Share this @internewscast.com

Exclusive: A chef in New South Wales, who had lost his $150,000 retirement savings due to a major superannuation collapse, is “hugely relieved” that he will be able to retrieve his funds next week.

Michael “Micki” Donovan, aged 58 and based in Bermagui on the South Coast of NSW, was left without any superannuation funds following the collapse and liquidation of the Shield Master Fund.

ASIC investigation after Shield’s collapse

The Australian Securities and Investments Commission (ASIC) reported that MIML, acting as the superannuation trustee, managed approximately $321 million in super investments through Shield for about 3000 members between 2022 and 2023.

ASIC initiated legal action in the Federal Court against MIML, a Macquarie subsidiary, after it admitted to not acting efficiently, honestly, and fairly by neglecting to place Shield under increased scrutiny.

The regulatory body also secured a court-enforced commitment from MIML requiring Macquarie to reimburse members the full amount of their original investments in Shield, minus any withdrawals made.

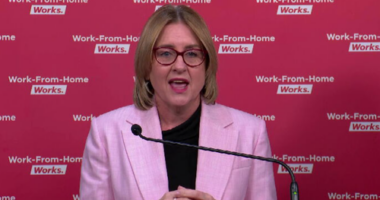

ASIC’s Sarah Court said yesterday she hoped other trustees would take similar action to Macquarie.

“I’d advise any other trustees to contact us to discuss how they can reinstate investors to their original positions prior to their investments in either the Shield Master Fund or the First Guardian Master Fund,” said Court.

“Superannuation trustees offering choice platforms are on notice.

“They are gatekeepers for retirement savings. ASIC expects them to take active steps to monitor the funds they make available to members through their platforms.”

In February 2024, ASIC halted new offers of investments in Shield.

“ASIC is investigating the circumstances surrounding Shield,” the financial watchdog said.

“ASIC is investigating Keystone Asset Management Ltd (in liquidation) (the responsible entity for Shield), its directors and officers, the role of the superannuation trustees, certain financial advisers who recommended investors invest in Shield, the lead generators, and the research house which rated Shield.”

Readers seeking support can contact Lifeline on 13 11 14 or beyond blue on 1300 22 4636.