Share this @internewscast.com

Australia’s ‘big four’ banks have collectively ruled out the prospect of an interest rate cut in the coming year, quashing any hopes for borrowers anticipating relief.

Westpac, which had earlier predicted a rate cut in 2026, is the latest major bank to assert that interest rates will likely stay steady, aligning its outlook with ANZ’s forecast.

According to the banks, Australian borrowers, particularly those with variable-rate mortgages, should brace for the possibility that their monthly repayments might rise rather than fall by 2026.

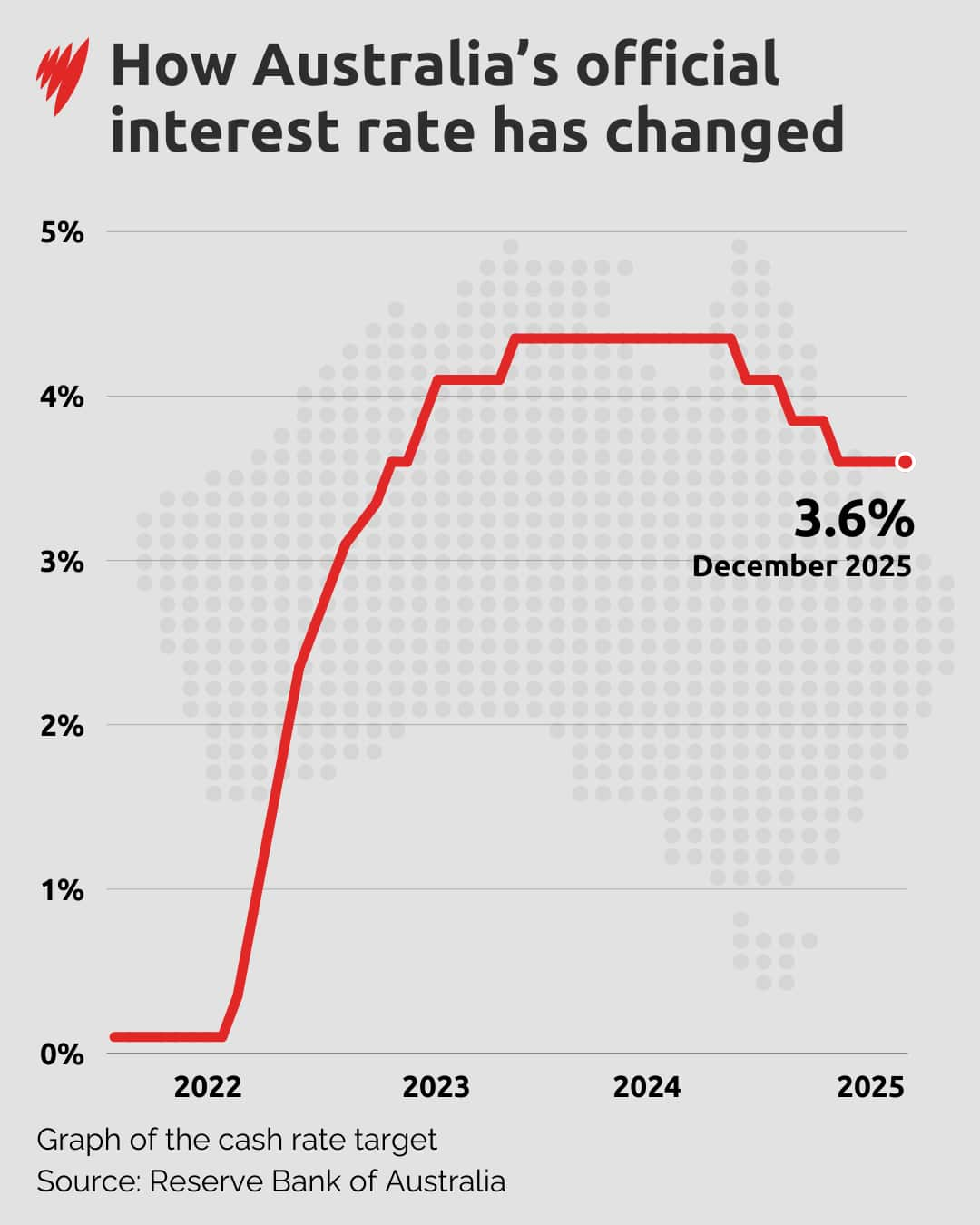

AMP’s chief economist, Shane Oliver, mentioned to SBS News that homeowners with mortgages had been feeling encouraged after witnessing a series of three rate cuts, which had led to expectations of further reductions.

However, with the current economic trajectory, the rising interest rates could once again contribute to an increase in the cost of living for many Australians.

Paying more in the supermarkets

“The real question is around the degree to which this happens,” he told SBS News.

“Increasing interest rates or increasing inflation might mean that they’re paying a little bit more at the supermarket each week, they’re paying a little bit more for their electricity and energy bills, and other utilities,” Grant said.

Cost pressures push more Australians into hardship

Finder’s Cost of Living Pressure Gauge — which tracks the financial burden on Australian households monthly — shows a significant jump in financial stress from 57 per cent in October 2019 to 77 per cent in October 2025.