Share this @internewscast.com

A start-up focused on artificial intelligence, which recently received a $14 billion investment from Meta, reportedly has a “highly inadequate” security system. It uses public Google Doc files to store sensitive information concerning clients like Meta, Google, and xAI.

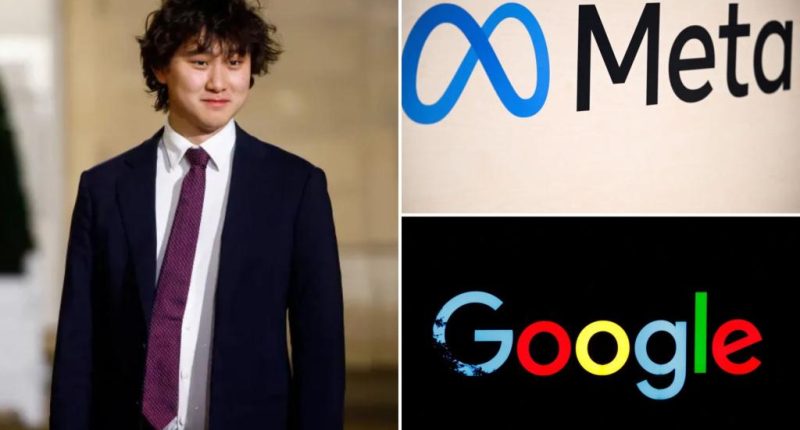

This month, it was announced that Meta would acquire a 49% stake in Scale AI for $14.8 billion and that the startup’s CEO, Alexandr Wang, would assume leadership of a new “superintelligence” lab.

The surprisingly large investment suggests that Meta considers Wang and his company crucial for advancing the AI capabilities within its social media platform.

But the company has been strangely relaxed when it comes to its work with high-profile clients, leaving top-secret projects and sensitive information like email addresses and pay details in Google Docs accessible to anyone with a link, according to Business Insider.

“We are conducting a thorough investigation and have disabled any user’s ability to publicly share documents from Scale-managed systems,” a Scale AI spokesperson told BI.

“We remain committed to robust technical and policy safeguards to protect confidential information and are always working to strengthen our practices.”

While there is no indication the public files have led to a breach, they could leave the company susceptible to hacks, according to cybersecurity experts.

Scale AI, Google and xAI did not immediately respond to The Post’s requests for comment. Meta declined to comment.

Five current and former Scale AI contractors told BI that the use of Google Docs was widespread across the company.

“The whole Google Docs system always seemed incredibly janky,” one worker said.

BI said it was able to view thousands of pages of project documents across 85 Google Docs detailing Scale AI’s sensitive work with Big Tech clients, like how Google used OpenAI’s ChatGPT to fine-tune its own chatbot.

At least seven Google manuals marked “confidential” including recommendations to improve the chatbot, then-called Bard, were left accessible to the public, according to the report.

Public Google Doc files included details on Elon Musk’s “Project Xylophone,” like training documents with 700 conversation prompts to improve an AI chatbot’s conversation skills, the report said.

So-called “confidential” Meta training documents with audio clips of “good” and “bad” speech prompts to train its AI products were also left public.

While these secret projects were often given codenames, several Scale AI contractors said it was still easy to figure out which client they were working for.

Some documents tied to codenamed projects even mistakenly included the company’s logo, like a presentation that included a Google logo, according to BI.

When working with AI products, sometimes the chatbot would simply reveal the client when asked, the contractors said.

There were also publicly available Google Doc spreadsheets that listed the names and private email addresses of thousands of workers, the news outlet found.

One spreadsheet was frankly titled “Good and Bad Folks” and labelled dozens of workers as either “high quality” or “cheating,” BI said. Another document flagged workers with “suspicious behavior.”

Still more public documents laid out how much individual contractors were paid, and included detailed notes on pay disputes and discrepancies, according to the report.