Share this @internewscast.com

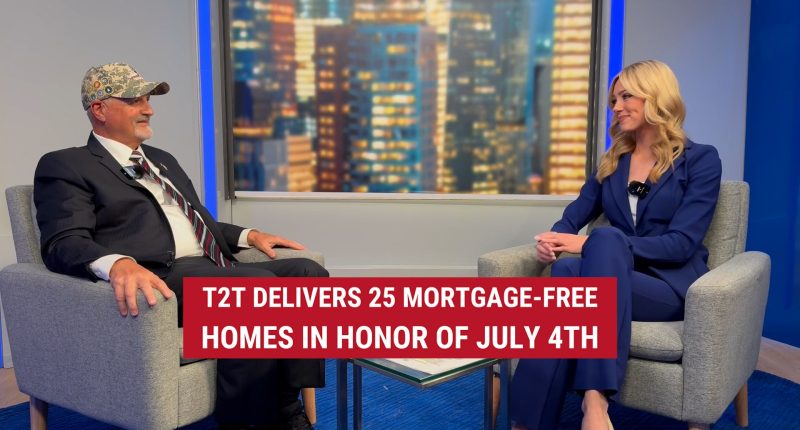

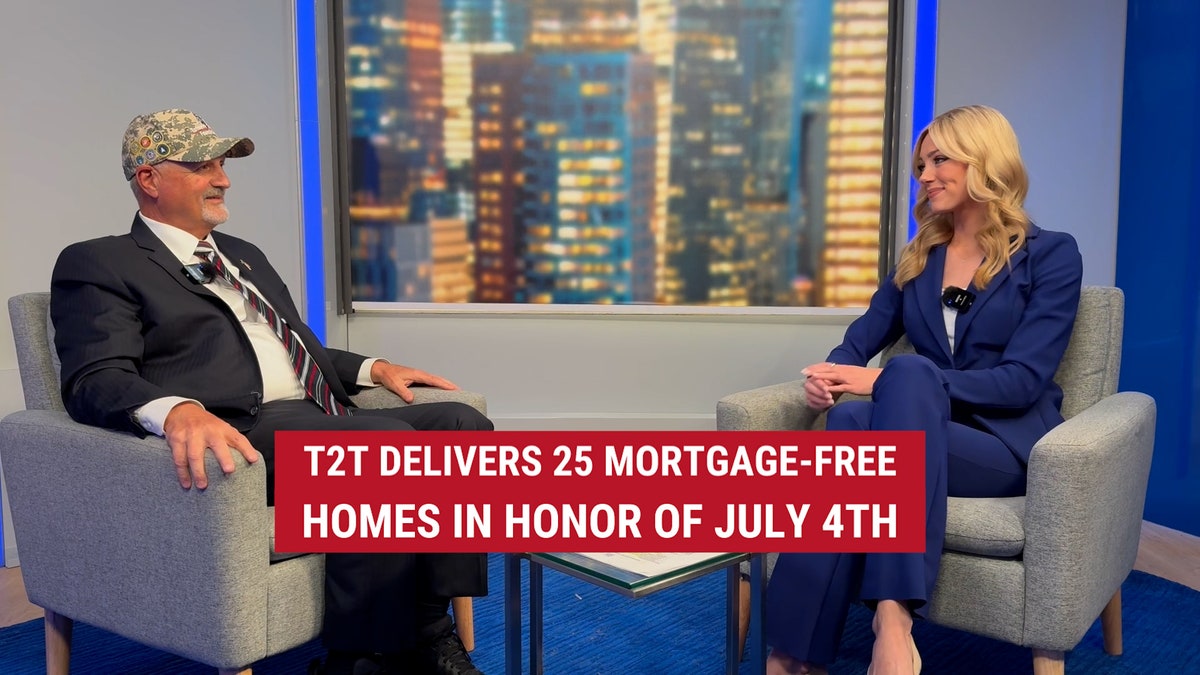

As America marks its Independence Day, Frank Siller, the Chairman and CEO of the Tunnel to Towers Foundation, spoke with Abby Hornacek from Fox Nation to discuss the deep significance of the 4th of July: acknowledging those who safeguard our liberties. In celebration of this day, Tunnel to Towers is presenting 25 mortgage-free homes to deserving heroes.

The foundation’s main initiative is constructing custom “smart homes” for service members and first responders who have been severely injured. This mission was initiated by the specific needs of Sergeant Brendan Marrocco, a quadruple amputee. Siller highlighted how the program has expanded from initially building a few homes to potentially developing 100 to 150 smart homes in the following year, thus granting independence to those who have made significant sacrifices.

In addition to aiding injured veterans, Tunnel to Towers also offers mortgage-free homes to families of fallen first responders and Gold Star families whose members died in service. Siller recounted emotional stories from recipients who often feel unworthy of the support, despite their significant sacrifices. He emphasized America’s moral responsibility: “If you’re willing to risk your life… we’re going to ensure your family is cared for.”

Siller urged viewers to join this crucial mission of gratitude. “Make that promise,” he implored, asking all to visit T2T.org and donate just $11 a month to ensure these heroes and their families are cared for.