Share this @internewscast.com

The inventor of the Sarco suicide pod is building a ‘kill switch’ implant which could allow dementia sufferers to seal the time of their death years in advance.

Dr Philip Nitschke, whose controversial capsule ended an American woman’s life in Switzerland last September, has told MailOnline that his newest device is nearing the testing phase.

His plans have been labelled ‘disturbing’ by critics, who argue that enabling people to trigger their deaths with a simple switch could have serious consequences for individuals with various mental and physical health conditions.

The mechanism would be sewn into a person’s body – most likely their leg – and contain a timer which would make a beeping noise and vibrate to warn them to turn it off each day.

If they failed to do so due to deteriorating brain function in the late stages of the disease, Nitschke says, it would then release a lethal substance into their system to kill them.

The assisted dying campaigner believes that his new device could solve the ‘dementia dilemma’ – the situation whereby someone suffering from the disease is seen as lacking the mental capacity to consent to their death.

While he admitted there were ‘very real problems’ with the switch that his team would need to overcome, he predicted that it would ‘work well enough and be reliable enough for people to see it as the answer to a very, very difficult problem.’

Alistair Thompson, a spokesperson for anti-euthanasia group Care Not Killing, responded to the news: ‘This is yet another chilling development from Dr Death who brought us the personalised gas chamber.

The Sarco’s inventor Philip Nitschke has slammed claims that the first woman to end her life in the capsule had ‘strangulation marks’, calling the allegation ‘absurd’

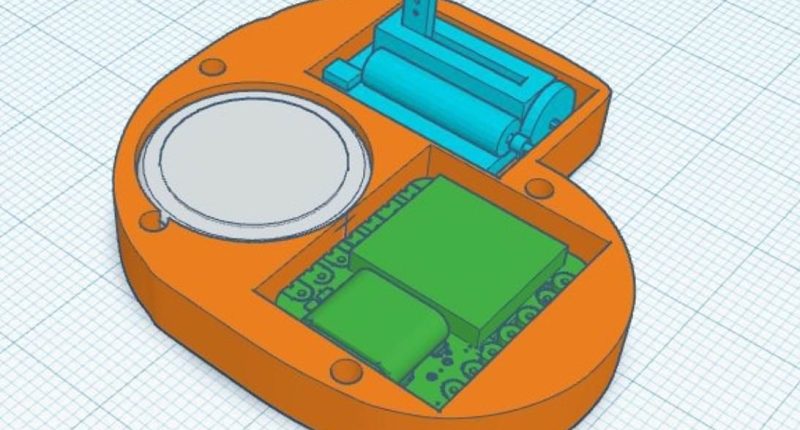

The design for the dementia switch, created by Darab Jafary. According to Nitschke, the blue part is the micro syringe that contains the lethal drug, the green is the processor that provides the timing, and the white element is the lithium battery

Philip Nitschke lies down in a ‘suicide pod’ known as ‘The Sarco’ in Rotterdam, The Netherlands, July 8, 2024

‘Not content with advocating for killing vulnerable terminally ill adults, he has turned his attention to those with neurodegenerative conditions,’ he went on.

‘But we should not be surprised, because when a society decides that some lives are worthless and should be ended, this is the slippery slope you quickly go down.’

Last week, MPs debated whether to legalise assisted dying in England and Wales, while MSPs in Scotland voted in favour of a bill which would allow terminally-ill, mentally competent adults to seek medical help to end their lives.

Assisted dying has been decriminalised in several European countries since the early 2000s, and is also legal in Canada, which has one of the highest rates of euthanasia in the world.

In the Netherlands – which was the first European country to legalise euthanasia – patients can sign an advanced euthanasia directive which gives doctors permission to end their life once they are in the late stages of dementia.

However Nitschke – a former physician who is often dubbed Dr Death – believes these rules don’t go far enough, leaving people’s deaths in the hands of doctors rather than their own.

‘It doesn’t work well at all,’ Nitschke says. ‘It’s not satisfactory and I have talked about it with a lot of Dutch doctors who have tried to use this system and are not happy with it.

‘Trying to kill people who don’t know what day it is just because they’ve got a piece of paper they signed ten years ago doesn’t make it any easier.

‘Instead of outsourcing your death to another person – asking someone else to do it – you can do it yourself with some sophisticated technology,’ he argues.

But just as patients are required to make their decision on the euthanasia directive before their mental state worsens, Nitschke’s switch would also need to be implanted in advance of the person losing mental capacity – something he admits most doctors may not want to do.

The device would contain one millimetre of a powerful deadly substance which would be released when the person fails to switch it off – though Nitschke said he is still unsure what this would be.

Early stage designs of the switch, which have been shared with MailOnline, show the lithium battery-powered device with a micro syringe containing the lethal injection and a remotely-controlled timer – all of which would be concealed beneath the skin.

Nitschke plans for the switch to be programmed to go off with the reminder ‘beep’ and vibrations at a time of the user’s choosing.

Rather than pressing a physical switch on the body, he says the mechanism would be remotely controlled.

When a prototype is built, the inventor says he will be the first to try it out.

Early blueprints of the switch, shared with MailOnline, show the various components it could include

‘In my case I’m going to make sure it is just saline solution inside – obviously I don’t want to discover that there’s some fault with the software when there’s some lethal risk involved, but that will be a fairly low-risk part of the whole testing process,’ he said.

The device would be designed to only work when the user is experiencing such severe dementia that they have stopped noticing the noises and vibrations it makes.

‘You won’t forget to press it otherwise, because after the time comes it’ll start beeping and buzzing,’ he insisted.

‘If you really don’t know what this thing is doing, beeping and buzzing for a week I think you’ve lost a lot of capacity.

‘If you don’t know the risks that are involved by not acting, that is, that you will die, then you’re getting your wish from when you had it implanted.’

He said that the alarm could beep for ‘a day or two’ before the switch is activated to ensure the dementia had progressed far enough.

But he also suggested it could be limited to go off every year or two instead, if it were implanted long before dementia sets in.

Asked what would happen if a patient changed their mind, he said: ‘There’s no problem technically in removing it – but you do have to go off and get someone to do it.’

The first use of Sarco capsule took place in the middle of the forest in Switzerland, according to the creators of the device

He admitted that removal would be complicated if someone was already experiencing cognitive decline, ‘so are not in a position to negotiate the removal of this device.’

He suggested a get around for this could be to adjust the timer so it wouldn’t go off for decades ‘then forget about it,’ so the poison would stay dormant in a person’s system for years.

‘There are a series of legal problems, but right now we’re pre-occupied with the technical hurdles,’ he said.

‘It has to be a system that is resistant to any kind of hacking, any interference, so there are a lot of real issues with it.

‘I’m not trivialising the issues we’ve got, but I still see it as better than the current situation.’

He said that the designer, who is based in Iran, is struggling to get hold of the parts to build the device, delaying their planned timeline.

The project is ongoing while Nitschke’s plans for his flagship Sarco pod have been put on hold by Swiss authorities.

In September, dozens of police swooped on the forest where a 64-year-old woman was found dead inside the capsule, seizing the machine and arresting those present.

The woman had been suffering with a severely compromised immune system in the lead-up to her death, which Sarco’s operators described as ‘peaceful and fast’.

The device was used on the same day as Swiss Interior Minister Elisabeth Baume-Schneider told the National Council that she considers the use of the Sarco in Switzerland to be illegal.

Swiss law allows assisted suicide so long as the person takes his or her life with no ‘external assistance’ and those who help the person die do not do so for ‘any self-serving motive,’ according to a government website.

Months later, Nitschke’s organisation and The Last Resort, the firm set up to operate the machine, say they have received no update from authorities regarding the investigation.

Nitschke plans to push ahead with the roll-out of Sarco, and says a double pod, which would allow two people to end their lives in the same chamber, will be ready by October.

The capsule is designed to allow a person inside to push a button that injects nitrogen gas into the sealed chamber, according to its creators.

The person is then supposed to fall asleep and die by suffocation in a few minutes.

According to Sarco’s creators, some 120 applicants are hoping to use the machine to end their lives, with Nitschke saying that around 50 people in Britain had got in contact about using the machine.

Among them are a former RAF engineer and his wife, who revealed earlier this year that they were signing up to become the first British couple to use the double pod.

Peter and Christine Scott, who have been married for 46 years, made the decision after former nurse Christine was diagnosed with early-stage vascular dementia.

The couple want to travel to Switzerland to die in each other’s arms in the death capsule, a wish which their son and daughter reluctantly said they would respect.

The euthanasia campaigner says his dementia switch has also generated significant interest from people in the UK and around the world.

‘A lot of the drive in interest is coming from the US and Canada and our members there,’ he said.

‘We’re trying to move along with the death switch now quickly in this hiatus – while we’re waiting for Sarco to be sorted out by the Swiss – to do something which will be of benefit to the whole world.’

Care Not Killing, which is made up of disability and human rights groups, healthcare providers, and religious bodies, said in their statement: ‘In every jurisdiction that has legalised assisted suicide or euthanasia, over time those eligible for death have increased.

‘At a time when the NHS is in crisis and when the UK’s palliative care system is broken with one in five hospices being forced to make cuts, we need to focus on fixing this. In short we need more care, not killing.’

- UK: For help and support, call the Samaritans for free from a UK phone, completely anonymously, on 116 123 or go to samaritans.org

- US: If you or someone you know needs help, the national suicide and crisis lifeline in the U.S. is available by calling or texting 988. There is also an online chat at 988lifeline.org