Share this @internewscast.com

The U.S. housing market is subtly shifting into a downturn. After years of significant appreciation, price reductions are now evident in nearly one-third of the largest metropolitan areas in the country, marking the broadest retreat since 2012.

Earlier this year, only six of the top 100 metropolitan areas experienced year-over-year price decreases.

That figure has surged to 32, representing the most extensive share of declining markets since early 2012, as revealed by the latest home price insights from Cotality.

The housing sector, which once sizzled with activity, has cooled to the point where economists predict this shift may redefine the homebuying landscape for years ahead.

Nationally, annual price growth has slowed to a near standstill, with just a 1.1 percent increase in October—marking the weakest growth rate in over a decade and a sharp fall from the 3.4 percent growth earlier this year.

A closer look at the data reveals why the national average appears stagnant. Price reductions are not uniformly spread across the nation. Instead, significant declines are concentrated in a few previously booming states.

Nine of the ten weakest markets for home price growth are in just two former boom states: Florida and Texas.

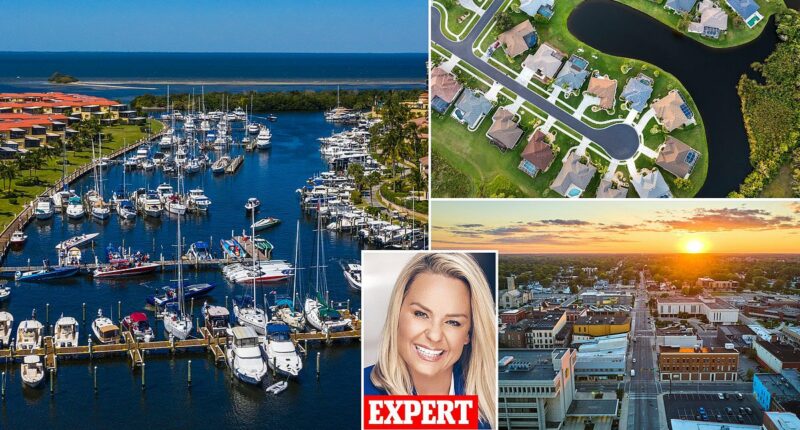

Five of the ten biggest declines are in Florida, where prices are down between 5.5 percent and 8.9 percent in metros including Punta Gorda, Cape Coral, Sebastian, North Port and St. Petersburg.

The University of Illinois in Champaign, where weaker demand around a university-centric economy has coincided with a 10.6 percent fall in home values, the largest of anywhere in the US.

Corelogic chief economist Selma Hepp

Four more are in Texas, with falls ranging from 4.9 percent in Waco and Brownsville to 8.4 percent in Wichita Falls and 8.0 percent in Victoria.

Those declines reflect how hard these markets ran up during the pandemic — and how quickly demand has cooled since.

In many Florida and Texas cities, prices jumped far faster than local incomes as buyers piled in from out of state when mortgage rates were near record lows.

Once borrowing costs rose, that flow of buyers thinned out fast.

At the same time, supply surged. Homes built or bought during the boom are now coming back onto the market, leaving sellers competing for fewer buyers and cutting prices to get deals done.

The shift has been especially pronounced in places that became symbols of remote-work living.

The outlier is Champaign, Illinois — the only market in the top ten biggest declines outside Florida and Texas. Home prices there are down 10.6 percent over the past year, the steepest drop of any major metro.

That fall is striking because Champaign never experienced the same bidding-war frenzy as Sun Belt boomtowns. Instead, the market has been weighed down by slower population growth.

Join the debate

How do you think plummeting home values in Florida and Texas will impact families and communities?

Historic downtown Terre Haute, Indiana, which now leads the nation for home price growth with values up 15 percent over the past year.

North Port, Florida suffered a cooling market from January to the end of 2025. High mortgage rates and too much inventory hurt Florida’s housing market

Punta Gorda, Florida, where home prices have fallen 8.9 percent over the past year as once-booming Sun Belt markets cool sharply in 2025.

Muncie, Indiana has seen prices rise 11.6 percent. Muskegon, Michigan is up 10.6 percent, with Fond du Lac, Wisconsin, Kokomo, Indiana and Pittsfield, Massachusetts each recording gains of around 10 percent.

While some of the Sun Belt is sliding backward, a very different picture is emerging in parts of the Midwest, Northeast and Pacific Northwest — where prices are still rising, in some cases at double-digit rates.

Terre Haute, Indiana leads the country, with home prices up 15.0 percent over the past year. Youngstown, Ohio is close behind, posting a 13.0 percent increase.

Prices in these cities never surged during the pandemic, leaving them less exposed as mortgage rates rose.

With fewer speculative sellers and more buyers anchored to local jobs and incomes, demand has held up — even as former boomtowns struggle to find footing.

Nationally, home prices were still rising at a 3.4 percent annual pace in January.

That momentum slowed steadily through the year, falling to a record low by October — the latest month covered in Cotality’s report, which typically lags by two months due to the depth of its data.

‘Slowing price growth reflects a much-needed rebalancing after years of unsustainable gains,’ said Cotality’s chief economist Dr Selma Hepp.

St. Petersburg’s waterfront skyline. The city has recorded a 5.5 percent annual decline in home prices amid Florida’s broader housing slowdown.

The Champaign City Building in central Champaign, Illinois, which leads the nation for home price declines with values down 10.6 percent.

Muncie City, Indiana, has seen prices rise 11.6 percent, despite many other metros across the country losing value over 2025

Cape Coral, Florida, is undergoing a major housing market crisis. Home values in the metro dipped in 2025

Hepp said the price declines will help buyers find affordable homes in the market.

‘These adjustments will help restore affordability over time and make housing more accessible to a wider group of buyers,’ she said.

The slowdown has been driven by higher mortgage rates earlier in the year, prices that ran well ahead of what many buyers could realistically pay, and a surge in housing supply in former boomtowns such as Florida and Texas.

The explosive gains of 2022 — when some Florida and Southeast metros surged by roughly 30 percent — are firmly in the rearview mirror. Price declines now stretch across Texas, California and much of the Mountain West.

‘Looking ahead, regional differences will remain pronounced, with demand favoring areas that offer both economic opportunity and relative affordability,’ Hepp said.

Hepp said mortgage rates will determine what happens next.

‘Mortgage rates will play a critical role in shaping the 2026 housing market,’ Hepp said.

‘A notable drop in mortgage rates combined with low supply could lead to a re-acceleration of price gains.’