Share this @internewscast.com

In the ongoing debate about California’s financial future, one key player isn’t Governor Gavin Newsom or former President Donald Trump. Instead, it’s a formidable union leader whose influence could significantly affect the state’s economy. Many worry that his actions might lead to a loss of $1 trillion in wealth from California.

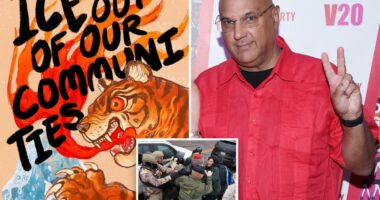

Dave Regan, who has been at the helm of SEIU-United Healthcare Workers West since 2011, is advocating for a tax measure targeting the state’s billionaires. His proposal suggests that these wealthy individuals should contribute 5% of their total wealth to California’s coffers.

This controversial tax plan is already causing ripples among California’s elite, many of whom are contemplating relocation to states with more favorable tax conditions due to potential tax liabilities as high as $12 billion.

The initiative, which requires 874,641 signatures to appear on the November ballot, aims to levy a one-time 5% tax on the assets of roughly 200 billionaires residing in California.

Proponents argue that this tax could generate up to $100 billion in revenue over a five-year span. However, critics warn that such a move might precipitate a mass departure of business leaders who collectively provide tens of thousands of jobs and contribute hundreds of millions in tax revenue to the state.

While supporters claim the one-off tax would raise $100 billion over about five years, it’s also widely predicted to drive an exodus of entrepreneurs responsible for tens of thousands of jobs and hundreds of millions in tax revenue.

Regan has a reputation as a bare-knuckled operator known for pushing statewide ballot measures as political leverage — and even Newsom hinted at frustration with his tactics last year.

“We have one individual that represents one labor union in the state of California that has not collected one signature that is considering putting on the ballot, after he collects signatures, a wealth tax that the vast majority of labor opposes,” Newsom griped in December at the New York Times Dealbook conference, speaking of the billionaire tax.

Download The California Post App, follow us on social, and subscribe to our newsletters

California Post News: Facebook, Instagram, TikTok, X, YouTube, WhatsApp, LinkedIn

California Post Sports Facebook, Instagram, TikTok, YouTube, X

California Post Opinion

California Post Newsletters: Sign up here!

California Post App: Download here!

Home delivery: Sign up here!

Page Six Hollywood: Sign up here!

It’s not Regan’s first rodeo pushing a divisive voter initiative — a tactic he once called the “best bargain in politics.”

His progressive union has led the charge on vexing ballot questions like whether to regulate the kidney dialysis industry — which California voters rejected three times in a row —along with others, like a $15 minimum wage proposal in 2015 that it pulled after legislators offered their own plan to raise wages.

Dialysis corporations and their consultants were forced to spend over $110 million to defeat just one of the union’s ballot questions. And the labor group claims credit for boosting wages, expanding Medicaid and improving bankruptcy protections at the ballot box.

All told, the union representing 120,000 mostly healthcare workers has spent $75 million on 45 initiatives since 2012 — the majority of which were either rejected or tossed out, according to The Information.

The union denied that the controversial billionaire tax is a bid for political leverage, rather a way to make up for the state healthcare and education programs that have been cut by the Trump administration.

“The campaign is seeing broad support from voters for a one-time, 5% tax on billionaires to close the gap on federal healthcare cuts in HR1. Voters will have the chance to vote Yes on this ballot measure in November,” said Nathan Selzer, spokesperson for SEIU-UHW.

“There is no other viable solution right now – within the state budget or otherwise – to fill the funding gaps and chaos created by HR1,” he added, referring to Trump’s so-called Big Beautiful Bill that cut healthcare funding.

Regan declined repeated interview requests.

“He’s an organizer. He’s not a big, flashy character,” Jim Ross, a longtime California political consultant.

Regan, who led another SEIU chapter in Ohio, West Virginia and Kentucky before landing in California, has ruffled feathers even within the labor movement.

Regan was installed SEIU-UHW president after a contentious takeover that involved firing “dozens of staffers” and sidelining more than 200 elected stewards that he deemed disloyal, according to Payday Report.

Past allegations of misconduct by Regan resurfaced during a 2023 Senate Judiciary Committee confirmation process, years after a California lawsuit accusing union officials of widespread misconduct ended in a confidential settlement.

The lawsuit, filed by former union staffer Mindy Sturge, described a toxic workplace culture involving alcohol, sexual harassment and misconduct by senior leaders, including Regan.

Other allegations involved Regan being intoxicated at events and showing up drunk to an October 2017 training where he “asked women if he could smell their panties,” according to the lawsuit.

This was an 8-year-old lawsuit that was settled. Dave Regan was never a defendant in the suit,” Selzer said.

The union claims it’s racking up major support for the billionaire tax — as out-of-state allies like lefty Sen. Bernie Sanders stump in favor of the plan.

“The support from labor, community allies, and voters around this initiative has been overwhelmingly positive. The majority of endorsements will be intentionally announced once signature gathering has been completed,” Selzer said. “We have over 100 endorsements already and expect hundreds more — most of which will be rolled out between April and November.”

But critics say it’s already butchered the golden goose by driving as much as $1 trillion in wealth out of California — crippling future tax revenues.

The independent state Legislative Analyst wrote that the tax could raise tens of billions in revenue — but result in an ongoing revenue loss of “hundreds of millions of dollars or more per year.”

Billionaires including venture capitalist Peter Thiel and Google co-founders Sergey Brin and Larry Page have taken steps to move assets out of California after the tax was proposed.

Brin, who could be hit with a $12 billion bill if the billionaire tax measure passes, gave $20 million to a group called Building a Better California that is opposed to the tax, per reports.

Thiel, who could be on the hook for $1 billion in California taxes, moved an office for his firm Thiel Capital to Miami last year in what was seen as a move to dodge the tax.

Newsom and other mainstream Democrats have distanced themselves from the billionaire tax, saying it goes too far.

“It’s really just one rogue guy on an island trying to steer money to his special interest at the expense of everyone else,” said a source familiar with the campaign.