Share this @internewscast.com

Chinese financial institutions lent $1.34 trillion to developing countries from 2000 to 2021, U.S. researchers at AidData said in a report that showed the world’s biggest bilateral lender switching from infrastructure to rescue lending.

While lending commitments peaked at almost $136 billion in 2016, China still committed to almost $80 billion of loans and grants in 2021, according to the data, which captures almost 21,000 projects in 165 low- and middle-income countries as probably the most comprehensive dataset of its type.

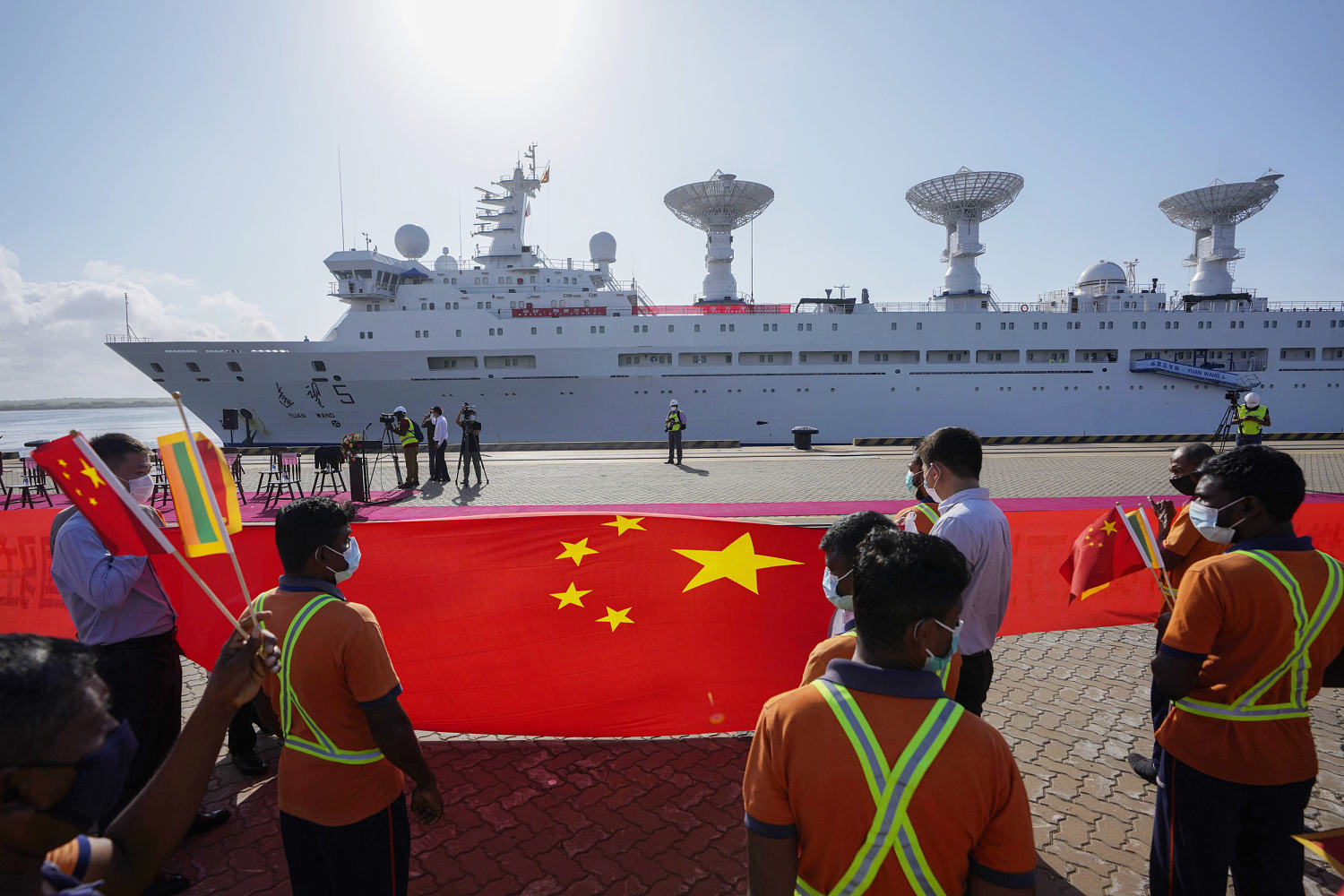

Overseas finance has won Beijing allies across the developing world, while drawing criticism from the West and in some recipient countries, including Sri Lanka and Zambia, that infrastructure projects it funded saddled them with debt they were unable to repay.

Both the sources and the focus of China’s overseas financing have changed, the data showed.

In 2013, when President Xi Jinping launched the Belt and Road Initiative to build infrastructure across the developing world, China’s policy banks accounted for over half of the lending. Their share started falling in 2015 and was 22% by 2021.

The People’s Bank of China and the State Administration of Foreign Exchange (SAFE), which manages China’s foreign currency reserves, accounted for more than half of lending in 2021, almost all bailout lending.

“Beijing is navigating an unfamiliar and uncomfortable role — as the world’s largest official debt collector,” said the report by AidData, a research lab at William and Mary University.

Read Related Also: Joel Madden, Nicole Richie have had ‘lots of therapy’ during 12-year marriage

Much of China’s growing rescue lending is denominated in renminbi, the report found, with loans in the Chinese currency overtaking U.S. dollars in 2020. Overdue payments to Chinese lenders have also risen.

One way China is managing repayment risk is through foreign currency cash escrow accounts it controls, AidData said. The arrangement is controversial because it gives China debt seniority, meaning other lenders, including multilateral development banks, could get paid second during any coordinated debt relief.

AidData identified 15 countries, primarily in Africa, with escrow accounts totaling a combined $2.5 billion at their peak in June 2023.

Brad Parks, the study’s lead author, said they were not able to identify all such accounts, as they are normally kept private. He noted, though, that they had found collateralized loans worth $614 billion and that cash was the main source of collateral required by Chinese lenders, indicating that the amount in escrow accounts could be far higher than $2.5 billion.

China is also working more with multilateral lenders and Western commercial banks. Half of its non-emergency lending in 2021 was syndicated loans, 80% of that alongside Western banks and international financial institutions.

The destinations of Chinese overseas lending have also changed. Loan commitments to African countries fell from 31% of the total in 2018 to 12% in 2021, while lending to European countries almost quadrupled to 23%.

A different dataset showed loan commitments to African countries falling to a 20-year low in 2022.