Share this @internewscast.com

CHICAGO (WLS) — The Cook County Clerk’s office has some 80,000 boxes of records stored in warehouses.

However, records pertaining to Pope Leo XIV’s paternal grandfather were right in their office.

ABC7 Chicago is now streaming 24/7. Click here to watch

Anyone who has participated in a legal case in Cook County likely has records stored on the 11th floor of the Daley Center. Despite living in a digital era, they still maintain paper records that date back to the early 1800s.

When news broke about Pope Leo’s ties to Chicago, curiosity spiked in the office. They couldn’t locate records under Pope Leo’s birth name, Prevost, but were successful in linking him to his paternal grandfather, Salvador Riggitano.

“So that connection was made, and we were able to look for the Riggitano name in the archive,” Cook County Clerk of Courts Mariyana Spyropoulos said.

Born in Milazzo, Italy in 1876, Salvador Riggitano immigrated to the United States via Ellis Island, New York, in 1905. He eventually settled in Chicago.

His grandson, the new pope, took the opposite route, starting in Chicago and moving to Italy.

RELATED | Pope Leo XIV’s family tree shows Black roots in New Orleans

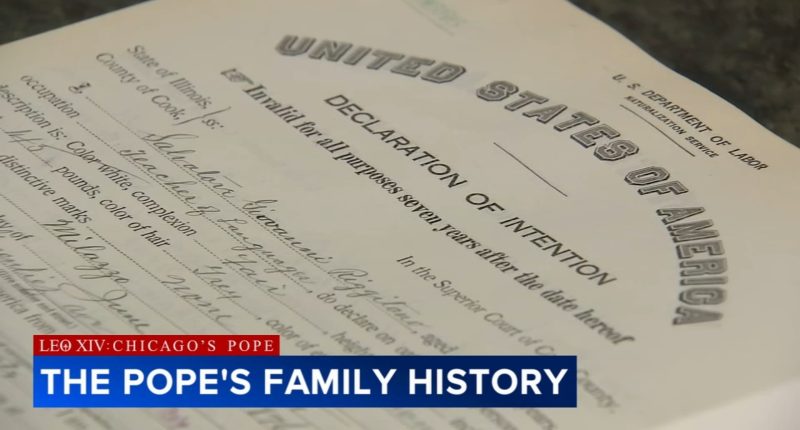

The records offer no explanation about how or why Riggitano came to Chicago, but there is a record of his filing a declaration of his intention to become a U.S. citizen.

It offers a little information about him. He was 5 foot, 4 inches tall and had gray hair and brown eyes, but there is no indication of whether he actually became a U.S. citizen.

“That’s all we have on our books is the declaration of intention where Mr. Riggitano says he is a teacher of languages,” Spyropoulos said.

And that apparently runs in the family genes, as Pope Leo reportedly is fluent in five languages. The archives offer no explanation of how the family eventually settled in Dolton, but staffer Julius Machnikowski, who found the records, is still looking.

“We have a staff that are really passionate about archives, passionate about history,” Spyropoulos said.

The records are available for public viewing. In fact, the office is open during regular business hours and anyone is welcome to come by.

An appointment isn’t needed, whether people are looking for their own family records or the records of the pope.

Copyright © 2025 WLS-TV. All Rights Reserved.