Share this @internewscast.com

When Rachel Reeves announced a sweeping £30 billion tax increase, it sent ripples across Britain, leaving some of the country’s most diligent workers facing the brunt of her decision. The Chancellor’s move to raise taxes and expand benefit handouts has sparked discontent among various groups.

Succumbing to Left-wing pressures, the Chancellor has reneged on Labour’s previous tax promises. She has implemented a £13 billion freeze on income tax and National Insurance thresholds for the next three years, a decision that many see as a departure from earlier commitments.

Business owners, single mothers striving to make ends meet, professionals, and farmers have all voiced their frustrations. They feel this tax hike is a setback, describing it as a “real kick in the teeth.” These individuals share their personal stories, highlighting the financial strain brought on by the Chancellor’s decisions.

The backlash against the Chancellor’s actions is palpable. Critics are vocal about the decision to eliminate the two-child benefit cap, a move that has contributed to a projected increase in welfare spending by £16 billion annually.

In a fiery critique, Kemi Badenoch labeled the Chancellor’s announcement as “a Budget for Benefits Street, paid for by working people,” capturing the sentiment of many who feel burdened by these changes.

Echoing this sentiment, Nigel Farage has condemned the Budget, describing it as “an assault on aspiration and saving,” reflecting the unease felt by those who strive to achieve economic stability and growth.

The Office for Budget Responsibility said economic growth under Labour would be even lower than forecast last year – and warned that none of the 88 measures unveiled by Ms Reeves on Wednesday would have a ‘material impact’ on boosting GDP.

The decision to axe the two-child cap was cheered by Labour MPs and could help secure the short-term survival of the Chancellor and Sir Keir Starmer.

As Rachel Reeves dropped a £30billion tax bomb on Britain, these are the strivers hit hard by her decision to increase taxes and boost benefit handouts

In the most chaotic Budget in history:

- Official figures showed Labour will push the tax burden to an all-time high of 38.3 per cent of GDP by the end of the decade;

- Ms Reeves refused to rule out further tax raids next year, despite levying an unprecedented extra £70billion in Labour’s first 18 months in office;

- She hit salary sacrifice pensions schemes with a £4.7billion raid;

- Ms Reeves bowed to Left-wing demands for a mansion tax of up to £7,500 a year despite Treasury warnings it will cost the taxpayer £300million in lost revenue in the coming years;

- Motorists faced a double whammy, with fuel duty due to rise next year and the Chancellor ushering in a new 3p-a-mile road pricing scheme for electric vehicles;

- The Treasury set aside £1.8billion for the development of Labour’s controversial plan for digital ID cards;

- Ms Reeves unveiled plans to knock £150 off energy bills by switching some green levies on to the taxpayer;

- Experts said one million older people living on the state pension will be dragged into the income tax system by the latest stealth raid;

- The annual limit on cash Isas was slashed from £20,000 to £12,000;

- Total welfare spending is forecast to top £400billion a year – a rise of 22 per cent;

- There are fears of rent increases after landlords were hit with a rise in the tax they pay on income;

- Inflation is forecast to remain above target throughout next year.

In a blistering response, Kemi Badenoch branded the Chancellor’s statement ‘a Budget for Benefits Street, paid for by working people’

‘We may have to raise ticket prices if the minimum wage keeps going up’

- Names: Katie and Tom Rollings

- Ages: 38 and 43

- Live: Billingshurst, West Sussex

- Jobs: Directors of a family farm park

Katie Rollings and her husband Tom run Fishers Farm Park in West Sussex, alongside his parents Tim and Trina.

It was founded in 1990 as a good-value day out for parents and children, with animals and rides, but as minimum wage for young people increases rapidly, Mrs Rollings said she is worried the family may have to raise their ticket prices.

The minimum wage for 18 to 20-year-olds will increase by 8.5 per cent to £10.85 an hour, narrowing the gap with older workers as part of the Government’s commitment to ‘raise the floor’ on wages for all workers.

Meanwhile, 16 and 17-year-olds and apprentices will see their minimum wage increase by 6 per cent. But for those over the age of 21, the living wage will rise by just 4.1 per cent.

Fishers Farm Park is a big employer in the community, with a team of 100 local staff, including 35 on permanent contracts – and the majority are young.

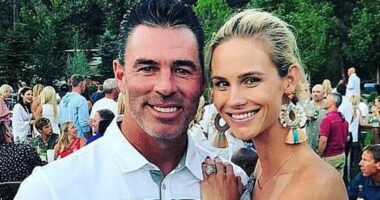

Tom and Katie Rollings with their twin children Ralph and Rosie and younger daughter Alice

Mrs Rollings said: ‘As the minimum wage increases, we have to raise all our wages, or they start to meet in the middle.

‘As a local business, it’s important we pay well, but it starts to become a pinch on top of the veterinary costs we already have with hundreds of animals.

‘We have more 16 to 18-year-olds in their first jobs, but we do have a chunk of our team in their late teens to early 20s who are students who have gone to university and come back in the holidays to work,’ Katie says.

Mrs Rollings, 38, and Tom, 43, have three children, twins Alice and Ralph, eight, and Rosie, five.

Their eldest two were born through IVF after a seven-year struggle to conceive, and Katie has since set up Fertility Action, a charity that supports parents who are going through a similar experience – but she is worried support will be hit.

Mrs Rollings said: ‘The reason the farm park business began was to give families somewhere to have a lovely time. But as costs of employing staff rise, we might have to put up our gate prices to remain profitable.

‘If it becomes unaffordable to go to these sorts of places, is everyone going to be at home on screens?’

I’m trying to boost the economy with my business…but I keep being knocked back

- Name: Karen Burke

- Age: 55

- Lives: Tunbridge Wells

- Role: Recruitment consultant and small business owner

Recruitment consultant Karen Burke earns £34,000, but commission can drag her across the higher rate threshold – which yesterday remained frozen.

The Chancellor announced that current income tax thresholds will remain in place for three years instead of the forecast two.

Ms Burke, 55, who has an adopted 12-year-old daughter, said: ‘I work hard to support her. But if I earn a lot of commission, I end up paying 40 per cent tax.

‘That’s money that could go on school uniform bills or fixing the car, especially when I don’t have a partner with another salary coming in.’

Ms Burke, who also owns a small business selling children’s swimming towels, says: ‘I decided to adopt by myself, that was my choice. But I don’t think I’m being helped.

Recruitment consultant Karen Burke earns £34,000, but commission can drag her across the higher rate threshold

‘I’m putting extra hours in to start another business to help the economy. But it feels like I’m being knocked back.

‘I could be a single mum who just gives it all up and gets the council tax, mortgage, everything paid, but I don’t want to do that.’

Ms Burke’s business, Go Goosey, turned a profit for the first time last year, but she points out that as soon as this happened, she was hit with corporation tax.

‘I haven’t been able to pay myself a salary from it yet,’ she says. ‘These measures aren’t encouraging me to work harder.’

‘They keep moving the goalposts…I’ll probably have to change career and may move abroad’

- Name: Zahid Razzaq

- Age: 41

- Lives: Manchester

- Job: IT contractor

Zahid Razzaq is a 41-year-old IT contractor, currently working for the Metropolitan Police. He lives in Manchester with his wife and three children aged 16, 13 and nine.

He said he was ‘gobsmacked’ by the announcement of a 3p pay-per-mile tax on electric vehicles (EVs), which he said was ‘a real kick in the teeth’.

He said: ‘We got our first EV around four years ago, on the basis that it was meant to be road tax-free, help the environment, and be cost-effective to run.

‘There were free charging points available at supermarkets and everything was really good. I bought a second, thinking, this is great, it’s going to save me a fortune. But the Government is clamping down on all the benefits it advertised. It’s moving the goalposts.’

He is also concerned about the £2,000 cap that has been introduced on salary sacrifice – which he currently uses to boost his pension.

Mr Razzaq said: ‘With that restricted, I think I will probably have to change career. The contractor market has been uncertain, and it will no longer be worthwhile for me, so I’ll try to start a business.’

Zahid Razzaq, an IT contractor working for the Metropolitan Police, was an early adopter of EVs

‘Until now, I had been paying myself a minimum wage, while everything else was going into my pension. I was maximising the benefit of salary sacrifice.

‘The cap is making me completely rethink the work I do, I think I might just change career, because it won’t be worthwhile for me.

‘By the time I look to retire, I don’t know how old I might be. And as the Government ups the pension age in combination with all these changes, it’s putting people off investing into pensions.’

Mr Razzaq said the extent to which policies have been changed in recent years has encouraged him and his wife to consider moving abroad.

‘£100,000 is not what it says on the tin’

- Names: James and Daniela Sponder

- Ages: 46 and 38

- Live: South London

- Jobs: Product manager and primary school office assistant

James Sponder earns more than £125,000 working for a tech distribution company – and salary sacrifice is one of the few areas where he is not taxed.

But Rachel Reeves announced that the amount employees can shield from National Insurance (NI) in these pension schemes will be capped at £2,000.

Mr Sponder, 46, will now have to pay NI on the contributions he makes above this amount. He said: ‘I put a lot in because I know I’m improving my overall situation by doing that for when I’m older.

James Sponder and his wife Daniela live in South London with their children Luca and Alessia

‘I’m not going to sit here and say I’m worried about paying the bills as a higher earner. But my money is budgeted out each month, and we don’t live a lavish lifestyle.

‘The National Insurance changes aren’t great, but it would be worse if I had to pay income tax above the cap.’

Mr Sponder and his wife Daniela, 38, live in south London with their two children, Luca, five, and Alessia, three.

Mrs Sponder works part-time as an office assistant for a primary school. She was previously an HR manager, but the couple were frustrated to find that after their second child was born, because of Mr Sponder’s high salary, they would actually lose money if she were to go back to her job.

She says: ‘When you look at the real terms value of it, and all the expenditure in our bills and putting food on the table in London, once you’re in the tax trap, £100,000 is just not what it says on the tin.’

Mr Sponder also has an EV which he got through salary sacrifice. With a 3p-per-mile charge now being brought in for EVs, he said: ‘I probably wouldn’t have got the car if I knew that was going to change significantly, I don’t think it’s a very good idea. If you try to encourage everyone to move to EVs, you can’t then start taxing people, it will just switch everyone off.’

‘We want to help feed the nation – but now we may have to sell up after 100 years’

- Name: Gill Grimwood

- Age: 56

- Lives: Hedingham, Essex

- Job: Farmer

Gill Grimwood’s family have been putting ‘blood, sweat and tears’ into their farm for 100 years, and after the inheritance raid announced last autumn, she may have to sell up. Yesterday the Government made no significant changes to the hated policy.

‘My mother is 89 and in very poor health, and my father is 86,’ Ms Grimwood said. ‘They have been encouraged by various governments over the years to die with their boots on.

‘Now I’m in the situation where if they go after April 26 [when the new rules on inheritance tax come into force], I’m going to be faced with a bill of about £200,000.

Gill Grimwood with her son Josh, granddaughter Maeve, and father David

‘I can’t even get an extension on my overdraft for £30,000 without jumping up and down, so we would have to sell some assets, or perhaps the whole farm.’

Tattersalls Farm in Hedingham, Essex, was originally started by her grandfather Christopher in 1926. Now, Ms Grimwood is in partnership with her parents.

‘I have a 31-year-old son, Josh, who works on the farm and is very keen to continue it. And he has a nine-month-old daughter, Maeve.

‘We don’t make a lot of money. We just want to make a reasonable living and help feed the nation, but the Government is screwing everybody over.’

Mansion tax: ‘There is a culture of jealousy in Britain’

- Name: Mervyn Mandell

- Age: 73

- Lives: North London

- Role: Semi-retired chartered surveyor

Mervyn Mandell, a semi-retired chartered surveyor, has been involved in property for the last 50 years. His apartment, worth more than £2million, will be hit by the mansion tax.

From April 2028, owners of properties valued at over £2million will pay a recurring annual charge, which will be additional to their council tax bill.

There will be four price bands, with the surcharge rising from £2,500 for a property valued in the lowest £2million to £2.5million band, to £7,500 for those in the highest band of £5million or more.

The measure is estimated to raise £400million in 2029 to 2030 for central Government.

Mr Mandell said: ‘I’ve just recently moved from a band H house to another band H, an apartment worth more than £2million in North London.’

Mervyn Mandell will be hit by a mansion tax on his apartment in North London

‘It’s less of a worry for me, but one of my sons falls just within these bands. He has three boys, and he has a large mortgage, so this would be an additional cost they would have to budget for.

‘I hope by 2028, when the system is due to come in, something changes. But at least the charges aren’t as high as I thought they might be.’

Mr Mandell has two children and three step-children with his wife, as well as 13 grandchildren.

He added: ‘The thought of leaving the country has crossed my mind, to be perfectly honest, as it has for numerous people.

‘All my children and grandchildren live in the UK. There may come a stage when they start leaving the country, in which case, what’s the point of me staying here?

‘There seems to be a negativity in British culture of people being successful, viewing it as a bad thing. It’s a jealousy.’

‘The Government’s got zero interest in helping hospitality’

- Name: Hugo Willett

- Age: 19

- Lives: Kent

- Role: Pub landlord

‘Britain’s youngest pub landlord’ Hugo Willett is concerned that the increase in alcohol duty will hit his profit margins hard.

‘How is a pub supposed to make any money if the price of beer and wine keeps going up and customers expect the price of a pint to remain the same?’ he asks.

Rachel Reeves announced yesterday that alcohol duty would rise in line with inflation, by 3.66 per cent, after a 3.6 per cent hike last year.

Rachel Reeves announced that alcohol duty would rise in line with inflation. Pictured: Hugo Willett

‘If I put up my prices, my customers will be up in arms. They might buy three fewer pints that evening. Or the alternative is that they might go to a rival pub charging less.’

Hugo, who quit his politics degree to take over the Bowl Inn in Hastingleigh, Kent, in June 2024 when he was 18, says that measures announced at this Budget and the last show ‘the Government’s got zero interest in helping hospitality’.

‘A lot of my customers rely on the pub for their social life,’ he says. ‘It’s their one chance to unwind in the week, especially in rural communities. The Government needs to recognise they role play.’

‘I’m glad I can keep using my cash Isa’

- Name: Jules Ackerman

- Age: 74

- Lives: Aberdeenshire

- Role: Retired former nurse

Jules Ackerman, 74, breathed a sigh of relief knowing that she will keep her full £20,000 cash Isa allowance – due to her age.

The former nurse, who continues to work as a carer and dog-sitter, has put her NHS pension into an Isa and tries to top up these savings each month.

She said: ‘I haven’t got enough money to gamble, so I didn’t want a stocks and shares Isa. It would be so alien to me and I couldn’t afford to lose what I’ve got.

Jules Ackerman said: ‘I haven’t got enough money to gamble, so I didn’t want a stocks and shares Isa’

‘If you’re trying to save some pennies, like me, you don’t want to be taxed on your money again. So I’m glad I’ll be able to keep using my cash Isa.’

While the Chancellor did reduce the cash Isa allowance to £12,000 yesterday, those over the age of 65 are exempt from the changes.