Share this @internewscast.com

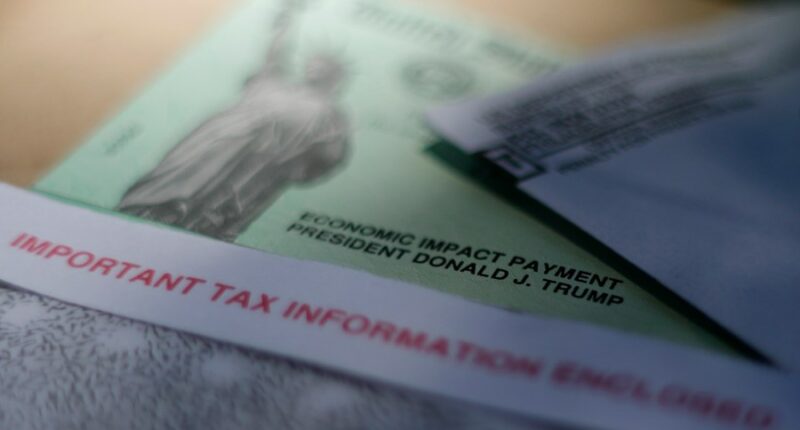

WASHINGTON (AP) — The U.S. government starts phasing out paper checks for most programs on Tuesday.

The policy change, initiated by an executive order from President Donald Trump in March, intends to impact those receiving Social Security, Supplemental Security Income, and tax refunds.

The Trump administration asserts that transitioning to electronic methods for all payments and collections is intended to shield taxpayers from fraud and theft, expedite processing, and reduce expenses. However, some advocates express concerns that this move may disadvantage marginalized individuals lacking access to digital services and who might be unaware of this transition.

“Many claimants frequently relocate and might not always receive their mail,” explains Jennifer Burdick, a divisional supervising attorney in the SSI Unit at Community Legal Services in Philadelphia. “Those I represent who depend on paper checks primarily learned about this change from me.”

Approximately 10% of Burdick’s clients rely on paper checks. She is concerned that newcomers needing a paper check to establish a bank account may face significant challenges after the transition.

Close to 400,000 Social Security and SSI beneficiaries still utilize paper checks, constituting under 1% of the 70.6 million retirees, disabled individuals, and children benefitting from Social Security.

Beneficiaries will transition to receiving funds via direct deposit or a Direct Express card, catering to those without bank accounts. Nonetheless, the Social Security Administration states that paper checks will still be made available if no other alternatives are feasible.

“Where a beneficiary has no other means to receive payment, we will continue to issue paper checks,” the SSA says.

Kathleen Romig, the director of Social Security and disability policy at the Center on Budget and Policy Priorities, notes that the people most affected by this change tend to be the most vulnerable, “often unbanked or unhoused, and lacking in the tools and skills they need to access digital services.” There are reasons they haven’t made the switch yet — some people’s mental health crises make them wary of financial institutions, and others simply don’t have enough money to open a bank account.

“This is a population that can’t afford to miss a payment, so it’s very important that the Trump administration manage the transition without interrupting their benefits,” Romig said.

Nancy Altman, president of Social Security Works, an advocacy group for the preservation of Social Security benefits, calls the phase-out of paper checks unnecessary.

“If it’s not handled right, it will be devastating” for people who are unaware of the change and have limited incomes, Altman said. “I think anyone should be able to get a paper check. And while less than 1% is getting a check, that’s still a lot of people.”