Share this @internewscast.com

(The Conversation) – Lawyers frequently advise clients that it is crucial for everyone to have a will that specifies who should inherit their assets after passing away. However, merely having a will may not suffice to prevent an expensive and contentious legal battle.

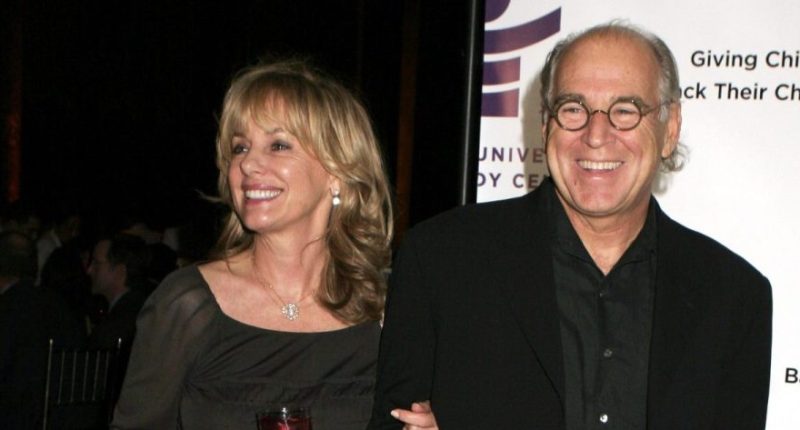

Consider the case following the death of Jimmy Buffett from skin cancer at the age of 76 in 2023. The famed singer and founder of the Margaritaville brand stipulated in his will that his wealth should be placed into a trust posthumously. Buffett appointed two co-trustees to oversee the trust: his widow, Jane Slagsvol, and Richard Mozenter, an accountant and his financial adviser for over 30 years.

Nevertheless, in separate petitions filed in Los Angeles and Palm Beach, Florida, in June 2025, Slagsvol—referred to as Jane Buffett in her filing—and Mozenter are each seeking to remove the other as a trustee.

The outcome of this litigation will determine who gets to administer Buffett’s $275 million estate.

As law professors who specialize in trusts and estates, we teach graduate courses about the transfer of property during life and at death. We believe that the Buffett dispute offers a valuable lesson for anyone with an estate, large or small. And choosing the right person to manage the assets you leave behind can be just as important as selecting who will inherit your property.

Buffett’s business empire

Buffett’s estate includes valuable intellectual property from his hit songs, including “It’s 5 O’Clock Somewhere,” “Oldest Surfer on the Beach” and “Cheeseburger in Paradise.” Buffett’s albums have sold more than 20 million copies worldwide and continue to generate some $20 million annually in royalties. Buffett also owned a yacht, real estate, airplanes, fancy watches and valuable securities.

In addition, he owned a 20% stake in Margaritaville Holdings LLC, a brand management company he and Slagsvol founded in the 1990s. Margaritaville owns 30 restaurants and 20 hotels, along with vacation clubs, casinos and cruise ships. It also sells branded merchandise.

According to Slagsvol’s petition, Buffett’s trust was set up to benefit his widow. Slagsvol, who married Buffett in 1977, is one of two trustees of that trust, which is required to have at least one “independent trustee” in addition to her “at all times.” That requirement is stated expressly in Buffett’s trust declaration.

Slagsvol receives all income earned by the trust – an estate-planning technique for giving away property managed by a trustee on behalf of the trust beneficiaries – for the rest of her life. She can also receive additional trust funds for her health care, living expenses and “any other purpose” that the independent trustee – Mozenter, as of July 2025 – deems to be in Slagsvol’s best interests.

The estate plan also created separate trusts for their three children: Savannah, Sarah “Delaney” and Cameron Buffett, who are in their 30s and 40s. Each child reportedly received $2 million upon Jimmy’s death. When Slagsvol dies, she can decide who will receive any remaining assets from among Buffett’s descendants and charities.

The structure of Buffett’s plan is popular among wealthy married couples. It provides lifelong support for the surviving spouse while ensuring that their kids and grandchildren can inherit the remainder of their estate – even if that spouse remarries. This type of trust typically cannot be changed by the surviving spouse without court approval.

Dueling trustee removal petitions

Slagsvol is trying to remove Mozenter as the trust’s independent trustee.

She claims he refused to comply with her requests for financial information, failed to cooperate with her as her co-trustee, and hired a trust attorney who pressured her to resign as trustee. Slagsvol also raised numerous questions about the trust’s income projections and compensation paid to Mozenter for his services.

Mozenter’s petition, filed in Florida, is not available to the public. According to media coverage of this dispute, he seeks to remove Slagsvol as trustee. He claims that, during his decades-long role as Buffett’s financial adviser, the musician “expressed concerns about his wife’s ability to manage and control his assets after his death.”

That led Buffett to establish a trust, Mozenter asserted, “in a manner that precluded Jane from having actual control” over it.

Estate planning lessons

We believe that the public can learn two important estate planning lessons from this dispute.

First, anyone planning to leave an estate, whether modest or vast, needs to choose the right people to manage the transfer of their property after their death.

That might mean picking a professional executor or trustee who is not related to you. A professional may be more likely to remain neutral should any disputes arise within the family, but hiring one can saddle the estate with costly fees.

An alternative is to choose a relative or trusted friend who is willing to do this for free. About 56% of wills name an adult child or grandchild as executor, according to a recent study. Some estates, like Buffett’s trust, name both a professional and a family member. An important consideration is whether the people asked to manage the estate will get along with each other – and with anyone else who is slated to inherit from the estate.

The second lesson is, whether you choose a professional, a loved one or a friend to manage your estate, make clear what circumstances would warrant their removal. Courts are reluctant to remove a handpicked trustee without proof of negligence, fraud or disloyalty. But trustees can be removed when a breakdown in cooperation interferes with their ability to administer the estate or trust.

Some trusts anticipate such conflicts by allowing beneficiaries to replace a professional trustee with another professional trustee. That can resolve some disputes while avoiding the cost of seeking court approval.

Preventing disputes from erupting in the first place can help people avert the costly and embarrassing kind of litigation now ensnaring Jimmy Buffett’s estate.