Share this @internewscast.com

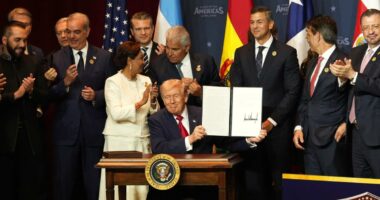

At a lively campaign rally in Georgia, President Trump staunchly defended his tariff policy, asserting his presidential “right” to enforce them.

The Supreme Court’s ruling on the legality of Trump’s tariff strategy could be announced as soon as Friday.

“I’ve been waiting an eternity for this decision. The language is explicit that, as President, I have the authority to impose tariffs for national security reasons,” Trump stated.

He emphasized that tariffs on nations like China and Canada were necessary to address longstanding trade imbalances that have disadvantaged the U.S.

In Georgia, Trump toured a steel factory to highlight his administration’s economic achievements ahead of the midterm elections, aiming to demonstrate efforts to maintain affordable living costs and secure Republican congressional control.

It has been over three months since the Supreme Court last issued a decision regarding tariffs.

Trump’s frustration was evident.

“I have to be in the United States Supreme Court for many, many months waiting for a decision on tariffs,” he said. “Without tariffs, this country would be in such trouble right now.”

Later in his remarks, he lamented again about the delay.

“I’m waiting for a decision from the Supreme Court. Can you imagine we have to wait?”

The US has collected more than $130 billion in tariff revenue, according to US Customs and Border Protection statistics. If the Supreme Court strikes down the program, it could have to give the money back. Consumers could see refunds from companies that upped prices to counter the additional tariffs.

But Trump may have to wait longer. In addition to Friday, the court announced it will release opinions next Tuesday, Feb. 24; and next Wednesday, Feb. 25.