Share this @internewscast.com

The Star was prepared to extend millions in gambling credit to a well-known money launderer and created fabricated letters to facilitate international bank transfers from unidentified individuals.

These details and many more have been exposed as financial watchdog AUSTRAC pursues the embattled casino giant in the Federal Court.

The Star committed “innumerable contraventions” of Australia’s anti-money laundering regulations through these actions, demonstrating a readiness to engage with 117 high-risk clients, according to barrister Daniel Tynan at a Federal Court session today.

The casino has admitted that 70 of these customers – who were junket funders, operators or players – each posed a high money laundering risk.

“They would have the opportunity to gamble that money, get the returns, wash it, do it again,” Tynan told Justice Cameron Moore.

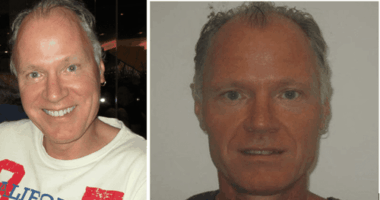

One of these customers, Suncity junket operator Alvin Chau, was provided with credit of up to $266.67 million.

Chau funded at least 3690 junket programs at The Star’s Sydney casino, bringing in a turnover of about $12.6 billion.

Despite media reports linking him to overseas crime syndicates, The Star continued to engage with the Suncity head, Tynan said.

It wasn’t until Chau was apprehended by Macau authorities and faced multiple charges, including money laundering, that the casino ceased its transactions with him, as heard in court.

Another customer was given almost $167 million in credit despite The Star knowing from at least 2014 that he had been involved in alleged money laundering, Tynan said.

The casino also facilitated high-risk transactions from 1221 customers who transferred money in and out through channels that obscured their identity, the court was told.

Staff at EEIS, a Macau-based subsidiary of The Star, wrote up falsified letters for local customers wanting to send funds through the Bank of China directly to the casino, Tynan continued.

These letters contained false claims about the source of the funds being deposited, the barrister said.

Almost $990 million in deposits were made through The Star’s hotel debit cards, allowing gamblers to transfer money directly to the casino without going through an Australian bank.

The cards also allowed gamblers in countries like China with restrictions on gambling to disguise their transactions by claiming they were for other purposes like hotel accommodation, Justice Moore was told.

The Star advanced money to customers who complained about the 24- to 48-hour waiting period before funds hit their accounts.

Individuals could also withdraw cash directly, Tynan said.

“This is coming in anonymously, taken out in cash – it can be used for anything.”

AUSTRAC is seeking $400 million in penalties over the breaches while the casino has argued it can only pay $100 million without being pushed into administration.

In April, the failing casino business received a $300 million rescue package from US gaming giant Bally’s Corporation.

The hearing continues tomorrow.