Share this @internewscast.com

In 2025, a series of immigration policy updates significantly altered the landscape for travel, visa acquisition, and citizenship in the United States.

Here are five major transformations set to take place:

Trump administration launches H-1B visa overhaul

In September, the Trump administration announced a plan to revamp the distribution of H-1B visas, a program instrumental to the tech sector by enabling U.S. firms to employ highly skilled international workers, such as software engineers and data scientists.

These H-1B visas, issued by the Department of Homeland Security, serve as temporary work permits and are crucial for American tech companies seeking to attract global talent.

The proposed changes aim to motivate employers to offer higher wages or prioritize H-1B petitions for positions that demand advanced skills. This regulatory amendment was officially published in the Federal Register, following President Donald Trump’s signing of a proclamation that introduced a $100,000 application fee for H-1B visas.

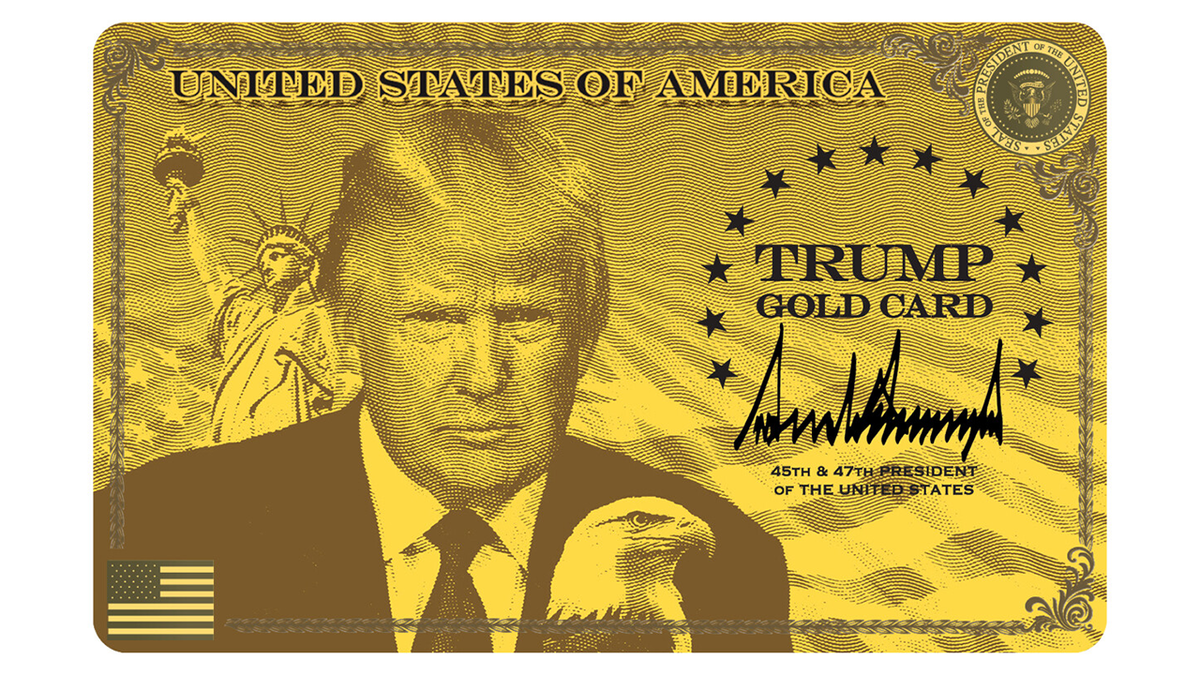

On September 19, 2025, in the Oval Office at the White House, Trump signed two significant executive orders. One established the “Trump Gold Card,” a visa program providing foreign nationals with permanent residency and a pathway to U.S. citizenship in exchange for a $1 million investment in the United States. The other order introduced a $100,000 fee for H-1B visas. (Photo by Andrew Harnik/Getty Images)

DHS said the changes will go into effect in February and are meant to “better protect the wages, working conditions, and job opportunities for American workers.

“The existing random selection process of H-1B registrations was exploited and abused by U.S. employers who were primarily seeking to import foreign workers at lower wages than they would pay American workers,” U.S. Citizenship and Immigration Services spokesman Matthew Tragesser said in a statement.

Expanded facial recognition for non-citizens looking to enter and exit the US

The Department of Homeland Security implemented a new rule on Dec. 26, 2025, that expands facial recognition for non-citizens who are entering and leaving the United States.

The DHS said on its website that the rule “amends existing DHS regulations to authorize U.S. Customs and Border Protection, an operational component within DHS, to collect facial biometrics from all noncitizens upon entry and exit at airports, land ports, seaports, and other authorized points of departure.”

The rule applies to green card holders and other non-U.S. citizens living legally in the country.

“Although U.S. citizens are not covered by this rule, they may continue to voluntarily participate in the facial biometrics process at entry and exit,” the DHS added.

Passengers wait in line to use the Automated Passport Control Kiosks set up for international travelers arriving at Miami International Airport on March 4, 2015, in Miami. (Joe Raedle/Getty Images)

Homeland Security moves toward scrutinizing foreign tourists’ social media accounts before entry

The Department of Homeland Security is moving toward scrutinizing the recent social media histories of foreign travelers before allowing them to enter the United States.

In a notice filed in December in the Federal Register, U.S. Customs and Border Protection wrote, “In order to comply with the January 2025 Executive Order 14161 (Protecting the United States From Foreign Terrorists and Other National Security and Public Safety Threats), CBP is adding social media as a mandatory data element for an Electronic System for Travel Authorization (ESTA) application.”

“The data element will require ESTA applicants to provide their social media from the last 5 years,” it added.

Homeland Security describes ESTA as “an automated system used to determine the eligibility of visitors to travel to the United States under the Visa Waiver Program and whether such travel poses any law enforcement or security risk.”

Trump launches $1M Gold Card for US residency status

Trump in December announced the launch of the much-anticipated “Trump Gold Card,” an immigration initiative designed to provide a new, streamlined path to U.S. citizenship.

The card, which has a starting price of $1 million, features a portrait of the president, the Statue of Liberty and the American flag underneath a gold background, with “Trump Gold Card” stamped on the left side.

President Donald Trump announced the “Trump Gold Card” in 2025. (@realDonaldTrump via Truth Social)

“We anticipate THE TRUMP GOLD CARD will generate well over $100 Billion Dollars very quickly,” Trump wrote in a post on Truth Social. “This money will be used for reducing Taxes, Pro Growth Projects, and paying down our Debt.”

Interested parties can apply for the “exclusive privileges” on the official website, trumpcard.gov. According to the site, applicants will submit their documents and pay a nonrefundable processing fee, triggering an accelerated probe by the U.S. Citizenship and Immigration Services.

Once an applicant is approved, a Trump Gold Card will be available for use throughout all 50 states and territories. They will be given lawful permanent resident status as an EB-1 or EB-2 visa holder.

Revamped US citizenship test adds questions, goes into effect

A new version of the U.S. citizenship test is requiring applicants to answer twice as many questions as the old one.

“The 2025 naturalization civics test is an oral test consisting of 20 questions from the list of 128 civics test questions. You must answer 12 questions correctly [60%] to pass the 2025 test. You will fail the test if you answer 9 of the 20 questions incorrectly,” U.S. Citizenship and Immigration Services said on its website.

The new test foregoes geographical questions and test-takers will be required to name all three branches of government instead of just one.

An image of a U.S. citizenship test. (Getty Images )

“American citizenship is the most sacred citizenship in the world and should only be reserved for aliens who will fully embrace our values and principles as a nation. By ensuring only those aliens who meet all eligibility requirements, including the ability to read, write, and speak English and understand U.S. government and civics, are able to naturalize, the American people can be assured that those joining us as fellow citizens are fully assimilated and will contribute to America’s greatness. These critical changes are the first of many,” USCIS Spokesperson Matthew Tragesser said.