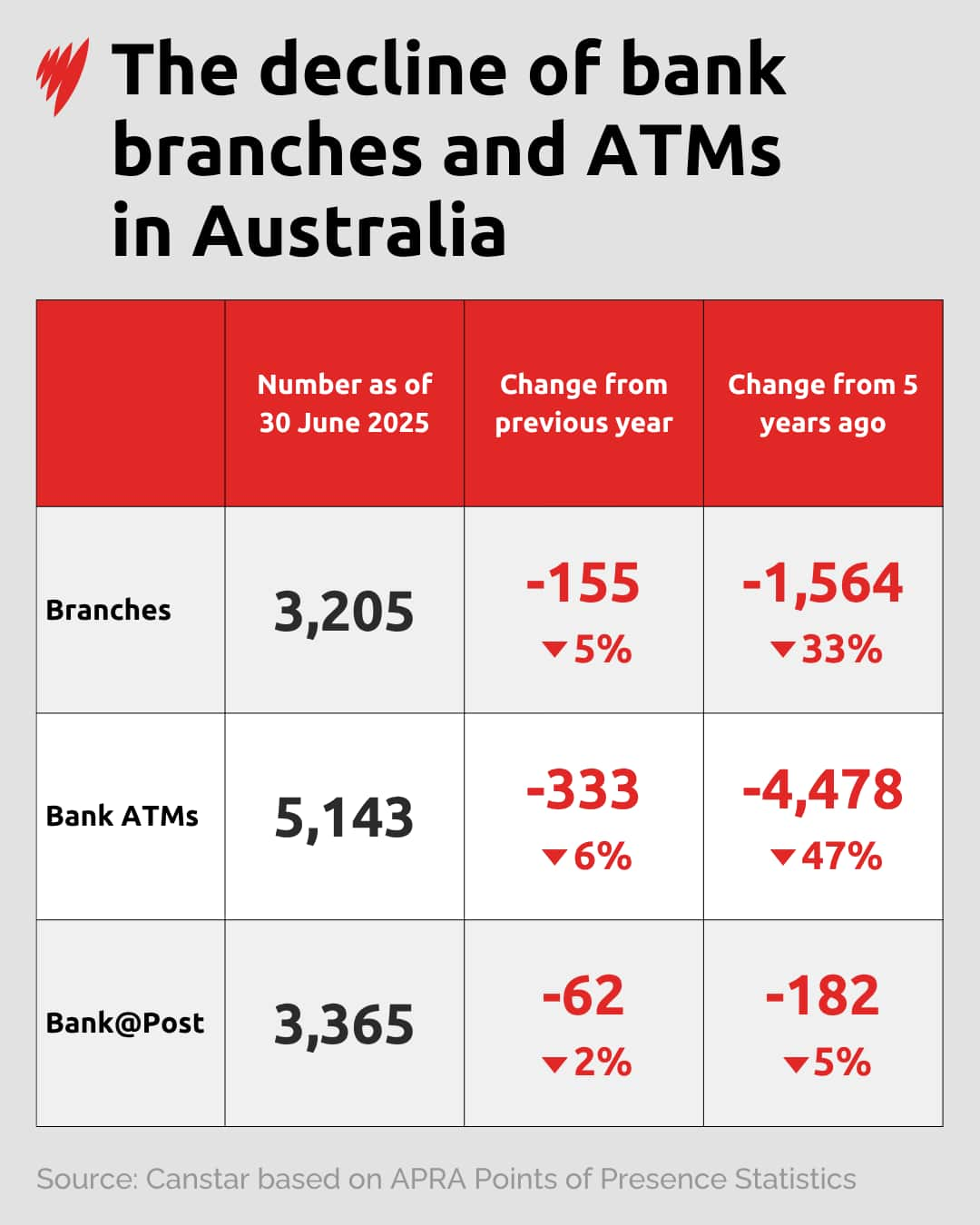

The latest report sheds light on the array of banking services available to Australians, covering traditional in-branch services, alternative face-to-face interactions, banking through Australia Post’s Bank@Post, as well as ATMs and EFTPOS terminals.

According to SBS News, this data illustrates the evolving landscape of banking accessibility across the nation.

Advocates emphasize the importance of maintaining face-to-face banking options and cash transactions, particularly for those who face barriers with technology or have concerns about online security. They argue that despite technological advancements, personal banking services are crucial.

“While it’s important to drive technological innovation, it’s equally vital to ensure that financial services remain inclusive and accessible to all,” remarked Zhou.

Grice also highlighted the critical role of bank tellers, noting, “Bank staff have been instrumental in identifying situations where a caregiver or family member might be exerting undue pressure on an elderly person’s financial decisions.”

Cash and in-person banking can become crucial to all Australians when banking apps fail, Grice noted.

Zhou said face-to-face banking can be essential for those living in regional and rural areas because digital banking relies on internet service, and internet infrastructure in such areas is “relatively weaker, compared to the metro areas”.

Security concerns and scams

“I’ve spoken to people who have done a big financial transaction — that might be whether they’ve moved house or whatever it is — and they’re very nervous about doing that online.”

Banks ‘pivotal’ to regional communities

“What happens therefore is that normal trade, people who might have a coffee or lunch or whatever, they don’t buy it in their local town; they buy it when they have their trip 40 or 50 minutes down the road.”

“We don’t want to lose the human connection and what’s important in the community. I know there’s lots of jokes about bankers but it is an essential service and people actually do like going in and talking to a real person and not everything being automated,” she said.

Government mandate for accepting cash

Last year, the Albanese government also pledged to mandate businesses to accept cash when selling essential items such as groceries and fuel, with a proposed start date of January 2026.