Share this @internewscast.com

The consumer watchdog has slapped National Australia Bank with the biggest ever fine for breaking customer data rules.

NAB was penalized with a $751,200 fine for violations of the Consumer Data Right (CDR), a federal government initiative that empowers Australians to access the data businesses maintain about them.

The Australian Competition and Consumer Commission (ACCC) charged NAB with failing to properly disclose credit card limit information when requested by CDR-accredited providers acting on behalf of customers.

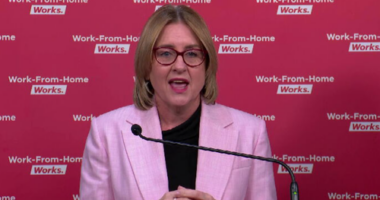

ACCC deputy chairwoman Catriona Lowe said poor quality data prevented customers from experiencing the full benefits of CDR.

“When banks or energy retailers fail to deliver accurate data, consumers are unable to utilize CDR products and services effectively to compare offers, secure better deals, manage their finances, or make informed decisions regarding product switching,” she stated.

The ACCC said NAB’s failure to provide accurate information relating to credit card limits impacted the service of financial technology provided to customers, including mortgage broking tools using CDR data.

“All CDR participants are reminded that failure to comply with the CDR rules will result in scrutiny by the ACCC and may result in enforcement action,” Lowe said.

NAB’s payment marks the highest amount paid for alleged contraventions of the CDR rules to date.

The bank said it rectified the error and cooperated with the ACCC.

“NAB has made a significant investment to deliver the complex CDR requirements as well as investing resources to develop our capabilities to deliver new innovations,” a spokesperson for the bank said.

“We have fully cooperated with the ACCC’s review and have resolved the data quality error identified.

“We appreciate and recognise the importance of ensuring we are meeting the standards necessary and expected under the regulations.”