Share this @internewscast.com

CHICAGO (WLS) — This week, the Cook County Assessor’s Office is hosting a series of workshops aimed at addressing the concerns of residents in neighborhoods most affected by significant property tax hikes.

Despite the personalized assistance offered during these sessions, many attendees find this year’s tax bills overwhelming and beyond their financial reach.

ABC7 Chicago is now streaming 24/7. Click here to watch

“I haven’t made any improvements to my home, yet my property taxes have surged by 400%,” shared Michael Strode, a resident of West Garfield Park.

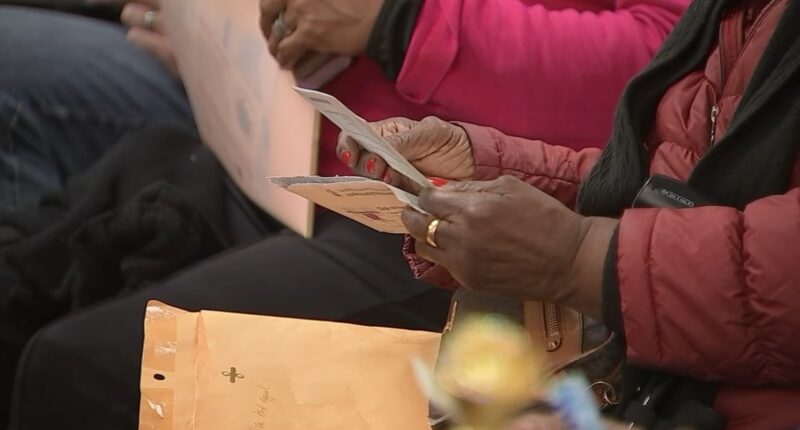

On Monday evening, the basement of West Garfield Park’s New Mt. Pilgrim Missionary Baptist Church was filled with residents clutching their second installment tax bills, eager to understand the reasons behind the dramatic rise in their taxes.

“They handed me a bill for $2,500,” said Selestine Washington, another resident of West Garfield Park. “And soon, I’ll be facing another bill in just a few months.”

The event served a dual purpose: it was both an informative session provided by the Cook County Assessor’s Office and a gathering for community members seeking support and answers.

On the one hand, county employees worked with residents to see if they might be missing out on any qualifying property tax exemptions. On the other, religious leaders and city council members representing the neighborhoods hardest hit by the latest reassessment rallied the crowd of angry homeowners.

“We need the same treatment that they have up north here on the West Side of Chicago,” said 28th Ward Ald. Jason Ervin. “This is an error that has been perpetrated on us by the assessor’s office.”

The Cook County Treasurer’s Office estimates the average residential bill in the city of Chicago increased by more than 16% this year. A slump in commercial real estate downtown is being blamed for the increases. But three of Chicago’s poorest neighborhoods are seeing spikes that are hard to imagine.

In West Garfield Park, bills soared 133%. North Lawndale saw a 99% spike. And in Englewood, taxes climbed more than 80%.

“We’re here to help people fight back. We’ve got to make noise,” said Rev. Marshall Hatch with New Mt. Pilgrim Missionary Baptist Church. “We need, really, those taxes to be frozen in last year’s rate until we can figure out how to make this system fair and make this system make sense.”

READ MORE | Chicago residents worry over Cook County property tax increases as payment due soon

Cook County Assessor Fritz Kaegi faced many angry questions even as he tried to pass the blame onto others for the current predicament.

“There is a system of appeals, where reductions are being made and pushed onto us,” Kaegi said.

Michael Strode said, in response, “I’m in the hood. I don’t have the money to purchase a tax attorney to keep on retainer to get my property lower.”

Cook County property tax bills are due Dec. 15. Those unable to pay on time will be able to sign up for a payment plan with the Cook County Treasurer’s Office starting on Dec. 16.