Share this @internewscast.com

“In the Labor Party, every caucus member supports gender equality. That discussion is settled,” Gallagher said on Wednesday.

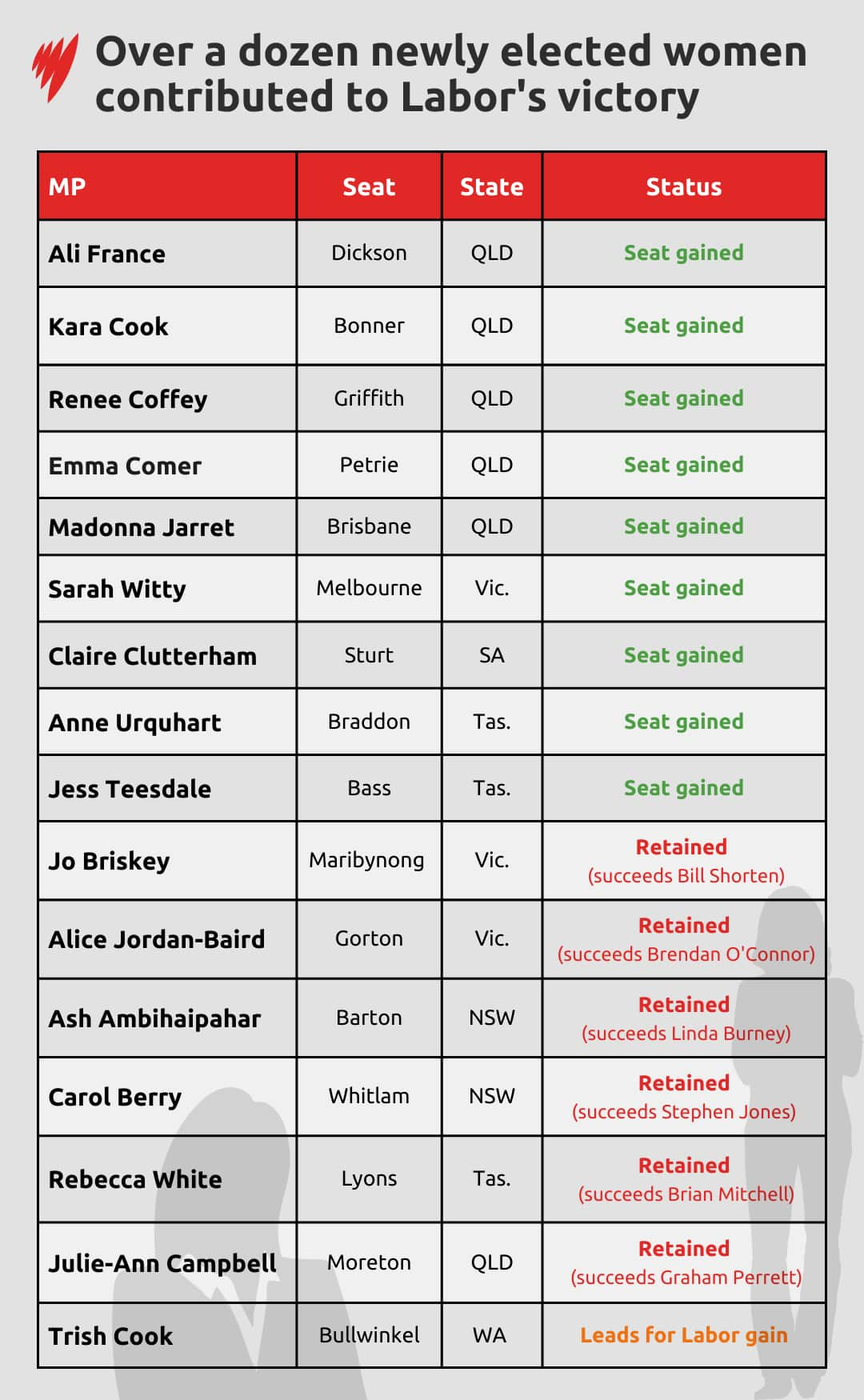

An unprecedented number of women will be part of Australia’s parliament, with Labor contributing a significant portion of female MPs to the House of Representatives. Source: SBS News

Labor MPs will join a historic 48th parliament with at least 68 women making up the lower house, an increase from 58 in 2022 and 40 under a Morrison-led government.

So, how does Australia compare to the rest of the world?

Coalition faces quota pressures as women representation drops

Pressed on women quotas specifically, he told SBS News the Liberals “need to increase its diversity in all areas”.

An unparalleled number of female representatives are about to serve in the federal parliament, marking a significant increase from the 58 women elected to the 47th parliament. Source: SBS News

Michelle Ryan is the director of the Global Institute for Women’s Leadership at The Australian National University.

“They do differ by party as well. For the Coalition, women were much more likely to be in those unwinnable seats.”

Source: SBS News