Share this @internewscast.com

“I absolutely despise grocery shopping,” Armstrong confessed, highlighting a sentiment many can relate to.

The current economic situation plays a significant role in driving impulse purchases. The challenging financial climate has made consumers more responsive to special offers and discounts.

“Promotional deals have become increasingly common, and amid the cost-of-living crisis, people are more inclined to seek out these bargains,” Asher explained.

“While there are still products with consistently low prices, finding them requires more effort. We’ve moved away from straightforward low pricing to a landscape dominated by half-price deals, which wasn’t always the case.”

This evolution in grocery shopping habits across Australia has heightened the tendency for spur-of-the-moment buying decisions.

Grocery shopping habits have also changed in Australia, which has increased the likelihood of impulse buying.

“It used to be that people might do one big shop a week or once a fortnight,” Asher said.

“The more frequently people are going now, the more there’s temptation.”

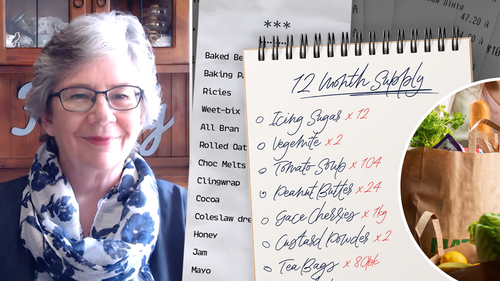

Armstrong has shared her money-saving tips with thousands of Australians for decades to help them live “debt-free, cashed up and laughing”.

For Australians who want to reset their budgets in the new year, she offers a few simple suggestions to kick-start the journey.

Her first tip is to take a look at your utility bills and see if there is a better deal.

“Don’t be afraid to swap, it’s really easy, it’s painless,” she said.

Her second tip is to adjust your grocery shopping habits as necessary.

“If you shop weekly, think about moving to fortnightly or monthly,” Armstrong said.

“If you don’t try it, you’ll never know.”

Her third tip is to write a shopping list, take it to the supermarket and stick to it.

“If you’ve forgotten something, add it to the list for next time and make do,” she said.

“The less money you spend in the shops, the more money you’re going to keep in your purse.”

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.