Share this @internewscast.com

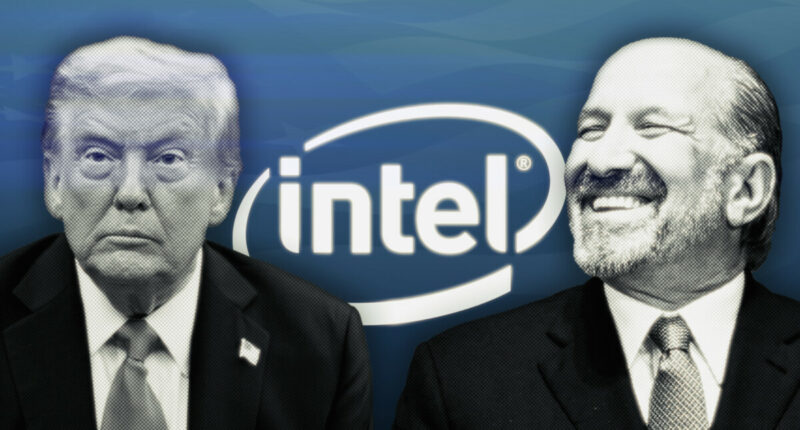

President Donald Trump announced on Friday evening, August 22, 2025, that the federal government has acquired a 10% stake in Intel, a decision he framed as a win for America but one that has left many conservatives, including Rand Paul and Thomas Massie, frustrated, viewing it as an unsettling move toward government involvement in private business.

Why it matters:

Orchestrated by Trump and Commerce Secretary Howard Lutnick, this acquisition has raised concerns among free-market proponents. They fear it creates a blurred boundary between governmental influence and business control, possibly paving the way for increased federal involvement in the economy, which could dismay those who prioritize entrepreneurial freedom.

Driving the news:

Trump confirmed the agreement on his Truth Social platform, revealing the U.S. government’s purchase of 433.3 million Intel shares at $20.47 each. This results in a non-voting 9.9% stake as part of an initiative to utilize CHIPS Act resources.

- The CHIPS Act, enacted in 2022, is a $52.7 billion bipartisan initiative to boost U.S. semiconductor manufacturing and reduce reliance on foreign supply chains, providing grants and loans to companies like Intel.

- Lutnick, on CNBC’s “Squawk on the Street,” explained the equity stake, saying, “We should get an equity stake for our money,” converting Biden-era grants into ownership.

- Trump credited negotiations with Intel CEO Lip-Bu Tan, presenting it as a boost for national security and economic strength, even though he called for his resignation a few weeks prior.

Catch up quick:

The announcement follows extensive discussions aimed at assisting Intel, which faced $19 billion in losses last year. Using taxpayer funds is seen as a way to bolster the company amid fierce global tech competition.

The intrigue:

The debate centers around whether this strategy will enhance U.S. tech dominance or indicate a worrisome shift towards governmental influence in private enterprises. Notable figures like Rand Paul are questioning if this move aligns with the foundational economic principles of America.

Between the lines:

The underlying patriotic rhetoric conveys a practical application of CHIPS Act funds. However, some view it as a move towards socialism, sparking debate about balancing governmental involvement with market autonomy.

Independent Takeaways:

Clint Russell, from Liberty Lockdown, critiques Trump’s Intel acquisition by comparing it to the 2008 financial bailouts under George Bush and Barack Obama, which he opposed due to his free-market beliefs. Russell argues that unlike the crisis-driven measures of 2008, this current action lacks an obvious emergency need, characterizing it as unwarranted government overextension.

He expresses frustration that Trump’s action resembles a “dictionary definition of fascism” by blending government ownership with corporate control, though he notes it differs from outright seizure. Russell further warns of broader implications, linking the Intel deal to other concerning trends like National Guard deployments and data surveillance via Palantir, urging listeners to reject this erosion of constitutional limits and economic liberty, regardless of their support for Trump.

What they’re saying:

- “If socialism is government owning the means of production, wouldn’t the government owning part of Intel be a step toward socialism? Terrible idea,” Rand Paul posted on X, embedding a link to AP News..

- “Our government should not have ownership in private companies. There are so many specific problems with an arrangement like this, but fundamentally, this is not who we are as a country,” Thomas Massie posted on X.

The bottom line:

Trump’s Intel purchase is a disappointing move that leans toward socialism, frustrating conservatives who value free markets, and while it may aim to bolster national interests by securing a foothold in a key industry, it risks undermining economic liberty by setting a troubling precedent for government overreach.

This decision not only clashes with the principles of limited government that many supporters once championed but also raises concerns about long-term consequences, potentially burdening taxpayers with the fallout of a struggling company while eroding the competitive spirit that drives innovation, leaving a legacy of increased federal control that could haunt future economic policy and disappoint those who hoped for a return to robust free-market governance.