Share this @internewscast.com

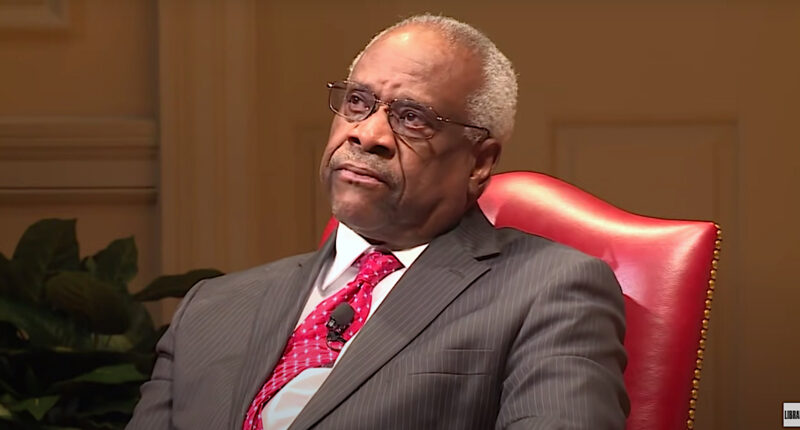

Clarence Thomas during a 2018 legal discussion (YouTube/Library of Congress).

On Monday, U.S. Supreme Court Justice Clarence Thomas expressed strong disapproval of the court’s decision to decline reviewing a lawsuit filed by the widow of a military serviceman. Her attempt to sue the federal government faced a roadblock after her husband perished in a crash involving a civilian government employee, who admitted full responsibility for the incident.

In a detailed eight-page dissent, Thomas urged the court to reconsider a 75-year-old precedent that shields the U.S. from liability in many civil cases not explicitly covered by the Federal Tort Claims Act (FTCA). This act allows individuals to seek damages from the government for injuries caused by federal employees acting within their official roles.

The FTCA includes an exception for military activities, barring lawsuits related to “combatant activities” during wartime. However, the judicially established Feres Doctrine has expanded this to prevent claims for injuries “incident to military service,” a principle Thomas has consistently criticized.

The case involves the tragic death of Air Force Staff Sergeant Cameron Beck, who was off-duty when a car crash claimed his life at Whiteman Air Force Base, Missouri, on April 15, 2021. Beck was returning home on his motorcycle for lunch when a civilian federal employee, distracted by her phone, veered a government van into his path. Beck died instantly, and the driver later admitted to criminal negligence, acknowledging the accident was entirely her fault.

Following the incident, Beck’s widow sought to hold the driver’s employer, the federal government, accountable for wrongful death. Thomas noted that it should have been a straightforward wrongful death case. However, due to the Feres Doctrine, the 8th U.S. Circuit Court of Appeals upheld the lower court’s dismissal, leaving Beck’s widow and their son without legal recourse.

“Today, the Court denies her petition, so Mrs. Beck will recover nothing in tort for her husband’s wrongful death,” Thomas lamented in his dissent.

The Feres Doctrine holds that the FTCA’s waiver of federal immunity does not apply in cases “where the injuries arise out of or are in the course of activity incident to military service.”

Thomas asserts that even under existing precedent, which has been “almost universally condemned by judges and scholars,” the court should have taken Beck’s case, as his death “did not arise out of …activities incident to his military service.”

“The Court of Appeals acknowledged that Staff Sergeant Beck was ‘killed during off-duty hours’ and that his death ‘arose out of nonmilitary activities,’” Thomas wrote. “Feres itself distinguished cases in which the injured serviceman was ‘under compulsion of no orders or duty’ and was ‘on no military mission.’ Beck was not ordered on a military mission to go home for lunch with his family. So Mrs. Beck should have prevailed under Feres.”

Thomas also emphasized that the doctrine has been problematic among the lower courts, calling application of the Feres Doctrine “irreconcilable.”

“They have told us that the Feres doctrine is now ‘an extremely confused and confusing area of law,’” Thomas wrote, referring to the lower courts. “As I have explained, it is unsurprising that, with its atextual roots and vague rationales, ‘[t]he Feres doctrine cannot be reduced to a few bright-line rules’ and has thus left courts in disarray.”

Justice Neil Gorsuch did not join Thomas’ dissent, but said he too would have granted review of the case.

Justice Sonia Sotomayor agreed in principle that Feres’s “atextual expansion” of the FTCA had garnered “near-universal criticism” and caused “significant confusion.” However, she voted to deny review “out of respect” for the court’s precedent, reasoning that it was on the legislature to make the necessary changes.