Share this @internewscast.com

Presently, the U.S. economy remains in relatively strong condition, with inflation significantly lower than its 2022 peak. However, experts are concerned about the future due to tariffs.

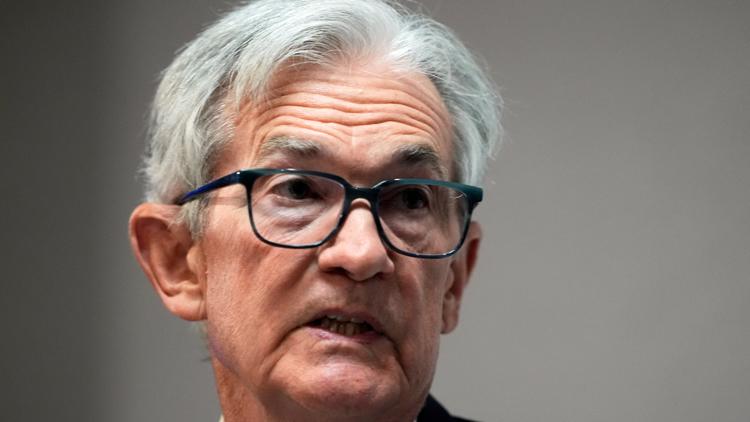

WASHINGTON — On Wednesday, the Federal Reserve decided to maintain its key interest rate, despite President Donald Trump’s calls for reduced borrowing costs. They expressed that the likelihood of both increasing unemployment and rising inflation has grown, creating an unusual scenario that challenges the central bank’s decision-making.

The Fed held the rate steady at 4.3% for the third consecutive meeting, following three consecutive cuts last year. Many economists and Wall Street analysts still anticipate rate reductions this year, but the broad tariffs introduced by Trump have created significant uncertainty for the U.S. economy and the central bank’s policies.

During a press conference after the release of the policy statement, Powell underscored that the tariffs have dampened consumer and business sentiment but have yet to noticeably harm the economy. At the moment, Powell said, there’s too much uncertainty to say how the Fed should react to the duties.

“If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth, and a rise in unemployment,” Powell said. The impacts could be temporary, or more persistent, he added.

“There’s just so much that we don’t know,” he added. “We’re in a good position to wait and see.”

It is unusual for the Fed to face the risk of both higher prices and more unemployment. Typically, rising inflation occurs when consumers are spending freely and businesses, unable to meet all the resulting demand, raise their prices instead, as happened after the pandemic. Meanwhile, increasing unemployment occurs in a weaker economy, which usually slows spending and cools inflation.

A combination of both higher unemployment and steeper inflation is often referred to as “stagflation” and strikes fear in the hearts of central bankers, because it is hard for them to address both challenges. It last occurred on a sustained basis during the oil shocks and recessions of the 1970s.

Most economists say, however, that Trump’s sweeping tariffs do pose the threat of stagflation. The import taxes could both lift inflation by making imported parts and finished goods more expensive, while also raising unemployment by causing companies to cut jobs as their costs rise.

The Fed’s goals are to keep prices stable and maximize employment. Typically, when inflation rises, the Fed raises rates to slow borrowing and spending and cool inflation, while if layoffs rise, it would cut rates to spur more spending and growth.

At the beginning of the year, analysts and investors expected the Fed would reduce its key rate two or three times this year, as the inflation spike that followed the pandemic continued to cool. Some economists also think the Fed should cut in anticipation of slower growth and worsening unemployment from the tariffs. But Powell was adamant that with the economy in good shape for now, the Fed can stay on the sidelines.

Several months ago, many analysts also expected the economy would achieve a “soft landing,” in which inflation would finally drop back to its target of 2%, while unemployment would stay low amid solid growth.

Yet on Wednesday Powell said that was less likely to be achieved.

“If the tariffs are ultimately put in place at those levels … then we won’t see further progress toward our goals,” Powell said. “At least for the next, let’s say, year, we would not be making progress toward those goals — again, if that’s the way the tariffs shake out.”

Powell also said the Fed’s next move will depend in part on which indicator worsens the most: inflation or unemployment.

“Depending on how things play out, it could include rate cuts, it could include us holding where we are, we just need to see how things play out before we make those decisions,” he said.

Krishna Guha, an analyst at EvercoreISI, said the Fed’s assessment of current conditions likely pushes back the timetable for a rate cut. “The combination of the two-sided risk assessment and the characterization of the economy as solid suggest the (Fed) is not looking to tee up a June cut at this juncture.” Many economists think the Fed may not be ready to cut until September.

Trump announced sweeping tariffs against about 60 U.S. trading partners in April, then paused most of them for 90 days, with the exception of duties against China. The administration has subjected goods from China to a 145% tariff. The two sides are scheduled to hold their first high-level talks since Trump launched his trade war this weekend in Switzerland.

The central bank’s caution could lead to more conflict between the Fed and the Trump administration. On Sunday, Trump again urged the Fed to cut rates in a television interview. Trump has backed off threats to try to fire Powell, but could reconsider if the economy stumbles in the coming months.

Asked at the press conference whether Trump’s calls for lower rates has any influence on the Fed, Powell said, ”(It) doesn’t affect doing our job at all. We’re always going to consider only the economic data, the outlook, the balance of risks, and that’s it.”

If the Fed were to cut rates, it could lower other borrowing costs, such as for mortgages, auto loans, and credit cards, though that is not guaranteed.

A big issue facing the Fed is how tariffs will impact inflation. Nearly all economists and Fed officials expect the import taxes will lift prices, but it’s not clear by how much or for how long. Tariffs typically cause a one-time increase in prices, but not necessarily ongoing inflation.

For now, the U.S. economy is mostly in solid shape, and inflation has cooled considerably from its peak in 2022. Consumers are spending at a healthy pace, though some of that may reflect buying things like cars ahead of tariffs. Businesses are still adding workers at a steady pace, and unemployment is low.

Still, there are signs inflation will worsen in the coming months. Surveys of both manufacturing and services firms show that they are seeing higher prices from their suppliers. And a survey by the Federal Reserve’s Dallas branch found that nearly 55% of manufacturing firms expect to pass on the impact of tariff increases to their customers.

AP Business Writer Alex Veiga in Los Angeles contributed to this report.