Share this @internewscast.com

Queensland mum Kelsie, 24, didn’t want to go back to work after giving birth to her second child but felt she had no choice.

More than 4000km away in WA, first time mum Abby-Rose, 25, felt the same way.

Both individuals desired to remain at home with their children but were concerned that relying on a single income might lead to financial difficulties; a common concern amidst the rising cost of living.

Neither expected user-generated content (UGC) would be the solution.

Kelsie was once offered $1000 for 1000 videos ($1 per video), and Abby-Rose was asked to produce 13 videos for nothing more than ‘gifted’ products.

But freebies aren’t going to pay the bills.

In fact, they could incur additional bills if you don’t declare them at tax time.

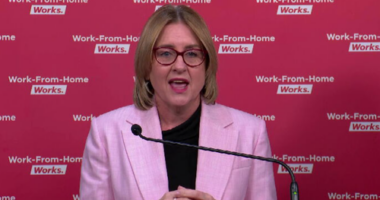

“Any form of compensation, whether it’s a sponsored post, skincare gifts, or complimentary hotel stays, must be clearly disclosed if it’s part of a commercial agreement,” emphasized Susan Franks, a tax expert from Chartered Accountants Australia and New Zealand, in an interview with 9news.

“If it’s part of the job, it’s part of your taxable income.”

Maintaining documentation of your earnings and expenses related to UGC is crucial. If your annual income exceeds $75,000, it’s advisable to register for GST to prevent costly errors during tax season.

Failing to do so – of trying to fly under the ATO’s radar – could land you with a hefty bill.

“The ATO keeps a close watch on social media [and] employs advanced data analytics to scrutinize tax returns, increasingly questioning their accuracy,” Franks cautioned.

“Omitting income on your tax return can lead to substantial financial penalties, including accruing interest, which can escalate quickly.”

The information provided here is purely informational and does not replace personalized financial advice. It has been prepared without considering your personal goals, financial situation, or needs. You should evaluate its suitability with respect to your circumstances before taking any actions based on this information.