Share this @internewscast.com

The country’s leading banker has issued a stark warning regarding the US economy, indicating that the full impact of President Trump’s extensive tariff measures is still unfolding.

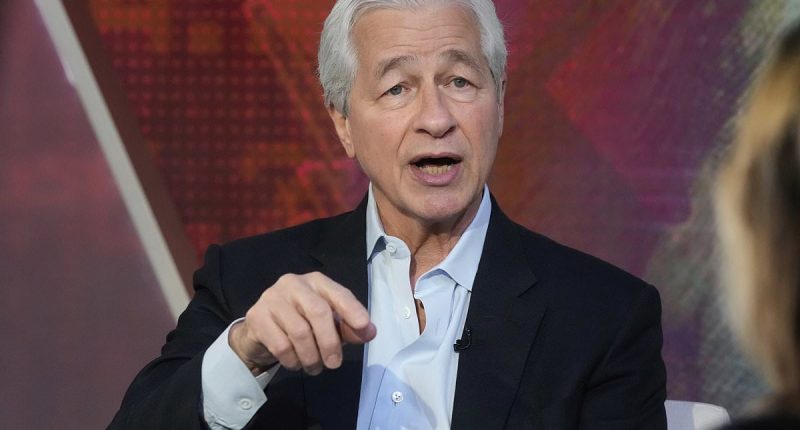

Speaking at JPMorgan Chase’s yearly investor gathering, seasoned CEO Jamie Dimon highlighted that despite a robust stock market, there is a significant and often overlooked danger lurking beneath.

Dimon, typically recognized for his balanced evaluations, expressed concern that escalating expenses, unpredictable trade conditions, and a US economy balanced on inflated asset values create a period of uncertainty.

‘There’s an extraordinary amount of complacency,’ Dimon said. ‘The last time the country saw 10% tariffs on all trading partners was 1971.’

Dimon pulled no punches as he described President Trump’s tariff strategy as ‘pretty extreme,’ even in its scaled-back form following an April 2 announcement that placed most tariffs on a temporary 90-day pause.

The CEO had warned of “considerable turbulence” in the economy at a time when clients were becoming cautious and pulling back on deals.

Dimon, 69, has run JPMorgan Chase, the largest US bank, for more than 19 years, outlasting many other CEOs, and is one of the most prominent voices in corporate America.

Despite the pause, tariffs remain historically high for the majority of US trading partners, and companies are already signaling the damage.

JPMorgan CEO Jamie Dimon has delivered a sobering assessment of the US economy , warning that the true fallout from President Trump’s sweeping tariff policy has yet to be felt

Dimon described President Trump’s tariff strategy as ‘pretty extreme,’ even in its scaled-back form following an April 2 announcement that placed most tariffs on a temporary 90-day pause

In its most recent earnings report, Walmart, the nation’s largest retailer, warned it would be forced to increase prices due to the tariffs, calling the resulting cost hikes ‘unprecedented in history.’

Other corporate giants, including General Motors, JetBlue, and Volvo, have suspended their forward guidance entirely, citing market unpredictability and rising input costs.

Inflation, while mild in April, is expected to surge in the coming months as the price increases ripple through supply chains.

Dimon issued a blunt warning suggesting stock markets could see a 10% sell-off as investors begin to grasp the full scope of the tariffs’ impact.

While much of the market remains bullish, Dimon also raised a red flag on another front: corporate credit.

Companies long accustomed to cheap financing are now facing a more hostile lending environment, and Dimon believes a credit crunch could be looming.

‘American asset prices, I still think they’re kind of high,’ Dimon said. ‘I think credit today is a bad risk.’

JPMorgan has the largest market share of US consumer accounts and houses 11.3% of retail deposits making it a reliable gauge of consumer health.

Dimon also noted how many other countries have already begun negotiating new trade agreements – without the United States

Jamie Dimon, the CEO of JPMorgan Chase, spoke out about President Trump’s tariff policies when they were first announced last month

Although trade negotiations have helped ease some jitters in the last few days, corporate executives remain wary about the economic outlook, with Dimon warning last week that a recession could not be ruled out.

It’s not the first time Dimon has sounded alarms, but the gravity of Monday’s message suggests a shift in tone from from caution to outright concern.

Adding to the volatility, Dimon expressed skepticism that central banks would be able to backstop the economy should the tariff-driven slowdown worsen.

‘We have what I consider almost complacent central banks that think they are omnipotent,’ he said. ‘They just set short-term rates.’

Compounding the threat, Dimon warned that America’s aggressive tariff strategy may permanently alter its position in the global economy.

‘It is unknown how other countries will respond,’ he said, noting how many are already negotiating new trade agreements – without the United States.

Dimon’s comments this week follow months of escalating concern.

In April, he used his annual letter to shareholders to caution that the White House’s tariff actions could ‘undermine global alliances and slow economic growth.’

‘Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth,’ he wrote.

Despite a large tip when the tariffs were announced last month, the markets have bounced back in remarkable fashion. Top, NASDAQ, middle, S&P 500, bottom, Dow Jones Index

At the time, JPMorgan raised its recession forecast from 40% to 60%.

In an appearance that same week, Dimon again delivered a two-part message that America’s fundamentals are strong, but the policy path is risky.

‘We have the best economy in the world,’ he told Fox Business. ‘Our GDP per person is $85,000. China’s is $15,000. But I hope what they really do is let [Treasury Secretary] Scott Bessent… negotiate.’

He added, ‘They put the tariffs in and it was way beyond what people expected. That will cause a little inflation, slow down growth.’

While President Trump has repeatedly downplayed the risks of his tariff policy declaring ‘BE COOL!’ and calling it ‘A GREAT TIME TO BUY’.

Trump’s supporters, including hedge fund billionaire Bill Ackman, have expressed rare concern. ‘Business is a confidence game,’ Ackman posted last month. ‘And confidence depends on trust.’