Share this @internewscast.com

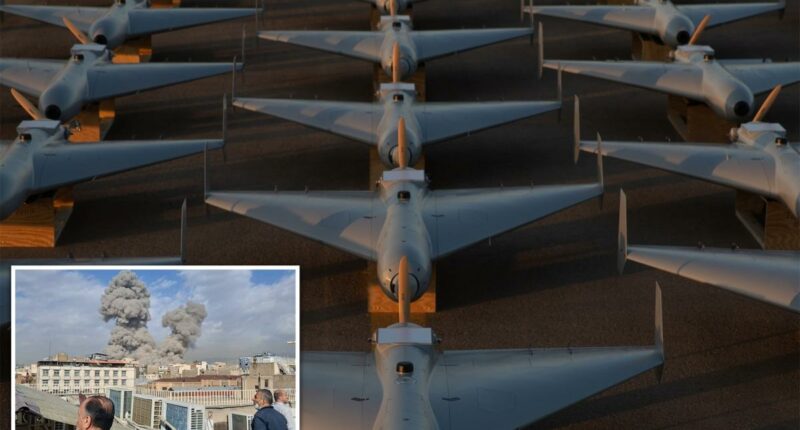

In a strategic twist on Saturday, US forces employed drone tactics directly inspired by Iran, utilizing kamikaze drones in combat as part of Operation Epic Fury for the first time.

These drones, termed the Low-Cost Unmanned Combat Attack System (LUCAS), were deployed to target key Islamic Revolutionary Guard Corps sites, including command centers, air defense systems, missile and drone launching facilities, and military airfields throughout Iran, according to US Central Command.

“For the first time in military history, CENTCOM’s Task Force Scorpion Strike is implementing one-way attack drones in combat during Operation Epic Fury,” declared CENTCOM, which oversees US military actions in the Middle East, via a statement on X Saturday afternoon.

“These economically efficient drones, inspired by Iran’s Shahed models, are now delivering American-made responses.”

While Iran’s Shahed-136 drones rely on GPS for precise strikes on buildings and military targets, the US variant, crafted by Arizona-based SpektreWorks, is notably lighter and can be launched using a catapult or rocket-assisted methods, as reported by Defense News.

The cost of each drone is approximately $35,000.

The first drone debuted during a December drill with the USS Santa Barbara in the Arabian Gulf.

“The President ordered bold action, and our brave Soldiers, Sailors, Airmen, Marines, Guardians, and Coast Guardsmen are answering the call,” CENTCOM commander Adm. Brad Cooper said on X.

The US and Israel launched airstrikes against Iran Saturday morning, killing Iranian Supreme Leader Ayatollah Ali Khamenei.

President Trump confirmed the dictator’s death, calling it “justice.”

“Khamenei, one of the most evil people in History, is dead,” the president wrote in a post on Truth Social.

“This is not only Justice for the people of Iran, but for all Great Americans, and those people from many Countries throughout the World, that have been killed or mutilated by Khamenei and his gang of bloodthirsty THUGS.”

The Israel Defense Forces also confirmed 40 top Iranian officials were killed in the airstrikes — including the head of the Islamic Revolutionary Guard Corps.

Iran has since fired retaliatory missiles and drones at US bases and facilities in multiple Middle Eastern countries — from Bahrain and Qatar to Kuwait, the UAE and Jordan — as well as attacks on Israeli sites.

US and Israeli officials said that the military campaign in Iran could last weeks.