Share this @internewscast.com

(NerdWallet) – Thinking about changing jobs? You’re in good company. According to data released by the Bureau of Labor Statistics, Americans are staying in the same job for shorter periods of time than in the past.

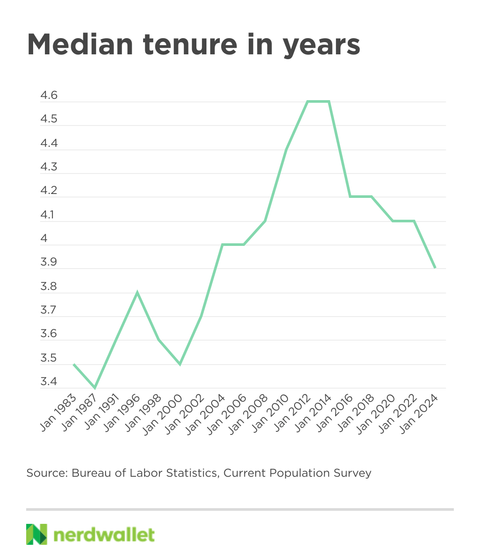

The length of time you’ve worked for your current employer is called your job tenure. In 2014, the median job tenure – across all age groups, occupations and industries – was 4.6 years. In 2024, it dropped to 3.9 years. In fact, job tenure is now the shortest it has been in over 20 years.

Economists care about tenure as a measure of employment security and health of the labor market. And personal job tenure is important to workers because job changes often raise questions about personal finances and planning for the future.

Tenure Trends

The median job tenure generally got longer from the 1980s through the 2010s. From 2014, it started to recede. Women tend to have shorter tenures than men – a gap that was starting to close in the 2010s, but has since opened back up. And tenure increases with age, as people have generally spent more time in the workforce.

On average, people in “management occupations” have stuck around the longest: 5.7 years. This makes sense, as one common path to management is when a company promotes a long-tenured employee into a supervisory role.

If your job tenure is dramatically above average for your occupation, that could be a sign that your job is a really good fit. But no matter how long you’ve been at your job, if you’re feeling unsatisfied, or think your future at the company is uncertain, you may be considering a change.

Consider the benefits of having more tenure

Changing employers could help you get paid what you’re worth. Wage growth is generally higher among job switchers, according to data from the Federal Reserve Bank of Kansas City.

But many workplaces provide incentives to stay. Senior employees often get more PTO, access to development programs or more job security. Your time at a company can also translate into institutional knowledge and a level of respect among colleagues who haven’t been around as long.

Another benefit of seniority is the possibility of advancement. If you’re not fully satisfied in your current role, your employer might consider what they can do to keep you. Being prepared to walk away from a job is a very strong negotiating position, and may help you find a better role at the same company.

It’s unlikely that any single one of these things will make or break your decision to leave. But it’s a good idea to closely examine whether or not the potentially higher salary with a new employer is offset by fewer benefits or other tradeoffs.

Financial checklist when job switching

If you ultimately decide it’s time to move on, take steps to get your financial house in order before turning in your notice:

Do: Make a plan to support yourself financially

You might already have a new source of income lined up, or a job offer for a new position. If not, or if that new job doesn’t pay as much as the one you’re leaving, you’re probably going to want to budget for this transition.

This means taking a look at your spending, your savings and how much you expect to make in the coming months. Cutting back on your spending, even in modest ways, can buy you more time. When you’re job hunting, there’s a big difference between running out of money in six months versus running out in one.

Don’t: Forget about your retirement account

If you have a 401(k account, the most common kind of employer-sponsored retirement account, you can leave it where it is, roll it over to another account or cash it out early. Cashing it out is the least recommended option because it comes with hefty tax penalties.

If your employer contributes to your retirement account, you should nail down how much of your balance is yours for the taking. Your employer’s contributions might be yours to take with you (known as “vested”) only after a certain number of years with the company.

If you’re unsure of how much of your retirement account is your contributions versus your employers’ portion, or you’re unclear on your vesting schedule, talk with your human resources or finance department.

Do: Have a plan for health insurance

Figure out when your employer-paid insurance is going to end, and who will insure you after it does. Temporarily extending your coverage through COBRA is one of several options. Switching to a new insurer will reset your deductible, so if you’ve met or are close to your current deductible, now may be a good time to get any health care you’ve been putting off.

Do: Cash out your use-it-or-lose-it benefits

Some employers pay out unused PTO when you leave, but how much varies from job to job. If you have unused days that won’t pay out when you quit, now is the time to use them. If you have a flexible spending account (FSA), it won’t follow you to the next job. Find out when it’s going to expire, and then spend it before it does.

Don’t: Forget your HSA

Unlike an FSA, you can keep your employer-provided health savings account (HSA) after you quit. If you have a significant amount in the account – which you might, especially if you’ve opted to invest it – don’t lose track of that money. You can choose to leave your HSA where it is, or you can transfer the funds to a new HSA to consolidate.

Do: Get a good reference

When you give your notice, communicate clearly, cordially and professionally. Do your best to part ways on a positive note. Your last few weeks at a job are a good time to thank your coworkers and superiors for working with you, and to ask if they’d be willing to provide you with a reference in the future.