Share this @internewscast.com

The conflict involving Iran, although occurring thousands of miles away, is poised to have significant repercussions on daily life in the UK, potentially affecting household finances in several areas.

The ongoing tensions are likely to manifest in the form of increased energy and petrol costs, higher mortgage rates, and rising grocery prices. Furthermore, travel expenses might also see an uptick, adding to the financial strain on families.

Crude oil prices have surged past the $100 (£75) per barrel mark for the first time in years. This spike is attributed to disruptions in oil shipments and attacks on oil wells, fueling concerns about escalating inflation.

The instability is also impacting global financial markets, with the FTSE 100 index experiencing a significant drop of over 100 points upon opening this morning.

Analysts are drawing parallels between the current surge in oil prices and the financial ripple effects experienced following Russia’s invasion of Ukraine in 2022. The repercussions on the international travel industry are being likened to the unprecedented challenges faced during the COVID-19 pandemic.

As Iranian strikes continue to hit critical economic centers such as Dubai and Doha, U.S. Defense Secretary Pete Hegseth issued a strong statement last night, assuring that Iran will eventually ‘surrender.’ This vow reflects a commitment to resolve the ongoing crisis.

But with no end to the conflict in sight, the hit to Britain’s economy is looking increasingly serious. Here’s how you could feel the impact –

Petrol prices

Brits could face the highest ever pump prices as the Middle East crisis pushes up the price of oil.

Experts have warned that petrol could hit £2 a litre for the first time, amid a staggering spike in global oil costs.

The price of a barrel of oil has already rocketed over $100, with supplies threatened by attacks on infrastructure of major producers in the region.

Tehran has also managed to effectively shut the Strait of Hormuz, through which around a fifth of the world’s oil travels.

Iran’s Revolutionary Guard has threatened to ‘set ablaze’ any Western tanker that attempts to navigate the strait. Hundreds of ships laden with oil, as well as liquefied natural gas, have amassed either end of it.

Analysts say there is a real risk the oil price will reach $150 a barrel, with estimates that would mean £2 a litre petrol for British drivers. The previous record was 191.4p in 2022, and they are currently running around 140p.

An emergency meeting of the G7 has been called for today, where Rachel Reeves will join other ministers discussing options including the release of oil reserves.

The price of a barrel of Brent crude was nearly 30 per cent higher in Asian markets at some points overnight, as traders concluded that the crisis will drag on.

ING said experts in the oil and gas market were seeing ‘parallels’ with the 2022 Russian invasion of Ukraine. The bank said the impact on prices would largely depend on the length of Iran’s blockage on the Strait of Hormuz.

Donald Trump has dismissed the soaring oil and gas prices saying they are a ‘small price to pay’ for taming Tehran.

Energy bills

Smoke rises into the air after an attack by the US/Israel coalition on Tehran yesterday

The UK’s largest household energy supplier said it has increased fixed-price tariffs and introduced exit fees for these tariffs in the face of soaring oil and gas prices.

Greg Jackson, chief executive of Octopus Energy, told Times Radio the company has to pass on some increases in wholesale energy prices to fixed-rate customers.

A raft of other major suppliers have pulled fixed-price tariff deals completely. In the week since attacks first started between Iran and US-Israeli forces, the number of fixed deals available has more than halved, according to data from Uswitch.

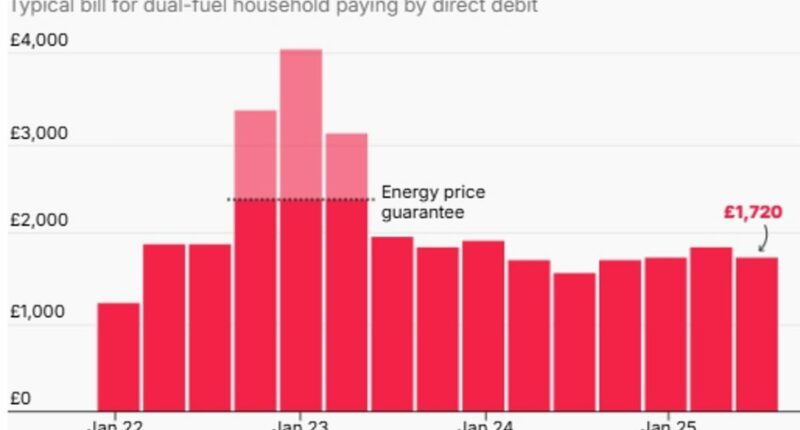

Remaining fixed deals, which are more closely linked to wholesale prices than variable deals, have seen price increases. Most UK households are on variable deals protected by the Ofgem price cap – which is falling by 7 per cent from April 1.

While typical bills will actually drop from then, experts have predicted that they are likely to rise by around 10 per cent from July – particularly due to higher gas prices.

Analysts at Cornwall Insight said forecasts for Ofgem’s price cap for July to September had surged to £1,801 a year for a typical dual fuel household – an increase of £160 or 10 per cent on April’s cap announced last week.

The think tank warned any increase would also feed through to electricity prices. However, it said the final price cap figure would be based on average wholesale prices over a three-month period, meaning that it would depend on how long gas prices stayed elevated and how long the period of volatility continued.

Groceries

The war could push up costs for shoppers in supermarkets due to the impact on supply chains and the price of oil and gas.

Simon Geale, chief procurement officer at Proxima, said that if the conflict persists, the narrative could ‘turn into a household budget story’.

Across Britain’s agricultural, food and drink and manufacturing sectors, there is growing concern about the impact on food supply chains and then at supermarket tills.

Richard Fattall, co-founder and chief executive of Zencargo, told the Grocer: ‘If this carries on, the result is fewer ships available when they’re needed, longer delivery times, higher transport costs, and less reliable schedules for both sea freight and air cargo.’

Delayed shipments will push insurance and freight costs higher and increase energy costs – and product shortages are possible if the conflict goes on for a prolonged period.

Experts at commodity price reporting agency Expana believe products such as Asian shrimp could become increasingly scarce, as shipments to Europe as delayed and rerouted via the Cape of Good Hope.

Some nut and dried fruit exporters have been facing problems supplying key markets.

Iran is a major supplier of dates, pistachios, walnuts, almonds and saffron. Disruption to its supply routes and chains are likely to have a knock-on effect on global supply levels of these products, according to Expana.

But the conflict could also reduce the price of other items, particularly from shipments moved to alternative destinations.

Mortgages

The average fixed mortgage rate has been going down over the past year. But could this soon change?

Compare true mortgage costs

Work out mortgage costs and check what the real best deal taking into account rates and fees. You can either use one part to work out a single mortgage costs, or both to compare loans

Homeowners are heading for higher mortgage costs as the ongoing Iran conflict means interest rates are likely to be raised to offset a predicted surge in inflation, a leading economist has warned.

Mohamed El-Erian, chief economic adviser to insurance giant Allianz, warned that the average person would face ‘higher mortgage rates’ as the Bank of England would need to keep rates higher for longer to prevent prices from soaring.

‘The Bank of England was correctly hoping that inflation would go down to 2 per cent throughout this year. We’re now looking at inflation remaining above 3 per cent. In order for investors to be compensated for that higher inflation, they will require higher interest rates,’ El-Erian told the BBC.

Inflation in the UK stood at 3.3 per cent in January.

Higher energy prices are expected to feed through into inflation, which in turn means the Bank of England will be less willing to cut interest rates.

This is because higher rates reduce spending in the economy, which means prices do not rise as fast as demand for goods is lower, bringing down inflation.

But higher rates also make loans such as mortgages more expensive to pay off, piling pressure on homeowners taking out new loans, renewing their fixed-rate deals or those with tracker mortgages where the interest changes in line with rate movements.

Interest rates have been falling since August 2024 and currently sit at 3.75 per cent. Prior to the turmoil in the Middle East they had been expected to drop further.

Holidays

The Foreign Office is advising against all but essential travel to the UAE, Bahrain, Kuwait and Qatar, with thousands of flights already cancelled.

But experts believe that travelling to other destinations could soon become more costly due to the rising cost of jet fuel – as well as higher demand for safer alternative locations.

North-west European jet fuel prices are currently hovering at around $1,500 (£1,124) per tonne, compared to $830 (£622) per tonne before the air strikes on Iran.

Jane Hawkes, an independent travel expert, warned of ‘more turbulence ahead’.

‘Airlines tend to build fuel costs into their pricing, so if those costs stay high we may well see fares creep up as we head towards the summer holidays,’ she told the BBC.

‘This isn’t great news for families who already face seasonal price hikes at this time of year and whose budgets are already tight due to the ongoing price rises across the board.’

However, she added that people who have already purchased air fares ‘should not suddenly be presented with an extra fuel surcharge’.

‘When you book a flight, the price you pay should be the final price and it should be honoured,’ she said.

Global airline shares have been hit hard by the conflict, with British Airways owner IAG down by nearly 12 per cent over the past five days. Meanwhile, easyJet has dipped by just under 11 per cent.

Paul Charles, a travel and aviation expert who runs the PC Agency, said the disruption to global air travel was the worst since Covid.