Share this @internewscast.com

Corrie Chabau had just renewed his home insurance when the letter arrived last week.

Printed under a crisp council letterhead were details of updated flood risk mapping that could send his already expensive premium through the roof.

But Chabau is one of the lucky ones; some of his neighbours’ homes could be rendered uninsurable under the proposed changes.

Logan City Council is working on a new town plan that includes updated flood risk mapping as required by the Queensland government.

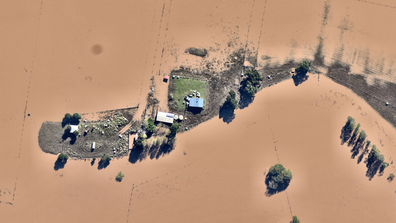

Two rivers and almost 90 creeks run through the region, which has experienced severe flooding as recently as 2022.

“This risk-based mapping considers a range of floods, from common to extremely rare, and their potential impact,” Mayor Jon Raven told 9news.com.au.

“We can’t stop floods but we can better understand and plan for them.”

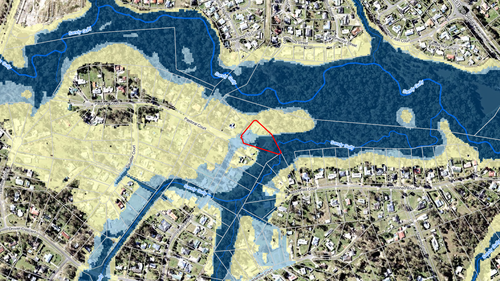

The new mapping published as part of the draft town plan last week identified areas of low, moderate and high flood risk.

About 20,000 letters were sent out to residents with properties in moderate and high-risk areas in late August.

Chabau, who has lived in Logan for more than 13 years, was one of them.

But he said the new mapping doesn’t reflect his experience of floods in the area, especially on his own property.

“I get stormwater runoff in the back of my place … but that’s stormwater,” he said.

“That’s not river flooding.

“Even through Cyclone Debbie, when we had 400mm in 20 hours, by the next day, you would not even know we had the rain.

He fears the new flood mapping will do more harm than good by making home insurance premiums spike.

Shocking before and after aerial images expose the severity of the NSW floods

And 13 suburbs were identified as “black zone” suburbs where more than 80 per cent of homes risk becoming uninsurable by 2030.

Those black zone suburbs included Tweed Heads South and Chinderah, less than two hours away from Logan by car.

One in five homes will also have exposure to some level of riverine flooding by 2030, which could affect insurance premiums.

Since moving to Logan in the early 2010s, Chabau’s premium has skyrocketed to more than $5000 a year.

The cost jumped by $1200 at his last renewal.

By comparison, the average cost for home and contents insurance in Queensland is $2735 according to Canstar, almost half of what Chabau now pays.

Some Logan residents claimed they had been quoted $17,000 to more than $30,000 for home insurance based on the new flood mapping.

Others fear their homes will become uninsurable for flood damage.

And anyone looking to sell could face new challenges in light of the changes.

”A lot of people are furious about it,” Chabau said.

“They’ve just destroyed everyone’s livelihoods.

“All the houses are basically worth nothing now, and we can’t insure them.”

He said that if his home insurance hits five digits, he may have to run the risk of going uninsured, as he simply can’t afford the cost.

Raven, the Logan City mayor, responded to these concerns by telling 9news.com.au council has “no control” over insurance premiums.

“While flood risk may be a consideration, there are many factors driving up the value of premiums across the country, not just in Logan,” he said.

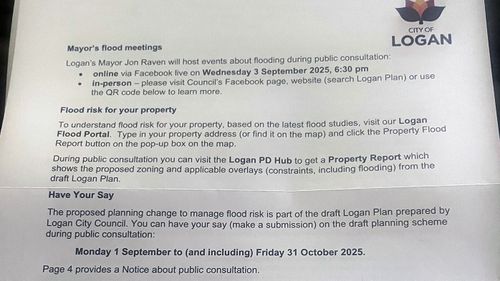

Council has begun public consultation on its draft town plan, which will run for nine weeks until October 31.

It is holding more than 50 engagement events and inviting submissions from residents in response to the updated flood risk mapping.

Every submission received will undergo a review and contribute to a consultation report. This report will be presented to the Queensland government alongside the revised town plan next year.

“The Logan Plan will be adjusted based on feedback where suitable, keeping in mind there are considerable legislative and policy limitations involved in this process,” Ryan stated.

But Chabau said that even if the mapping is changed, the damage has been done.

“The insurers go ‘well, it says here that it might flood’ and the premiums won’t ever come down. It’s just going to destroy everyone.”

Last night, a meeting was held in Logan to discuss the proposed changes.

“To say the place was packed would be an understatement,” Chabau said.

He described the meeting as tense, expressing that he and other residents were dissatisfied with how the council addressed questions regarding the new mapping and its implications for insurance.

“The worst part was as I was walking in, I heard a very elderly couple say, ‘We are going to lose everything because of this,'” he added.

“How dare they cause this stress on all these people?”