Share this @internewscast.com

In a bold move that could reshape the entertainment industry, Paramount launched a hostile takeover bid for Warner Bros. Discovery on Monday. This aggressive maneuver sets the stage for a high-stakes clash with Netflix over the acquisition of the powerhouse behind HBO, CNN, and DC Studios.

This surprising development comes on the heels of Netflix’s recent $72 billion agreement to acquire Warner Bros. Paramount, however, is upping the ante with an offer of approximately $74.4 billion, translating to $30 per share in cash, directly appealing to Warner shareholders.

Paramount’s proposal includes purchasing Warner’s cable television assets, a move that differentiates it from Netflix’s bid. Paramount’s executives argue their offer is significantly more valuable, claiming it exceeds Netflix’s offer by about $18 billion as they dismiss Netflix’s valuation of Warner’s cable assets as speculative.

Previously, Warner Bros. had turned down Paramount’s bid in favor of Netflix’s offer. However, Paramount remains undeterred, taking a critical stance towards Netflix’s proposal. They contend that Netflix’s offer subjects shareholders to an extended and uncertain regulatory approval process, alongside a complicated mix of equity and cash.

As the battle intensifies, the entertainment landscape stands on the brink of a significant transformation, with both industry giants vying for control over Warner Bros. Discovery’s future.

RELATED: How Netflix acquiring Warner Bros. could change the future of movies

Paramount said it had submitted six proposals to Warner Bros. over a 12-week period.

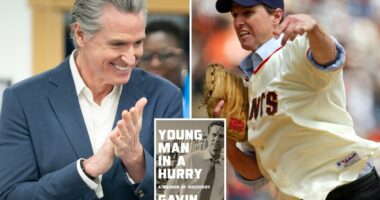

“We believe our offer will create a stronger Hollywood. It is in the best interests of the creative community, consumers and the movie theater industry,” Paramount Chairman and CEO David Ellison said in a statement. “We believe they will benefit from the enhanced competition, higher content spend and theatrical release output, and a greater number of movies in theaters as a result of our proposed transaction.”

On Friday, Netflix struck a deal to buy Warner Bros. Discovery, the Hollywood giant behind “Harry Potter” and HBO Max. The cash and stock deal is valued at $27.75 per Warner share, giving it a total enterprise value of $82.7 billion, including debt.

The transaction is expected to close in the next 12 to 18 months, after Warner completes its previously announced separation of its cable operations. Not included in the deal are networks such as CNN and Discovery.

But President Donald Trump said Sunday that the Netflix deal “could be a problem” because of the size of the combined market share.

The Republican president said he will be involved in the decision about whether the federal government should approve the deal.

Usha Haley, a Wichita State University professor who specializes in international business strategy, said Paramount’s ties to Trump are notable. Ellison is the son of longtime Trump supporter Larry Ellison, the world’s second-richest person.

“He said he’s going to be involved in the decision. We should take him at face value,” Haley said of Trump. “For him, it’s just greater control over the media.”

In October, Paramount said it bought the news and commentary website The Free Press and installed its founder, Bari Weiss, as the editor-in-chief of CBS News, saying it believes the country longs for news that is balanced and fact-based.

It was a bold step for the television network of Walter Cronkite, Dan Rather and “60 Minutes,” long viewed by many conservatives as the personification of a liberal media establishment. The network placed someone in a leadership role who has a reputation for resisting orthodoxy and fighting “woke” culture.

Paramount’s tender offer is set to expire on Jan. 8, 2026, unless it’s extended.

Shares of Warner Bros. and Paramount jumped between 5% and 6% at the opening bell Monday. Shares of Netflix edged lower.

___

AP National Writer Matt Sedensky and AP Media Writer David Bauder contributed to this story.

.