Share this @internewscast.com

Key Points

- The RBA has lowered the cash rate from 4.1 to 3.85 percent.

- A market analyst suggests rate cuts can cause moderate property price increases.

- Darwin and Melbourne are the most affordable capitals when considering median income and property costs.

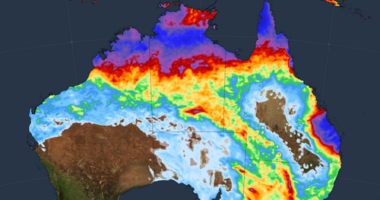

From property market proponents to prospective buyers — anyone vested in Australia’s real estate scene looks for answers to the prevailing query: Will the rate reduction enhance housing affordability?

Source: SBS News

Will the rate cut drive house prices up?

“Dwelling prices relative to household incomes are already significantly stretched. In fact, they are at historic highs, and we might see that strained affordability potentially deteriorate further from here.”

“Purchasing a home is a significant commitment, and greater confidence in one’s job stability and ability to manage mortgage payments or secure financing would make an individual more inclined to make such a long-term decision.”

Where are the ‘healthy’ property markets?

“Melbourne’s down towards the bottom of the pack in terms of that affordability ratio, which is a very healthy thing.”

More affordable than Melbourne were the ACT at 6.1 and Darwin at 3.9.

How much could you save monthly if the rate is cut?

A rate cut can also be a good opportunity to see what lenders are offering customers on a variable mortgage loan, according to Sally Tindall, data insights director at financial comparison site Canstar.

Credit: SBS News

Doing research ahead of time on the offerings of different banks can be a “bargaining chip” in negotiations,” she said.