Share this @internewscast.com

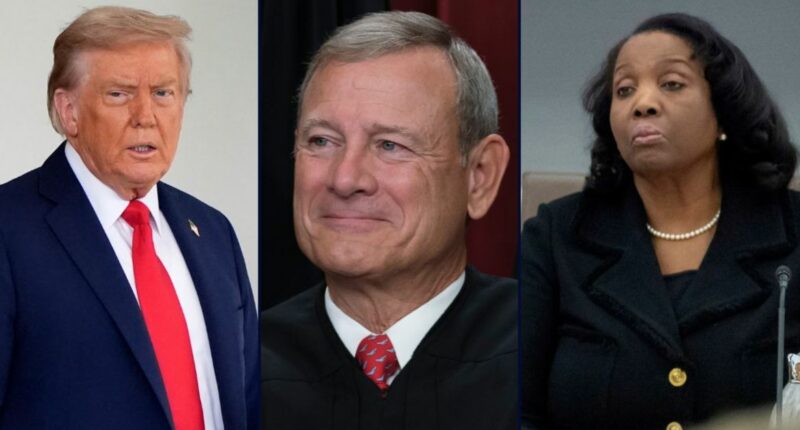

Left: President Donald Trump outside the White House on Monday, Aug. 18, 2025, in Washington. (AP Photo/Alex Brandon). Center: Chief Justice John Roberts with Supreme Court members for a group portrait in Washington, Oct. 7, 2022 (AP Photo/J. Scott Applewhite, File). Right: Lisa Cook of the Federal Reserve Board listens during an open meeting, June 25, 2025, in Washington. (AP Photo/Mark Schiefelbein, File).

Several former Federal Reserve Board chairs and U.S. Treasury secretaries from the administrations of Bill Clinton, George W. Bush, Barack Obama, and Joe Biden submitted a brief to the U.S. Supreme Court. They strongly defended the institution where Lisa Cook serves, opposing President Donald Trump’s attempt to dismiss her over a mortgage fraud allegation that has been referred to the Department of Justice for potential criminal charges.

Among those signing the brief are ex-Federal Reserve Board chairs Alan Greenspan and Ben Bernanke—and ex-Treasury Secretaries Janet Yellen, Timothy Geithner, Lawrence Summers, and Henry Paulson. These amici curiae, or “friends of the court,” petitioned the Supreme Court to prevent Trump from dismissing Cook before her lawsuit challenging the firing is resolved.

The brief argues that firing Cook, who has not been formally charged but is accused of “apparent misrepresentations” related to mortgage applications made before her board appointment, would jeopardize the Federal Reserve’s congressionally intended independence. This action could detrimentally affect the economy, leading to “higher inflation and borrowing costs,” counter to the Trump administration’s publicized objectives.

Drawing on their “practical experience with policymaking both domestically and internationally,” especially in nations where central bank independence has been threatened, the amici urged the Supreme Court not to politicize the Fed. They recommend allowing Cook’s legal proceedings to continue undisturbed to avoid unsettling the markets.

Any perceived reduction in the Federal Reserve’s autonomy could impair its influence over economic decision-makers, potentially resulting in increased inflation. Similarly, any actions that appear to politicize the Federal Reserve or compromise its ability to conduct independent monetary policy could have adverse economic consequences.

Sectors that pay close attention to the Federal Reserve—including the financial markets, the public, employers, and lenders—are watching the current dispute over the President’s removal of Governor Cook to judge how credible the Fed will be going forward. Those audiences will be more skeptical of the Fed’s independence and commitment to long-term low-inflation policies if it appears that a member of the Board of Governors is being removed based on allegations that are actively under challenge in litigation.

The DOJ has pushed for Cook’s immediate removal, most recently telling SCOTUS that Trump’s determinations about Cook’s “conduct, ability, fitness, or competence” to serve are within his “unreviewable discretion.”

Claiming Cook “applied for two loans for her personal benefit, and was able to obtain favorable interest rates by misrepresenting where she lived,” the administration said the allegations put the governor’s “trustworthiness” in question, thereby establishing “cause” for her firing.

But, the amici say, leaving the merits aside, removing Cook now will erode Fed independence and lead to unintended consequences that, on balance, simply aren’t worth inviting.

“Granting the government’s request to remove Governor Cook from the Board immediately would upset these longstanding protections and the essential functions they serve. Doing so would expose the Federal Reserve to political influences, thereby eroding public confidence in the Fed’s independence and jeopardizing the credibility and efficacy of U.S. monetary policy,” the signatories summed up. “Maintaining the status quo while the lawfulness of the termination is adjudicated, in contrast, would serve the public’s interest by safeguarding the independence and stability of the system that governs monetary policy in this country.”

Cook is expected, by order of Chief Justice John Roberts, to respond to Trump’s bid to fire her by 4 p.m. on Thursday. To date, her attorneys have called the attempted firing “unlawful” and the allegations against her “unsubstantiated and vague.”