Share this @internewscast.com

Federal authorities in Indiana recently nabbed two illegal immigrants accused of murder and strangulation, among other violent crimes.

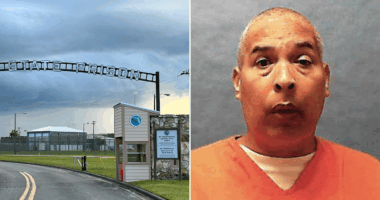

According to a statement from ICE posted on X on Tuesday, Immigration and Customs Enforcement (ICE) and Federal Bureau of Investigation (FBI) agents have detained Jonny Handy Martinez-Barillas, a Honduran national and alleged MS-13 gang member.

Martinez-Barillas had previously been charged with first-degree murder and possession of a firearm, officials said.

ICE and FBI agents arrested the illegal immigrant in Indiana. (@ICE via X)

The arrests come amid a 700% spike in assaults against federal immigration agents compared to 2024, and violent attacks reported this week.

The White House urged congressional Democrats to moderate their use of inflammatory language after a gunman fired at Border Patrol agents at an annex facility in McAllen, Texas, on Monday.

After injuring a police officer and two agents, the suspect was killed by authorities.