Share this @internewscast.com

The descendants of a deceased billionaire, who faced allegations of significant tax evasion, have consented to a $750 million settlement with the Internal Revenue Service (IRS) to conclude a substantial civil fraud lawsuit against him.

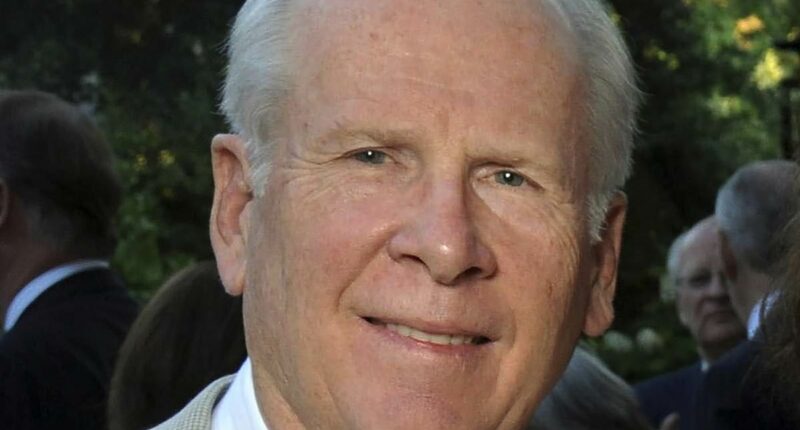

The estate of Robert Brockman, a pioneer in the tech industry, finalized the agreement on Tuesday, bringing to an end a protracted legal conflict initiated when he faced a 39-count indictment in 2020.

Brockman was accused of orchestrating a plan to conceal approximately $2 billion in income from the IRS.

This case represented the most extensive tax evasion accusation ever leveled against an individual by U.S. prosecutors.

The charges against Brockman extended to include wire fraud and money laundering.

Brockman passed away in August 2022 amidst his ongoing criminal proceedings, shortly after a judge declared him fit for trial despite his dementia diagnosis.

Brockman was survived by his wife of 53 years, Dorothy, his son Robert II, his brother David, a daughter-in-law and two grandchildren.

Now, his estate has agreed to pay back $456million in back taxes and $294million in penalties as part of a separate civil case, per the Wall Street Journal.

In 2020, Robert Brockman was charged with running a ‘scheme’ to hide about $2billion in income from the Internal Revenue Service

Brockman was survived by his wife Dorothy (right), his son Robert II, his brother David, a daughter-in-law and two grandchildren

Brockman was worth about $4.7billion when he died, according to Forbes.

Prosecutors said he owned a Houston mansion worth about $8million, a ski cabin in Aspen, Colorado, a Bombardier private jet and a 209-foot yacht.

The former chief executive of Reynolds & Reynolds Co was accused of hiding his vast income from the IRS over two decades.

He allegedly used a web of off-shore companies in Bermuda, and St. Kitts and Nevis.

The indictment alleged Brockman appointed nominees to manage those entities for him as a way to hide his involvement.

He even established an encrypted communications system and would use code words such as ‘Permit,’ ‘Red fish’ or ‘Snapper’ to communicate.

The tech billionaire was also accused of directing ‘untaxed capital gains income to secret bank accounts’ across Bermuda and Switzerland.

Join the debate

Should billionaires face harsher penalties for hiding massive wealth from the taxman?

Brockman lived in a $8million mansion (pictured) in Houston, Texas. He also owned a 143-acre Colorado property and fishing lodge on the Frying Pan River

Brockman’s lawyers argued he was unfit to stand trial, claiming that his Parkinson’s disease had only grown worse and led to dementia

As he awaited trial, Brockman’s lawyers argued he was unfit to take the stand, claiming his Parkinson’s disease caused dementia which had only grown worse after also contracting COVID.

In filings, his attorneys said Brockman had been hospitalized with toxic metabolic encephalopathy, which threatened to exacerbate his apparent cognitive decline.

However, a judge ruled that the tech billionaire was competent to face the charges.

That happened in May 2022, just weeks before Brockman passed on August 5.

Attorneys said Brockman was bedridden and in hospice care in the weeks before his death.

However, a civil case continued in tax court even after Brockman’s passing.

Brockman’s former associates and employees long described him as a frugal billionaire who would stay at budget hotels and eat frozen dinners while on business trips.

Prosecutors said he also owned a Bombardier Inc. Global 6000 private jet, valued at roughly $62million

Brockman’s attorneys said the former Reynolds & Reynolds Co chief executive was bedridden and in hospice care in the weeks leading to his death

He bought used furniture for his offices and banned his employees from smoking so that his company could save on health insurance.

The tech businessman believed the IRS unfairly went after taxpayers.

The agency had originally sought back $1.4billion including interest, per the Wall Street Journal.

Instead, Brockman’s estate will pay $456 million in back taxes and $294 million in penalties covering tax years 2004 to 2018.

Brockman’s tax evasion charges were deemed historic after he was indicted in 2020.

‘The allegation of a $2billion tax fraud is the largest ever tax charge against an individual in the United States,’ US Attorney David Anderson said in a press conference in San Francisco.

The order directing Brockman’s estate to reimburse the IRS was signed Tuesday by US Tax Court Judge Kathleen Kerrigan.

It was not immediately clear how much interest would apply.

The Daily Mail has reached out to McDermott Will & Schulte, which represented Brockman’s estate, for comment.