Share this @internewscast.com

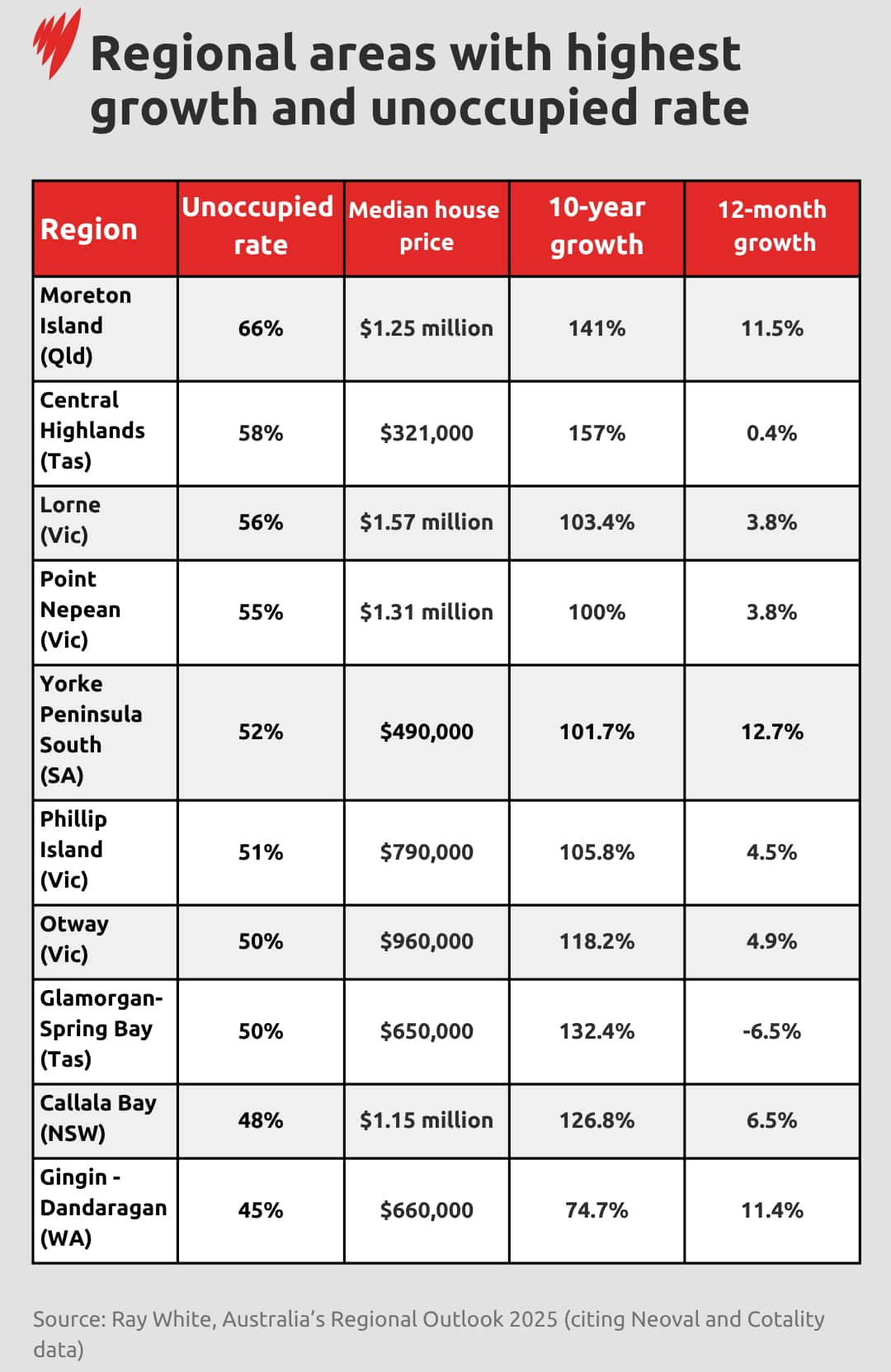

Moreton Island, nestled off the coast of south-east Queensland, is making headlines for its staggering vacancy rate. With a modest population of fewer than 300 residents, the island has become notable for having the highest vacancy rate among ten surveyed areas, reaching an astonishing 66 percent.

This secluded island has not only caught attention for its empty homes but also for its booming real estate market. Over the past decade, Moreton Island has seen an impressive 140 percent increase in median house prices, with the average property now valued at $1.25 million.

Meanwhile, another coastal area, the stretch from Callala Bay to Currarong on New South Wales’ south coast, is also experiencing a significant vacancy rate of 48 percent. Despite this, the region boasts a remarkable 126.8 percent growth in home values over the last ten years, with average home prices now reaching $1.15 million.

These statistics highlight a fascinating trend in coastal real estate, where high vacancy rates coexist with soaring property values. The dynamics in these areas reveal much about the current state of the housing market, particularly in desirable coastal regions.

Vanessa Rader, Ray White’s head of research, said the report revealed Australia’s holiday home phenomenon had a concentrated geography, and these areas challenged fundamental assumptions about property investment returns.

“I think it permanently boosted demand for homes in scenic and lower-density areas,” Powell said. “When you look at these regions, they cater for both second holiday homes, but also short-term letting as well.”

But looks — even pristine and coastal — can be deceiving.

What other considerations are there?

But perhaps the most significant concern is that many areas with high vacancy rates experienced environmental risks beyond what most traditional residential investments faced — and thus, higher insurance premiums.

“If you’re unsure of what the risk is associated with the home that you’re looking at, the quickfire way to find out is to get an insurance quote. The premiums really do tell you the risk profile.”

Is the bubble bursting?

With climate change continuing to intensify risks like rising sea levels and extended bushfire seasons, Rader said the long-term viability of homes in these scenic — but vulnerable — locations was also increasingly threatened.

“That market would really just cement itself as being a tourism destination first, more than a residential location. But people do need to live in these places, too,” she said.