Share this @internewscast.com

Key Points

- Home prices rose ! per cent in November, lifting Australia’s median dwelling value to $888,941.

- Three interest rate cuts since February raised borrowing power by about $55,000, but home values have risen $60,000.

- Renters also face worsening affordability, with the national rental index up five per cent in a year.

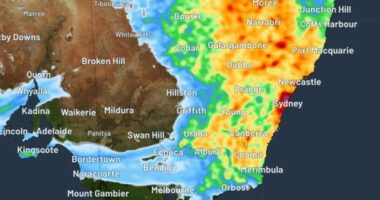

According to Lawless, the current real estate market appears to be developing into a “two-speed” scenario, characterized by varied outcomes across different regions.

In terms of property prices, Canberra, Hobart, and Darwin have experienced noticeable growth, with increases of 1 percent, 1.2 percent, and 1.9 percent, respectively.

Lawless suggests that this trend might indicate the beginning of market adjustments, as people come to terms with the reality that interest rates are unlikely to decrease further in the foreseeable future, particularly over the next six months.

Meanwhile, rental prices are climbing in all capital cities, with the national rental index showing a 5 percent increase over the past year, marking the steepest annual rise in 12 months.