Share this @internewscast.com

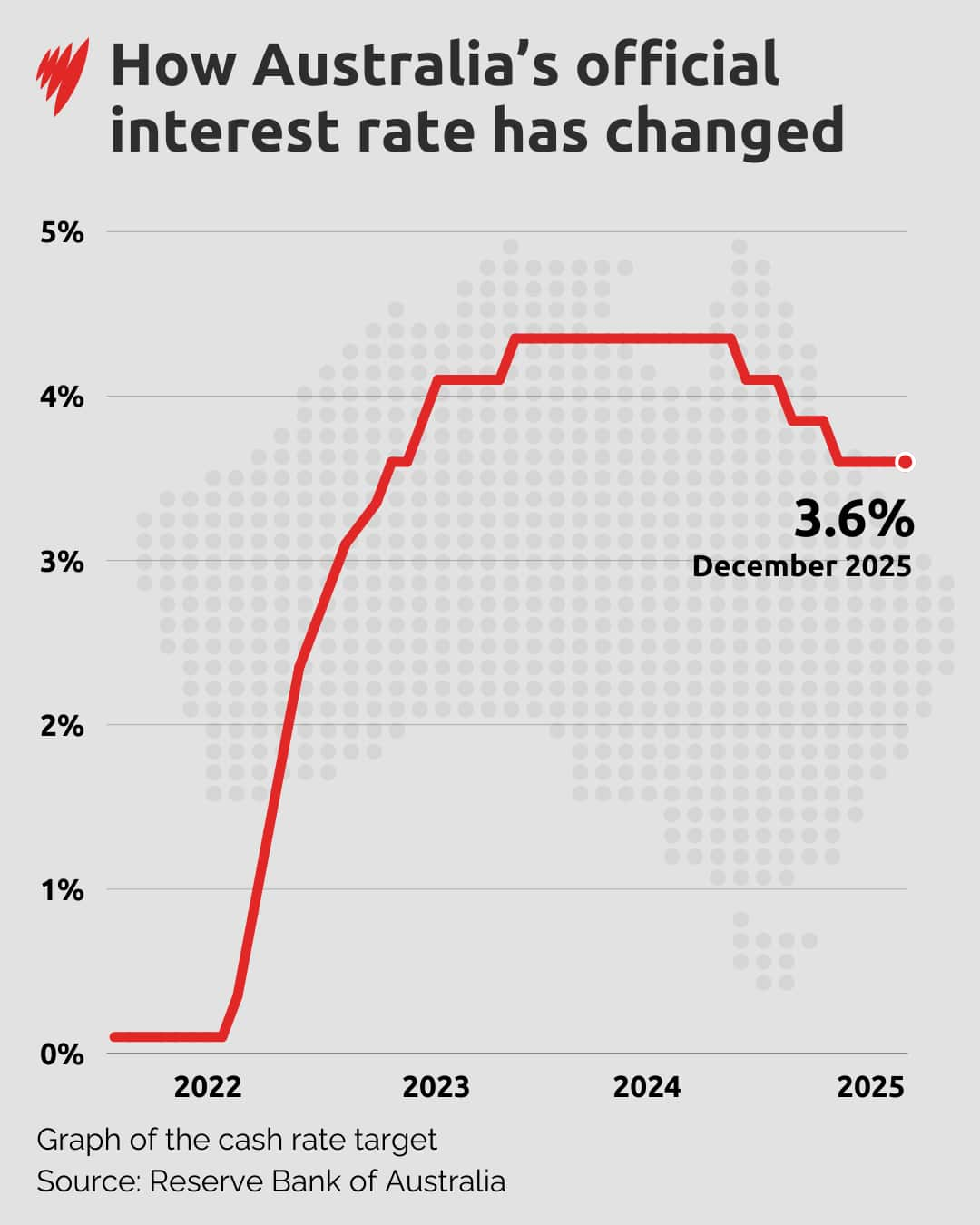

The prospect of an interest rate hike next year was a significant topic of discussion, according to a recent statement by a financial expert. “We thoroughly deliberated on the circumstances that might necessitate an increase in interest rates sometime in the upcoming year,” she remarked.

She further highlighted that current data indicates signs of inflation becoming more widespread. “Part of this inflation may be persistent, so it warrants careful monitoring,” she added.

Ahead of Tuesday’s meeting, major banks and economists widely expected the cash rate to remain steady at 3.6 percent, aligning with forecasts. This expectation was reported by SBS News.

The latest figures for the September quarter revealed a consumer price index of 3.2 percent, which surpasses the Reserve Bank’s target inflation range of 2 to 3 percent.