Share this @internewscast.com

THIS is the terrifying moment a cabin was swept away during the deadly Texas floods as onlookers watched on helplessly.

Screams could be heard as the floodwaters carried away the cabin packed with people as flash floods sweep through Kerr County.

The harrowing scenes showed the structure moving rapidly across the Guadalupe River in Hill County in pitch black darkness.

One witness called out: “Oh my god, there’s so many people in it.”

A second bystander screamed “oh my god” as she watched the chaos unfold.

It is unclear if anyone suffered injuries or if they were able to reach safety.

There are now nearly 80 people confirmed dead due to the central Texas flood, according to state officials.

Heartbreaking photos from the wrecked site at Camp Mystic show sodden mattresses and teddies strewn across dormitories.

Meanwhile, outside, trucks and heavy machinery were swept away -evidence of the floods’ deadly force.

Teams working tirelessly in harsh conditions to find victims have witnessed the atrocities first-hand, with dozens of bodies discovered.

Officials said more than 850 people had been rescued in the last 36 hours.

Bobby Templeton, the superintendent of Ingram Independent School District, mentioned, “People are still arriving here in search of their family members. We’ve had a bit of success, but not a lot.”

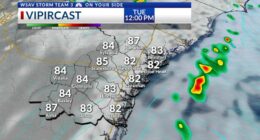

Worst-hit was Kerr County, particularly areas around the Guadeloupe River where waters rose by 26ft in 45 minutes following a freak dump of rainfall.

The threat persisted as rain continued to lash areas outside San Antonio on Saturday, with both flash flood warnings and watches remaining active.

About a third of a year’s worth of rain fell in a few short hours, completely overwhelming the waterways and creating an “extraordinary catastrophe”.

Dalton Rice, the city manager of Kerville, remarked on Saturday, “We’ve managed to rescue hundreds of individuals from these camps. Many people prefer to stay put, so we ensure they have access to food and water.”

Multiple people lost their lives in other counties, bringing the current confirmed death toll to 59 – though this is sadly expected to rise.

The parents of all the missing children have been notified – and many turned to social media to share desperate pleas for information about their girls.

Local reports suggest that up to five girls have been confirmed as dead, citing their families.

Janie Hunt, 9, was among the dead, her distraught mother told CNN.

A relative of nine-year-old Renee Smajstrla revealed on Facebook that the girls’s body had been found.

Shawna Salta wrote: “We are thankful she was with her friends and having the time of her life, as evidenced by this picture from yesterday.”

Lila Bonner’s family also released a statement confirming her death.

They wrote: “In the midst of our unimaginable grief, we ask for privacy and are unable to confirm any details at this time.

“We ache with all who loved her and are praying endlessly.”

Lila shared a cabin with her best friend Eloise Peck, 8, who also lost her life.

Her mom, Missy Peck, told Fox4: “Eloise was literally friends with everyone. She loved spaghetti but not more than she loved dogs and animals.

“She passed away with her cabinmate and best friend Lila Bonner who also died.

“Eloise had a family who loved her fiercely for the 8 years she was with us. Especially her Mommy.”

Camp Mystic’s owner and director Dick Eastland is amongst those confirmed to have died.