Share this @internewscast.com

In Chicago, a recent computer system upgrade has led to some delays in property tax bill distribution. Meanwhile, a new study reveals that homeowners in the city are experiencing the steepest property tax increase in over 30 years.

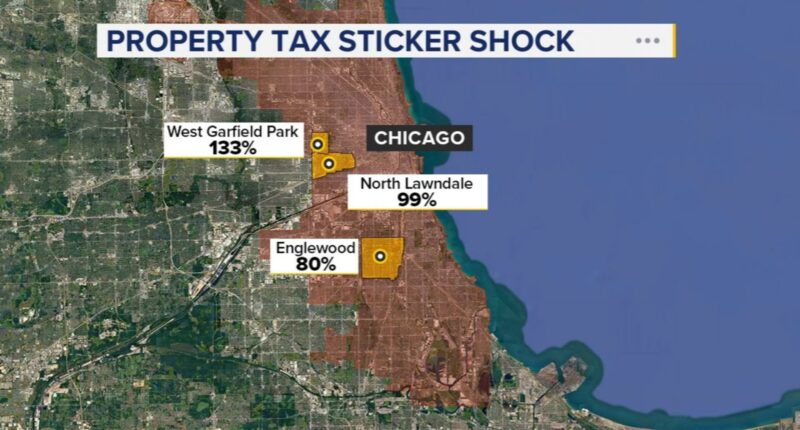

This research highlights that communities of color are disproportionately affected by these tax hikes.

ABC7 Chicago is now streaming 24/7. Click here to watch

Residents might be in for a surprise: An analysis by the Cook County Treasurer’s Office shows that the median residential property tax bill across the city has surged by more than 16%.

The treasurer’s office attributes this spike to increased city expenditures and a reduction in the number of commercial properties contributing to the tax base.

Treasurer Maria Pappas points out a significant decline in the value of downtown commercial real estate. Due to higher vacancy rates, these properties are contributing approximately $129 million less in taxes this cycle.

Pappas explained, “The decline was rapid, but the recovery is sluggish and insufficient to alleviate the burden on residents. Many commercial spaces remain unleased, leading to decreased tax revenue, which has shifted the weight of these tax increases onto homeowners.”

Black and brown communities on the South and West sides are the hardest hit. In West Garfield Park, bills soared 133%. North Lawndale saw a 99% spike. And in Englewood, taxes climbed more than 80%.

The treasurer says many of those homes may have been undervalued before the most recent assessment, done every three years.

If you haven’t gotten your bill, you can see it now or pay online. Taxes are due Dec. 15. But if you can’t pay right away, you can set up a payment plan with interest. More information on that is at www.cookcountytreasurer.com.