Share this @internewscast.com

On Monday, oil and gas prices experienced a significant spike as Iran’s aggressive actions across the Middle East disrupted supplies, posing a potential financial strain on UK households and drivers.

In response to the turmoil, Qatar halted its production of liquefied natural gas (LNG), and Saudi Arabia temporarily shut down its largest oil refinery.

There were also disruptions in the Strait of Hormuz, a crucial passageway for 20% of the world’s oil supply, due to multiple attacks on shipping vessels.

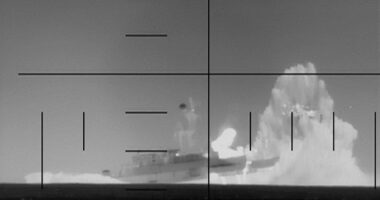

One of the affected vessels was the fuel tanker Athena Nova, which caught fire on Monday night after being struck by two drones launched by Iran’s Revolutionary Guards.

This turmoil led to natural gas prices in Europe soaring by as much as 45%. Experts warned that a prolonged conflict could lead to energy bills reaching £2,500, reminiscent of the 2022 crisis triggered by Russia’s invasion of Ukraine.

Additionally, oil prices surged by over 13%, reaching $82.37 a barrel, marking the highest level seen in over a year.

Saudi Arabia suspended operations at its Ras Tanura oil refinery after a drone strike

Experts warned that if the conflict continues it could soar to more than $100 with painful consequences for drivers and across the economy.

It prompted calls from motoring and industry groups for Chancellor Rachel Reeves to abandon planned fuel duty increases.

Meanwhile the likelihood that the crisis will push up inflation prompted traders to slash bets that the Bank of England will cut interest rates later this month, in a blow to millions of borrowers.

Global stock markets were rocked by the turmoil, with London’s FTSE 100 tumbling 1.2 per cent, or 130 points, amid big falls for airline stocks and banks – though the likes of BP and Shell made gains thanks to the rise in oil prices.

The crisis also raised questions over Labour’s race to net zero as the Tories said Energy Secretary Ed Miliband’s ban on new North Sea oil and gas licences have made Britain increasingly reliant on imports from Qatar.

Tory energy spokeswoman Claire Coutinho said: ‘We’re the only country shutting down our domestic energy supplies. The world is becoming more unsafe, we must change course.’

Qatar produces a fifth of the global supply of LNG – gas that is cooled into liquid form for transport by sea.

Monday’s spike in European gas prices took them to as high as $46.50 per therm – a unit of energy. That was dwarfed by the crisis in 2022 that saw them climb to $309.

A sustained rise in gas prices could mean a sharp increase in Britain’s energy price cap level from July, possibly wiping out the recently-announced £117 cut in annual bills to take effect from April.

Stifel analyst Chris Wheaton said: ‘We are much more concerned about European gas prices than we are about oil prices. If LNG production from Qatar/UAE was disrupted, we see a repeat of 2022.’

Mr Wheaton said a tripling in wholesale gas prices could translate into a typical bill of £2,500 a year, up from the £1,641 level that will take effect next month.

Meanwhile, the suspension of operations at Saudi Arabia’s Ras Tanura oil refinery – which produces 550,000 barrels per day – added to pressure on oil prices. It came after a drone strike on the site.

Torbjorn Soltvedt, Middle East analyst at risk intelligence firm Verisk Maplecroft, said it ‘marks a significant escalation, with Gulf energy infrastructure now squarely in Iran’s sights’.

Maurizio Carulli, global energy analyst at wealth manager Quilter Cheviot said that if the Middle East conflict calms down, oil prices were likely to drop back towards $60.

But he added: ‘If the situation precipitates into a wide-spread and prolonged Middle East war, with shipping across the Strait of Hormuz halted, then the oil price could feasibly rise to $100 and above.’

While the strait has never been actually closed, the latest conflict has prompted shipping companies to drop anchor due to the risk of damage or seizures and lack of insurance cover, he said.

‘Satellite data shows that oil tanker transit had virtually halted over the weekend,’ Mr Carulli added.

Simon Williams, head of policy at the RAC, the motoring organisation, outlined the impact a sustained rise in the oil price could have on the cost of filling up cars, compared to a current level of just under 133p.

‘If oil were to climb to and stay at the $80 a barrel mark, then drivers could expect to pay an average of 136p for petrol. At $90, we’d be looking at over 140p a litre and $100 would take us nearer to 150p, but it’s all too soon to know,’ he said.

A rise to 150p would add just over £9 to the cost of filling up a 55-litre car.

The oil and gas price increases threaten to add to wider UK inflation – a headache for Chancellor Rachel Reeves as she prepares to respond to latest independent economic forecasts in her spring statement today.

Ms Reeves announced last autumn that cuts to duty in fuel would start to be reversed from September but came under pressure on Monday to cancel the policy.

Howard Cox of Fair Fuel UK said: ‘In light of the ongoing crisis in the Middle East, Rachel Reeves must declare in her Spring Statement that Fuel Duty will remain frozen for the duration of her Parliament and cancel any planned increases.’