Share this @internewscast.com

Unlock the Editor’s Digest for free

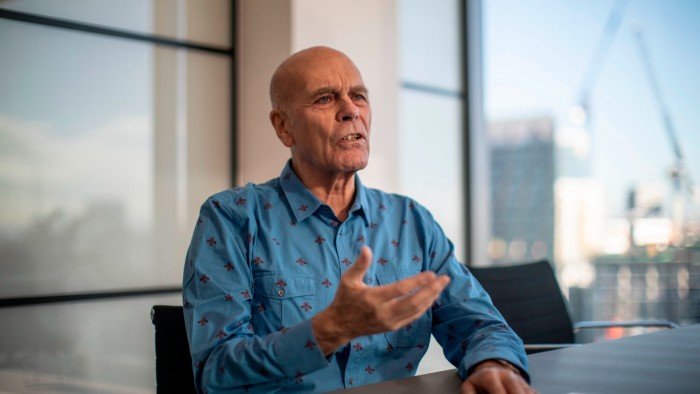

Peter Harf, chair and managing partner of Europe’s JAB Holdings, is retiring after more than 40 years building the fortune of Germany’s billionaire Reimann family, as the sprawling investment group he created pivots its consumer goods portfolio into insurance and asset management.

The 78-year-old German executive will be succeeded by managing partners and co-chief executives Joachim Creus and Frank Engelen, JAB announced on Monday. Creus will become chair and Engelen will serve as vice-chair.

Harf’s retirement ends a four-decade run in which he became one of Europe’s most powerful dealmakers.

He is credited with transforming an obscure German chemicals company, controlled by the Reimann family, into a conglomerate owning major stakes in some of the world’s largest consumer brands, including Keurig Dr Pepper, Pret A Manger, Krispy Kreme and JDE Peet’s.

Harf helped turn the heirs of the intensely private Reimann family, which traces its wealth back to the formation of chemicals business Benckiser, in 1823, into billionaires.

In 2012, Harf set up investment group JAB Holdings. Alongside running the family’s wealth, including its investments in consumer brands, JAB’s partners raised capital from other wealthy families and endowments, to fund a dealmaking spree in excess of $50bn.

However, JAB’s over-reliance on consumer-focused brands was badly exposed by dramatic changes in behaviour during the pandemic, and by the subsequent inflationary surge, which squeezed consumer spending power. JAB is diversifying aggressively into life insurance and asset management in search of more reliable income streams.

A spokesperson for the Reimann family said Creus and Engelen had “set forth a compelling strategic vision to prepare JAB for the next generation of sustainable long-term growth”.

The spokesperson added the pair had in the past year launched the firm’s new life insurance division and made its first acquisition in the sector. The deal for Prosperity Life, which manages $25bn of assets, valued the insurer at more than $3bn.

Despite its new focus, JAB continues to hold significant stakes in consumer companies, including beauty group Coty and Panera Brands, which owns bakeries and coffee shops. The value of JAB’s portfolio exceeds $70bn.

The company on Monday said Harf will remain “fully invested” in the firm and continue to serve as chair of the Reimann family’s non-profit organisation, the Alfred Landecker Foundation.

“I would like to express my gratitude to the Reimann family who, more than 40 years ago, entrusted me to embark on the journey of a lifetime,” Harf said. “It’s now time to pass the baton to a new generation of leadership.”