Share this @internewscast.com

Just arrived in my post is a letter from blue-blooded fund manager Schroders advising that the Capital Global Innovation Trust, the former Woodford Patient Trust, is winding down.

The message (not advice!) is to start taking the payments on offer now.

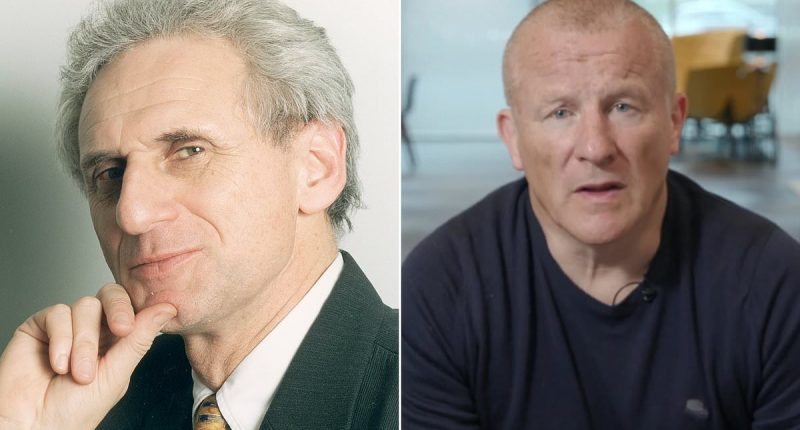

Neil Woodford’s ill-judged decisions left almost 300,000 clients of investment platform Hargreaves Lansdown (HL) nursing big losses.

Hargreaves didn’t advise clients to invest in Woodford per se. But its wealth list promoted Woodford, encouraging savers to pile in.

Those who opted to invest in Hargreaves house funds also were exposed to the flawed manager. A lack of liquidity forced closure in June 2019.

Life has moved on – but it is hard to forget that HL has never fully apologised for its misjudgement and is still the subject of a class action suit.

Fund scandal: Neil Woodford’s ill-judged decisions left almost 300,000 clients of investment platform Hargreaves Lansdown nursing big losses

Under HL’s current ownership – a CVC-led private equity consortium – it’s harder to know what is going on.

Former Financial Conduct Authority (FCA) chief Andrew Bailey, now at a higher calling, pledged a probe which is yet to be seen.

At the core of Woodford scandal is the question as to whether HL offered investors financial advice.

Under existing rules, inaugurated a decade ago, providers of financial services, such as banks and platforms, are forbidden from providing recommendations without a detailed and arm’s length assessment of client needs. That comes at a considerable cost.

An FCA proposal that would allow providers to offer clients low-cost pensions and investment direction ought to be a good thing.

Governments have a nasty habit of fiddling with pension rules. That makes events infernally confusing for investors.

Labour’s current drive to move people out of cash ISAs into alternative equity saving also will require guidelines.

Sorting this out will require trust in those offering new services. The divorce of advice from the mechanics of finance has caused distortions.

Bank branches, including those on my own High Street, have been shuttered and turned into cafes and pilates studios as cash transactions diminished. With more imagination, they could have been repurposed as trustworthy sources of financial wisdom.

Admittedly there is risk in cheap and cheerful help such as that provided by HL’s former wealth lists.

There is also the concern that a supplier, such as Lloyds Bank, might direct savers seeking counsel to group-owned Scottish Widows funds to harvest commissions.

UK savers, in contrast to US, Canadian and Aussie cousins, are far too risk averse. No one wants to be exposed to the next Woodford. But it is time for bureaucratic barriers to be braver and preferably UK equity investment was swept away.

Final offer

WH Smith has a strong survival instinct. Executives have a fear of backing away from heritage enterprises because of concern about a consumer and government backlash.

At a moment when retail is under extreme pressure because of surging costs, the group’s decision to sell its 230-year-old High Street chain, which offers Post Office services, was bold.

The offload to Hobbycraft-owner Modella Capital for £52million was contentious.

So much so that sales volumes in town centres have been affected and Modella negotiated a lower price of £40million.

WH Smith has chosen instead to focus on its faster growing chain of 1,200 outlets at airports and train stations across the world.

At a time when printed newspaper and magazine sales have been declining sharply, maintaining a High Street presence always was tricky.

Former chief executive Kate Swann kept the stores afloat by squeezing ever more product on to the shop floor as Smith’s built out the travel franchise. The bargain price doesn’t augur well for the new TG Jones branding.

High octane

The transformation of Liberty Global-owned F1 from a limited European-focused motorsport enterprise into a global franchise, with enormous exposure in the US and Middle East, is among the most remarkable financial and sport turnabouts of our time.

It has nurtured a generation of tech savvy, young petrol heads. In the past, car racing films stalled in the box office.

But Apple’s production F1, starring Brad Pitt, is off to a sprint start with receipts in its first weekend of £65million. Bravo!

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you