Share this @internewscast.com

Unlock the Editor’s Digest for free

Donald Trump’s social media business will become publicly listed after shareholders of a blank-cheque company approved the deal, unlocking a potential $3bn windfall for the former US president as he seeks to cover massive legal liabilities.

Trump Media & Technology Group, the company behind his Truth Social site, will list on the Nasdaq exchange with the ticker symbol DJT, Trump’s initials, next week.

The vote comes at a crucial time for Trump, who is facing mounting legal bills ahead of what is expected to be the most expensive election campaign in US history.

He has been struggling to raise almost $500mn to prevent assets from being seized as part of the enforcement of a fraud judgment in New York.

Trump is subject to a lock-up agreement that prevents him from selling his shares for six months, but may be able to use his large stake in the business as collateral to borrow money.

He could also seek approval from the merged company’s board, which is set to include his son Donald Trump Jr as well as several officials who served in his administration, to start selling his stake immediately to raise cash.

The vote breaks with a pattern of financial setbacks for Trump and his campaign, which spent more than $52mn on legal battles in 2023.

Sustaining the lofty valuation of his social media company could also bolster his image as a successful business person, which has been critical to his electoral appeal but was undermined by the judgment in the New York case.

Shares in Digital World Acquisition Corporation, the special purpose acquisition company with which TMTG first announced merger plans in late 2021, fell 13.7 per cent after Friday’s announcement.

If Trump is allowed to sell some or all of his stake, it could add downward pressure on the stock and potentially cause losses for some of the retail investors who piled into DWAC in recent months, more than doubling its share price this year.

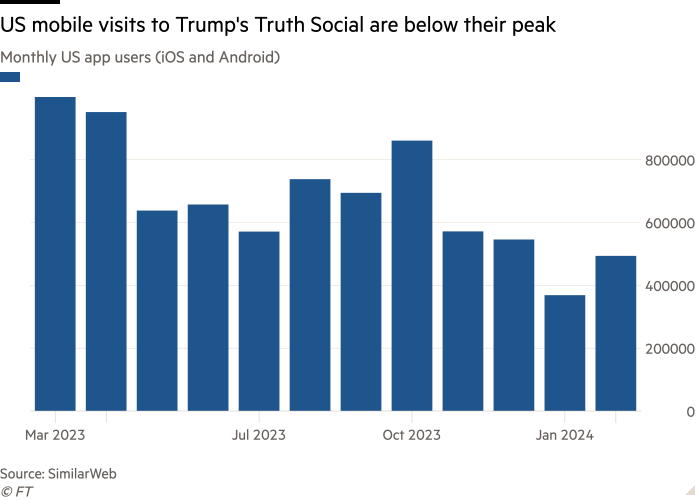

TMTG is banking on Trump’s popularity among Republican voters translating into users for Truth Social. The company estimates its social media app will reach 10mn users in 2024 and double that number next year, according to a presentation from December 2023.

The Florida-based business also plans to launch Truth+, which will provide what it called “non woke” entertainment to the American public. TMTG plans to launch the on-demand streaming service next year and estimates it will have 4mn users by 2026.

The shareholders’ approval of the transaction brings to an end a drawn-out saga that began in October 2021, when DWAC and TMTG announced they had signed a deal to take Trump’s media business public at a $875mn valuation.

Little was then known about TMTG, other than that it would operate a social media platform to compete with Big Tech rivals such as Twitter and Facebook.

But DWAC soared by more than 400 per cent in the days following the 2021 announcement.

The deal has been marred by delays, facing investigations by the US Securities and Exchange Commission and federal prosecutors.

In July, DWAC agreed to pay an $18mn penalty to the SEC to settle fraud charges stemming from its initial public offering.

The Wall Street watchdog found that executives behind the Spac had already had extensive discussions to merge with TMTG before it became a publicly listed company, something that is forbidden for blank-cheque companies, and had “failed to disclose a material conflict of interest”.

At the same time, the US attorney in Manhattan brought insider trading charges against three men, alleging one of DWAC’s former board members shared information about the transaction with two associates during a trip to Las Vegas and helped them make $22.8mn from illicit trades.